How to Stay Disciplined in Volatile Crypto Markets

Navigating volatile crypto markets can be extremely daunting for investors, especially if you're a beginner. With the right strategies and tools in hand, however, it is possible to stay disciplined and make the right decisions even in uncertain times. In this article, we'll explore how you can do just that!

Volatility in the crypto market

Volatility is a characteristic of the market that is often discussed and analyzed by traders and investors. It refers to the rapid and unpredictable changes in the value of a cryptocurrency, which can occur over a short period of time.

Regardless of perspective, it's important for investors to carefully consider the potential risks and rewards of investing in volatile assets, and to carefully manage their portfolios in order to minimize risk and maximize returns.

Which factors cause volatility in the crypto market?

Volatility in the market can be caused by a variety of factors.

One major driver of volatility is the relatively small size of the market compared to traditional financial markets. This means that even relatively small trades can have a significant impact on the price of a cryptocurrency.

Additionally, the market is highly susceptible to speculation and hype, which can drive prices up or down quickly based on investor sentiment.

Regulatory developments can also impact the market, as governments and regulatory bodies around the world have varying approaches to the treatment of cryptocurrencies.

Finally, the overall health of the global economy can also affect crypto, as investors may turn to cryptocurrencies as a safe haven asset in times of economic uncertainty.

Trading in cryptocurrency markets largely depends upon the right trading mindset and discipline.

Having understood the impact of the volatility in the market, how can a trader overcome those emotional variances in trades? To trade using the right strategies instead of emotional functions like fear or greed, it's essential to study, research, and gather as much information as possible.

This due diligence will help you base your trades on knowledge and help you identify your past mistakes in cryptocurrency trading.

Tools and tricks to keep a cool head and make the right choices in volatile cryptocurrency markets

Right Mindset

Often in the cryptocurrency trading industry, a beginner may experience losses or failure that will largely impact their psychology with trading.

Events such as winning trades cut short, a run of losing trades, aggressively trading after experiencing a loss, and even big profits that result in over-confidence - all of these things will create a lasting impact in the mind of a trader.

These patterns of emotional feedback result in beginners and crypto enthusiasts alike becoming discouraged and prone to making big mistakes. Remember that maintaining a positive mindset would help you succeed in the cryptocurrency market

Avoid Fears

Trading in a volatile market like with crypto, fear is inevitable, especially if the trade is not going along with your expectations. More often than not, traders will experience at least one loss which the trading world calls a "trade killer."

Trading fear comes from a variety of factors:

Fear of large losses makes you afraid to trade at all.

Media often discourages people from venturing into investing in crypto. Some blogs and media content might refer to crypto trade as a non-reliable investment or a risky business. This may lead to a trader second-guessing the original strategy or trading plan.

Once a trader lets fear in, it affects their trade patterns. If a trader continuously succumbs to fear, they will eventually leave the market altogether.

Consider the Time Factor

Crypto is volatile, which means that it's a long-term investment. When trading, you might feel the urge to sell only when the market has become stable.

Using volatility as an opportunity for long-term investment will boost returns for a trader since values are cumulative, and it's only after a given time that the result will be noticed.

Inevitability of Downtrends

Similar to any other markets, you will experience downtrends in cryptocurrency markets.

The key factor is to plan a trading approach that will help you look at downtrends strategically. Moreover, your plan must consist of several different factors that help minimize the short-term losses while understanding your long-term gains.

Having the right mindset even in the downtrending markets will help you execute your trades more strategically and enable you to look at long-term gains.

Use Cryptocurrency Trading Bots

Over the years, the cryptocurrency market has grown sophisticated with innovative tools and resources that help traders. One of the prominent tools that a trader can take leverage is cryptocurrency bots.

Beginners can use this tool to automate their cryptocurrency trading, and experts can use it to enable bots to work as per their planned strategies. Bots are accurate and don't need supervision, thus eliminating human error as well as emotions.

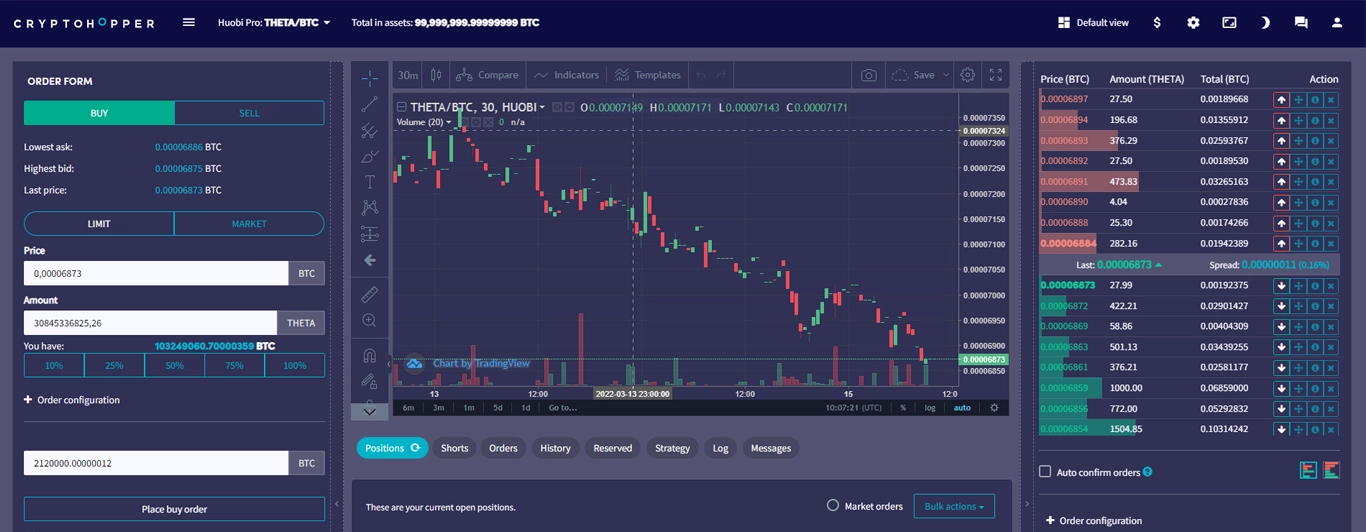

Cryptohopper is one of the best cryptocurrency trading bots available in the market today.

The Cryptohopper trading bot offers a myriad of features for beginners and experts to optimize their trading strategies in bullish or bearish markets. Alongside the basic features of automatic trading, users can also access mirror trading, backtesting, arbitrage trading, and more.

Moreover, by accessing its automated and manual trading features, a user can set up trades and allow them to be automatically executed.

Diversify your Portfolio

A diversified crypto portfolio refers to the act of investing in multiple digital currency tokens to reduce the factor of risk in the event that one or more failed to perform.

By investing in multiple cryptocurrencies, investors can protect themselves against negative events. Moreover, a diversified cryptocurrency portfolio also presents an opportunity to leverage the volatility in coin prices and invest in new cryptocurrency projects at a fairly low valuation that can yield massive returns.

Bottom line

It is true that cryptocurrency markets are volatile. Its volatility is also one reason many traders enter trades, hoping to make huge profits in a relatively short period.

But it is necessary to understand the markets and trade with a strategic plan instead of solely relying upon factors like emotions and media.

Trading in cryptocurrencies requires a certain degree of discipline, but it also presents the greatest opportunity for investment with the correct mindset.