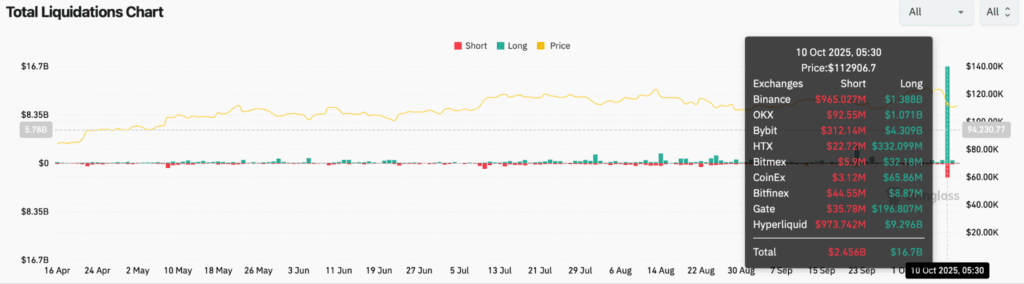

The sell-off was sparked by aggressive spot selling as US-China tariff tensions began escalating on 10 October, creating a 2.5x imbalance between sellers and buyers across major exchanges. Once the news broke of US tariffs on Chinese imports, futures markets compounded the decline, with Cumulative Volume Delta readings showing an overwhelming dominance of sell-side flow across both spot and perpetual markets. Historically, such liquidation-driven capitulations have been followed by mechanical rebounds as volatility compresses and excess leverage is flushed. For Bitcoin, reclaiming and holding above $110,000 would confirm a stabilisation phase and open recovery targets near $117,000–$120,000, while failure to do so risks a retest of the $100,000 zone.

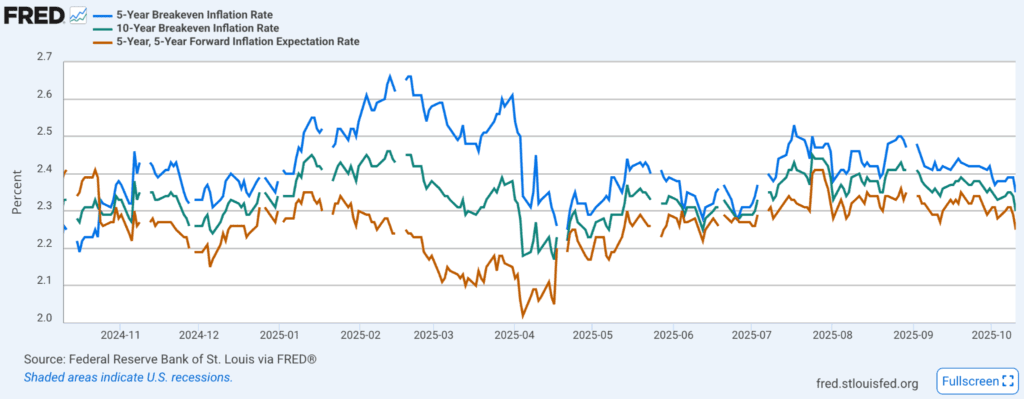

The latest economic backdrop in the United States reflects a widening disconnect between policy intent and real-world impact. The Federal Reserve’s September meeting minutes revealed deep divisions within the Federal Open Market Committee over the pace and scale of upcoming rate cuts. While most policymakers favour additional easing to counter slowing job growth, a minority remain concerned that progress on tackling inflation has stalled, and warn against moving too quickly.

Compounding the challenge is a surge in economic policy uncertainty, driven by the ongoing government shutdown, shifting tariff policies, and tighter immigration rules. The shutdown has halted key data releases, forcing markets to rely on private indicators showing an economy that is cooling but not contracting.

Despite the fiscal gridlock, financial markets have remained resilient. Treasury yields declined as investors sought safety, and a strong response to recent bond auctions highlighted sustained demand for long-duration assets. Credit markets have also held firm: both investment-grade and high-yield spreads sit near two-year lows, signalling steady investor confidence and limited concern over defaults.

The past week underscored how crypto and traditional finance are rapidly converging. In Japan, mobile payments giant PayPay acquired a 40 percent stake in Binance Japan, paving the way for its 70 million users to trade and transfer crypto directly within the country’s most popular digital wallet. Institutional finance is also deepening its crypto ties. Digital asset financing group, Antalpha led a $100 million investment to create Aurelion Treasury, soon to become the first Nasdaq-listed corporate treasury backed entirely by Tether Gold (XAUt).Meanwhile, GraniteShares filed to launch 3x leveraged crypto ETFs tracking Bitcoin, Ethereum, Solana, and XRP, expanding Wall Street’s roster of complex digital asset instruments. Grayscale debuts US Spot Crypto ETP with Native Staking Functionality.

The post appeared first on Bitfinex blog.