Mock trading is a great tool for novice traders to sharpen their skills without any risks.

Emotions can clutter a trader’s mind when not knowing how to manage them. Especially with the high volatility in the cryptocurrency markets that often leads to fear of missing out (FOMO) and panic selling.

One of the main keys to avoiding letting emotions take over your trades is to develop a trading plan and build a robust risk management strategy. Also, one must understand that the market tends to reflect or is influenced by the psychological state of its participants.

When the market sentiment is positive and prices are rising continuously, there is said to be a bullish trend or bull market. But when prices are declining in a bearish trend or bear market, pessimism usually takes over the market sentiment. That is why mastering your expectations through careful planning is vital to becoming a successful trader.

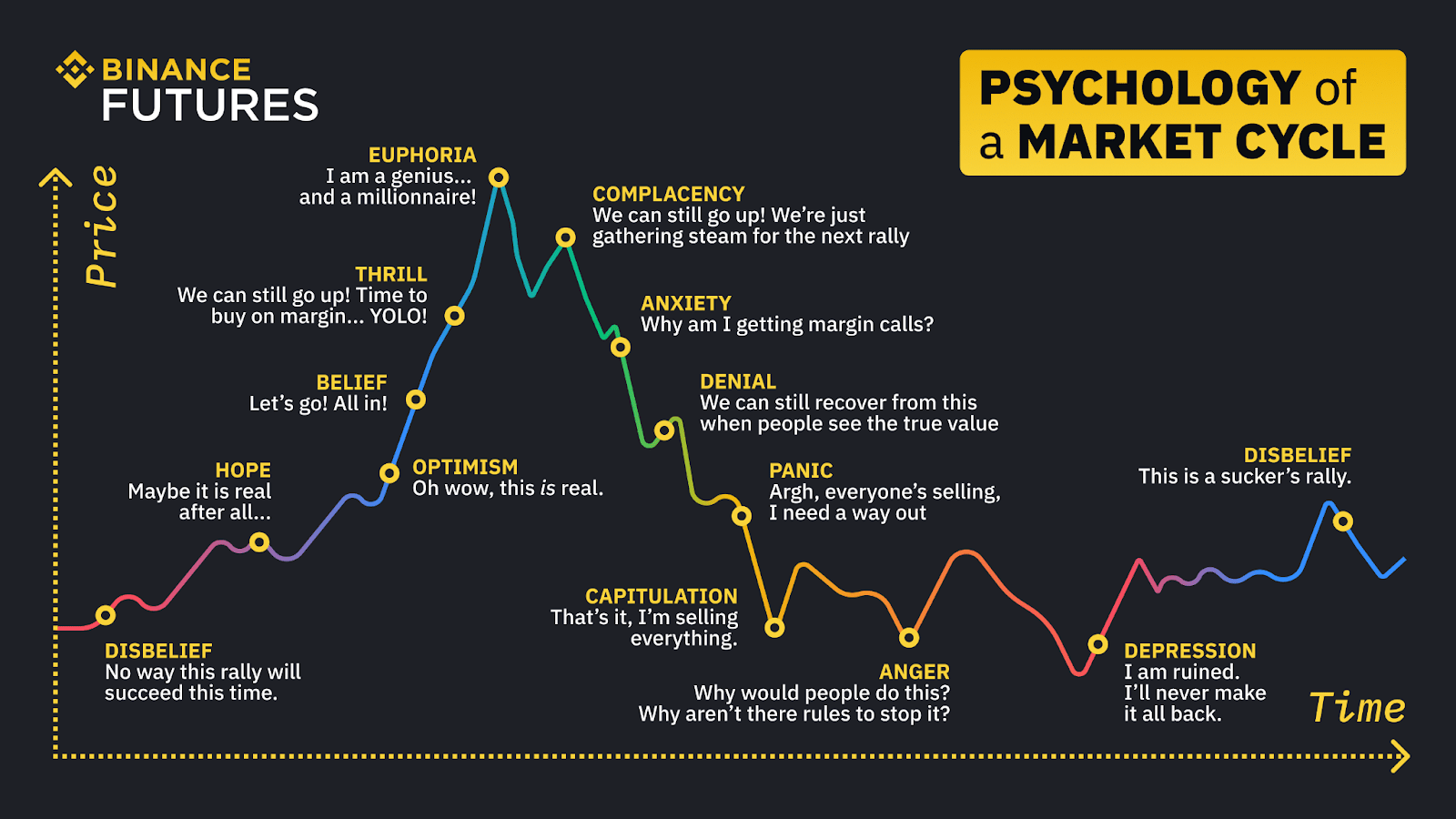

The Psychology of a Market Cycle

Traditional markets have always fluctuated, but cryptocurrency markets are known for their high volatility. The significant price movement that this new asset class goes through on a daily basis is something that had never been seen before. For a stock or a commodity to double in price, it would usually take years, but for a cryptoasset to gain 100% in market value can take only a few minutes.

Such an erratic price action can make it very difficult to time a trade properly, especially when emotions get in the way. For this reason, it is crucial to have a clear understanding of the 14 stages of the psychology of a market cycle to be aware of how your emotions may be controlling your trades.

Disbelief - After a prolonged downward trend, or bear market, traders tend to disregard the first rallies into a bull market because they believe the uptrend will fail to gain strength.

Hope - After a significant price recovery from the lows, traders start to think that it is possible for the uptrend to hold.

Optimism - Traders become more confident about the uptrend’s strength as prices start trending higher.

Belief - Traders have faith that the uptrend will hold and start entering the market with the expectation that prices will continue to surge.

Thrill - As profits start to pile up, the market sentiment turns bullish and traders are more vocal about the positions that they are entering.

Euphoria - After a parabolic price increase, FOMO starts kicking in among traders who feel that the uptrend will continue, there is more money to be made, and nothing can go wrong.

Complacency - Traders often mistake the first pullback after a parabolic price increase for a brief retracement to collect liquidity before new all-time highs.

Anxiety - As prices continue to drop without a major recovery, traders become concerned and worried about the state of the uptrend.

Denial - Traders become long-term HODLers because they believe prices will eventually the market will reverse and they will be able to recover their profits.

Panic - As prices continue to free fall, traders start to panic sell their holding to cut losses short and keep some capital to buy at the bottom.

Capitulation - Nothing seems to stop prices from continuing to decline, which generates further panic among traders and even the long-term HODLers sell.

Anger - Traders cannot believe that they never realized profits when the market was trending up, and they become angry at themselves because of the losses that they have incurred.

Depression - All hope is lost, and traders feel foolish for not exiting the market at the right time and believing that prices were going to continue to increase.

Disbelief - After a prolonged downward trend, or bear market, traders tend to disregard the first rallies into a bull market because they believe the uptrend will fail to gain strength.

All market participants go through the same emotions, which is why having a clear understanding of the 14 stages of the psychology of a market cycle is a must for any cryptocurrency trader to become successful.

Although no individual opinion is completely dominant, the overall market sentiment is what drives financial shifts.

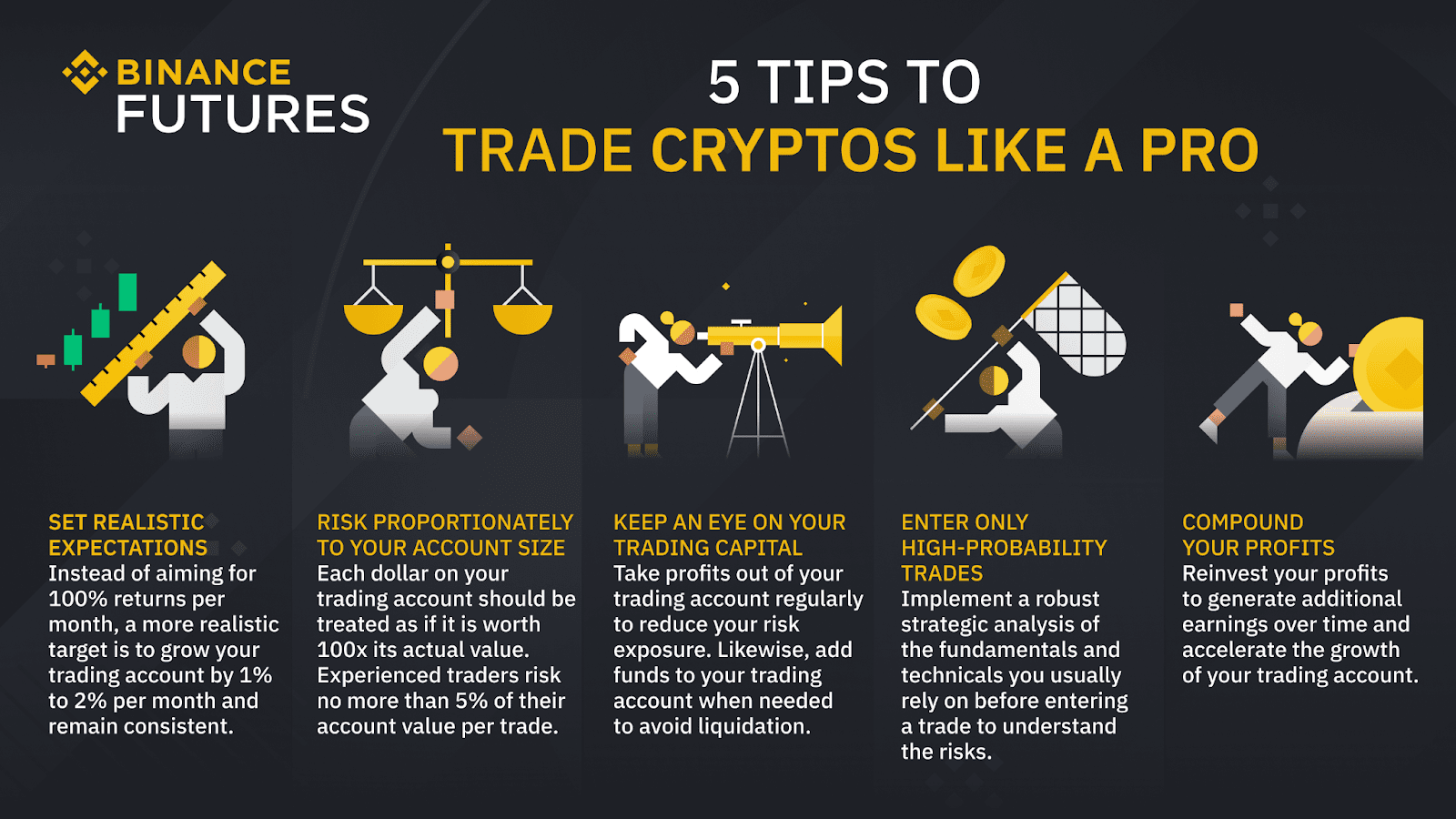

During uptrends, traders experience feelings of belief, optimism, and thrill, which often leads to FOMO near the market top. Here is where realizing profits after incurring substantial gains is important. You must set realistic expectations before entering a trade and exit the trade when your expectations are met instead of pushing your take-profit orders further.

On the other hand, traders experience feelings of complacency, anxiety, and denial, during downtrends, which often leads to panic selling near the market bottom. To avoid such actions you must have a clear understanding of how much you are willing to risk before entering a trade. Let your stop-loss orders prevent you from losing a lot of capital, and wait for high-probability setups to show up before entering your next trade.

Some of the most profitable traders often use diversification and dollar-cost averaging as their main strategies to help control emotions when trading.

With diversification, you can spread out your capital across multiple assets in different market sectors to reduce your risk. While one particular asset could be in a downtrend, another asset could be trending upwards, helping keep your portfolio afloat.

Dollar-cost averaging is another popular strategy that helps reduce your risk exposure by investing set amounts at certain price levels. When you invest slowly over time, rather than all at once, you reduce your exposure to market volatility, and you are more likely to actually buy the dip.

Both of these strategies as well as having a clear understanding of the emotions that drive a market cycle can help you stick to your trading plan, realize profits in time, exit losing trades, and improve your overall trading skills.

Avoiding FOMO and Panic Selling

Although it might be difficult to avoid FOMO and panic selling, it is possible to manage these emotions so they do not dictate how you trade.

Developing and sticking to a trading plan that works for you is the best method, plain and simple. A trading plan should outline the kind of conditions that make a setup tradeable as well as your objectives and the risk that you are willing to take on each trade.

Keeping a trading journal to record everything you do as a trader, including strategy development, risk management, feelings, and every step of the process can also be a very effective tool to avoid FOMO and panic selling. It can help to have a clear understanding of where mistakes were made in the past to prevent them from happening in the future. The more details you provide to yourself about your trading experience, the better insights you will have to grow your account and maintain your capital.

Successful traders usually have a clear understanding of the losses or the profits they will incur before entering a trade. Being very meticulous when documenting their success and failures helps them prevent making the same mistakes over and over again.

Many of the emotions that come up when trading are predictable, but if you fail to recognize when you are experiencing them, it is harder to manage them. You must be aware when you feel overly optimistic or highly anxious to stick to your trading plan.

Implementing a robust risk management strategy is an essential component of trading. With proper risk controls, you can reduce losses and prevent yourself from losing your entire trading capital. If risks can be controlled, you can increase the chance of making profits in the market.

When you are in a trade, the market will do whatever it wants to do — it could go up, down, or even sideways. As such, market movements are completely out of your control. But what you can control instead is risk, and decide how and when you trade under market conditions that are conducive to your methods and style.

Responsible trading is about having complete control over your trades and taking responsibility for your actions. Trading responsibly calls for not spending beyond your means and not risking money that you cannot afford to lose.

Likewise, you cannot let social media take over your trades, especially crypto Twitter. Whether through confirmation bias or shared panic, social media can influence your emotions drastically. Try to stick to more reliable sources like the Binance Futures Chat Room where experienced traders share news, strategies, and thoughts on the market while trading.

Sharpen Your Skills Before Trading

One fantastic way to build confidence in your trading strategy is with mock trading. At Binance Futures, we offer a testnet environment to help traders sharpen their trading skills with zero risk.

You can trade at your own pace and test multiple strategies without risking any capital. And when you feel like you are ready, you can easily switch to real trading and enjoy the same tools from the leading crypto derivatives exchange.

We also offer Binance Academy, which is a repository of trading knowledge for anybody who wants to learn more about trading cryptocurrencies.

Read the following helpful articles for more information about Binance Futures:

(Academy) The Psychology of Market Cycles

And many more Binance Futures FAQ topics…

Disclaimer: Crypto assets are volatile products with a high risk of losing money quickly. Prices can fluctuate significantly on any given day. Due to these price fluctuations, your holdings may significantly increase or decrease in value at any given moment, which can result in a loss of all the capital you have invested in a transaction.

Therefore, you should not trade or invest money you cannot afford to lose. It is crucial that you fully understand the risks involved before deciding to trade with us in light of your financial resources, level of experience, and risk appetite. If required, you should seek advice from an independent financial advisor. The actual returns and losses experienced by you will vary depending on many factors, including, but not limited to, market behavior, market movement, and your trade size. Past performance is not a guide to future performance. The value of your investments may go up or down. Learn more here.