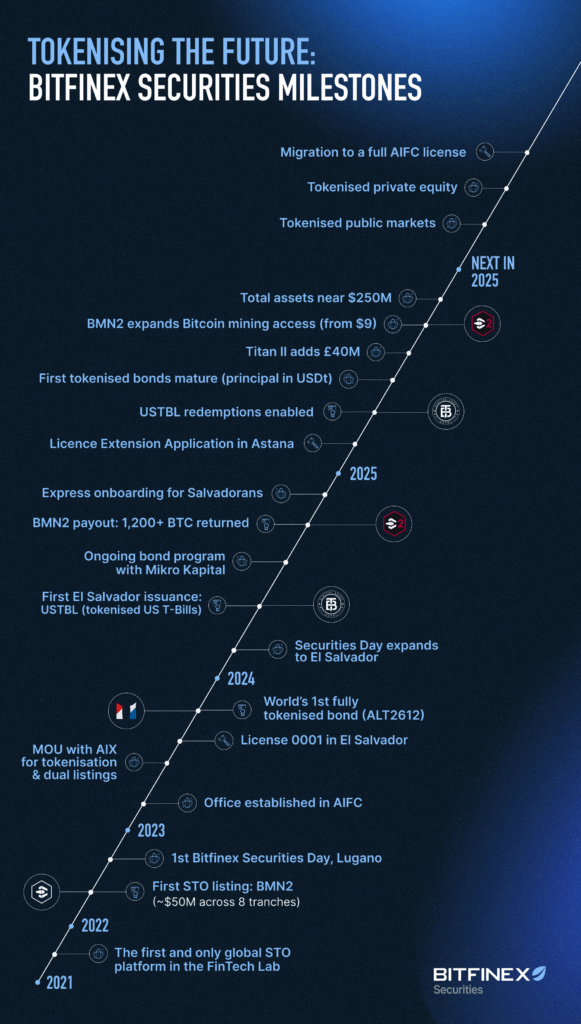

Bitfinex Securities joined the AIFC’s Fintech Lab, a regulatory sandbox to support development of the region’s financial industry, in September 2021. Since then, it has issued $206 million worth of tokenised securities whilst in the AIFC FintechLab, including Mikro Kapital’s regular tokenised bond programme and the first Blockstream Mining Note. Bitfinex Securities has also been separately licensed in El Salvador, by the Commision Nacional de Activos Digitales – El Salvador, since April 2023.

Bitfinex Securities’ licence extension plans in Astana come as the platform confirms it is on course to reach $250 million in tokenised assets across the platform, and signals the significant momentum spearheading Bitfinex Securities’ growth. This year has already seen a number of highlights, including:

The direct listing of TITAN1 and TITAN2, Bitfinex Securities’ first tokenised equity issuances, worth a combined total of GBP 143 million;

The successful full redemption of Mikro Kapital’s first tokenised bond, which paid out USDt 630,000;

The direct listing of Blockstream Mining Note 2 (BMN2) to enable secondary market trading opportunities from just under $9, based on fair value.

Paolo Ardoino, CTO of Bitfinex Securities said: “We continue to be grateful for the support that we receive from AIFC, who are a proven innovator in regulation of digital assets. After a successful initial licence period, we’re pleased to confirm we are applying to upgrade to a full licence in Astana this year. It’s no surprise that forward-looking jurisdictions such as AIFC are seeing the benefits of providing a clear and robust regulatory environment to attract and nurture companies such as Bitfinex Securities.”

Jesse Knutson, Head of Operations at Bitfinex Securities, commented: “Approaching $250 million in tokenised assets on our platform is an important milestone, and is a marker of the trust we have built with issuers. Given all of our listings are underpinned by the Liquid Network, it also highlights how the Bitcoin ecosystem is playing an important role in the development of tokenised financial markets. As appetite for tokenised securities continues to grow, we look forward to expanding our listings to make Bitfinex Securities the pre-eminent platform for the full spectrum of tokenised assets.”

Bitfinex Securities is also regulated in El Salvador, and was the world’s first international digital asset platform to be licensed under the country’s Digital Asset Issuance Law.

About Bitfinex Securities

Founded in 2021, Bitfinex Securities seeks to harness the technological advancements of the digital asset industry to transform global capital markets. With real-time settlement, 24/7/365 trading capabilities, access to global liquidity, and support for self-custody, Bitfinex Securities aims to create more efficient, cost-effective, and seamless interactions between investors and issuers. Bitfinex Securities is licensed and regulated in the Astana International Financial Centre in Kazakhstan and El Salvador.

Media Contact at Bitfinex Securities

The post appeared first on Bitfinex blog.