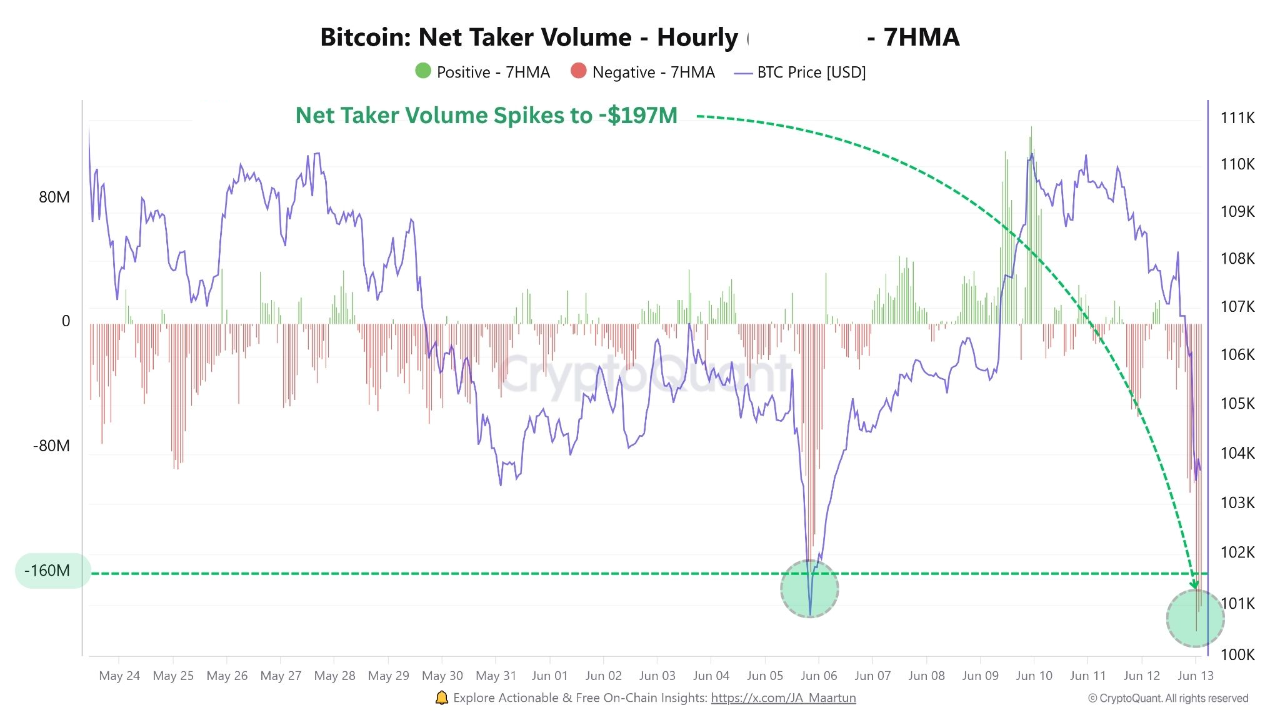

Beneath the surface, trader behaviour revealed mounting stress. Bitcoin’s Net Taker Volume plunged to –$197 million (see chart below), its lowest since June 6—signalling that sellers had seized control, aggressively offloading BTC at market prices. This selling, however, combined with a spike in liquidations, resembles past capitulation—style setups that often mark local bottoms. If Bitcoin can hold the $102,000–$103,000 zone, it may suggest that selling pressure is being absorbed and that the market could be primed for recovery—assuming geopolitical risks don’t intensify further.

Notably, the scale of the correction has been modest, especially compared to past bull market drawdowns. A 9 percent peak-to-trough pullback is well within normal volatility bands for Bitcoin, with nearly half of all trading days in the current cycle having seen deeper drawdowns. In addition, the rapid slide in the Fear and Greed Index into “Fear” territory, despite a relatively mild decline, suggests market psychology remains fragile. This reflexive fear, however, may actually reduce downside risk, as positioning remains cautious and susceptible to quick reversals if demand reasserts. For now, Bitcoin is navigating a classic consolidation within an uptrend—volatile, but not broken.

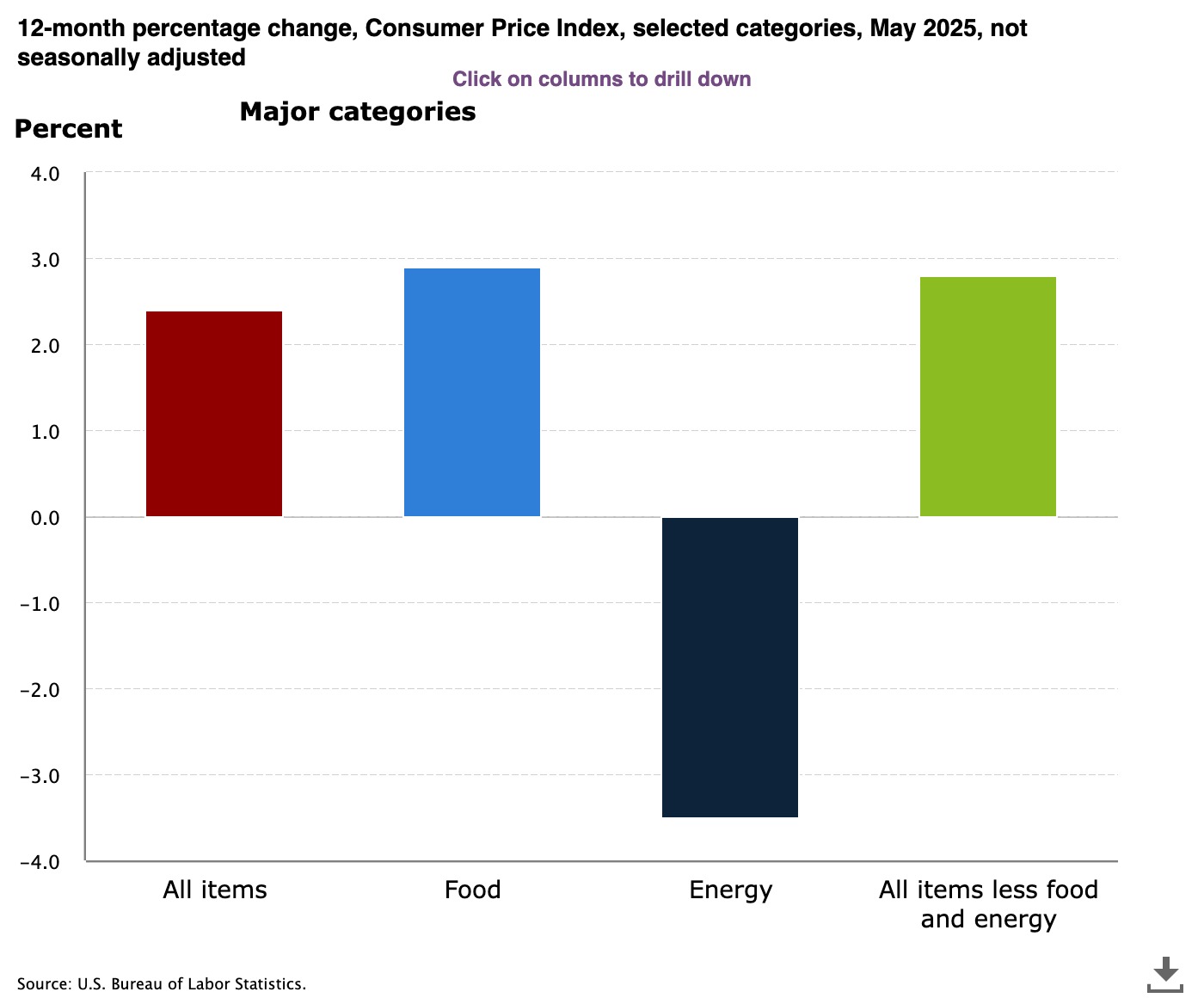

US inflation showed a mild increase in May, with the Consumer Price Index rising just 0.1 percent thanks to falling energy prices. However, this relief may be short-lived as trade tariffs and heightened geopolitical tensions raise the risk of renewed inflation through global supply chain disruptions and energy market volatility. Labour market signals are also turning cautious; jobless claims rose to 248,000, approaching levels associated with recession risks, while continuing claims hit their highest since 2021—suggesting it’s taking longer for displaced workers to find new jobs. Against this backdrop, the Federal Reserve is expected to hold rates steady at its upcoming meeting this week, balancing recent inflation softness with energy-driven price pressures and fragile job market trends. With inflation expectations still elevated and global uncertainties mounting, policymakers are likely to adopt a wait-and-see approach before committing to any rate cuts.

The crypto sector is witnessing a strategic pivot as major players embrace treasury deployment and regulatory recalibration to drive ecosystem growth. The Blockchain Group, positioning itself as Europe’s version of Strategy, unveiled a €300 million at-the-market equity program to expand its Bitcoin reserves—signalling growing investor appetite for BTC-backed equity vehicles amid regulatory clarity under MiCA. Meanwhile, Cardano is considering a $100 million diversification of its ADA treasury into native stablecoins and Bitcoin, aiming to deepen liquidity and strengthen its DeFi infrastructure without relying on external funding. In parallel, the US Securities and Exchange Commission has withdrawn several Gensler-era proposals targeting DeFi exchanges and custody frameworks, reflecting a broader shift toward more innovation-friendly regulation under Acting Chair Paul Atkins. Together, these developments highlight a new phase where blockchain foundations are actively leveraging capital to accelerate adoption, while regulators begin aligning with the decentralised nature of Web3 finance.

The post appeared first on Bitfinex blog.