Geopolitical uncertainty has contributed to market volatility, most notably during the recent escalation, and then subsequent de-escalation, of US strategic ambitions in Greenland. While tariff threats briefly triggered a risk-off response across equities and saw volatility spike, the rapid pullback in policy rhetoric restored near-term stability. However, investor positioning suggests that markets view recent rebounds as stabilisation rather than a return to expansionary conditions.

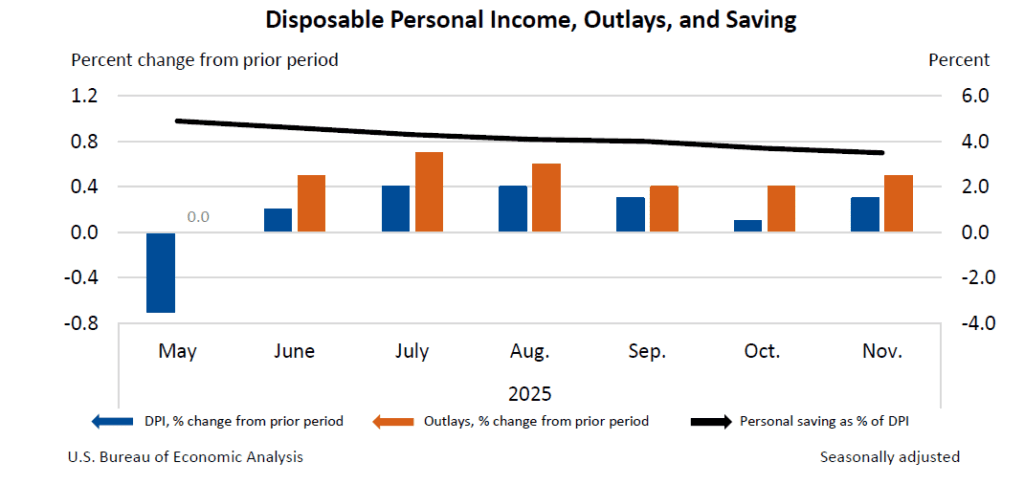

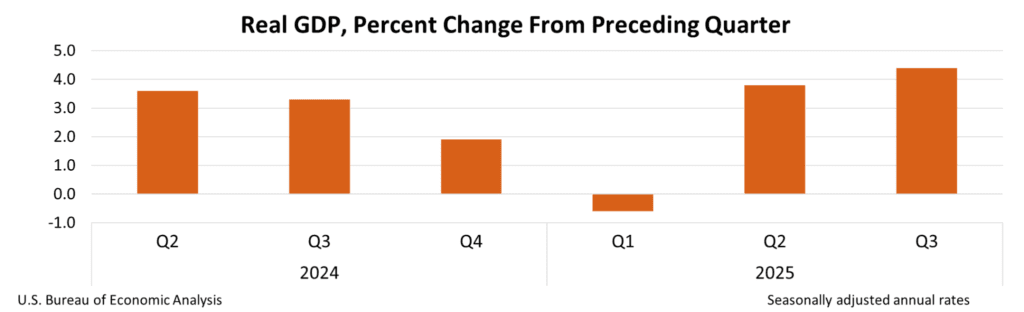

US economic growth, on the other hand, remains resilient, supported by strong consumer spending, but the expansion is increasingly constrained by persistent inflation, weakening household savings, and tightening financial conditions. While demand has kept output above trend, income growth has lagged, forcing households to rely more heavily on credit. Elevated prices, particularly for essential goods, continue to weigh on lower- and middle-income households, limiting the Federal Reserve’s ability to ease policy despite signs of cooling in the labour market. As a result, monetary conditions are likely to remain restrictive until clearer and broader-based disinflation emerges.

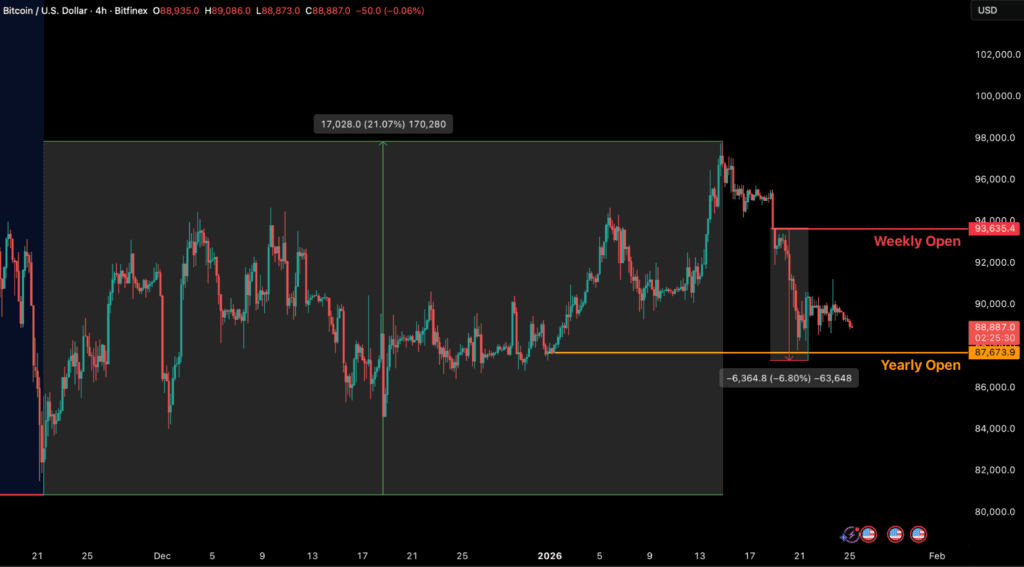

Financial markets are reinforcing this caution through a broad repricing of risk. Rising long-term yields, a higher term premium, and the unusual combination of US dollar weakness alongside bond market stress signal growing concern around fiscal sustainability, policy stability, and geopolitical risk. Capital has gradually rotated toward defensive assets, indicating that financial conditions are tightening in practice even as policy rates ease at the margin.

Within this environment, longer-term structural shifts continue to take shape. The New York Stock Exchange, via its parent Intercontinental Exchange, is launching a blockchain-enabled, 24/7 trading venue for tokenised equities, reflecting the gradual integration of digital infrastructure into traditional markets. At the same time, corporate adoption of digital assets continues, with perennial buyers Strategy and Bitmine Immersion Technologies expanding bitcoin and Ether holdings as long-term strategic reserves.

The post appeared first on Bitfinex blog.