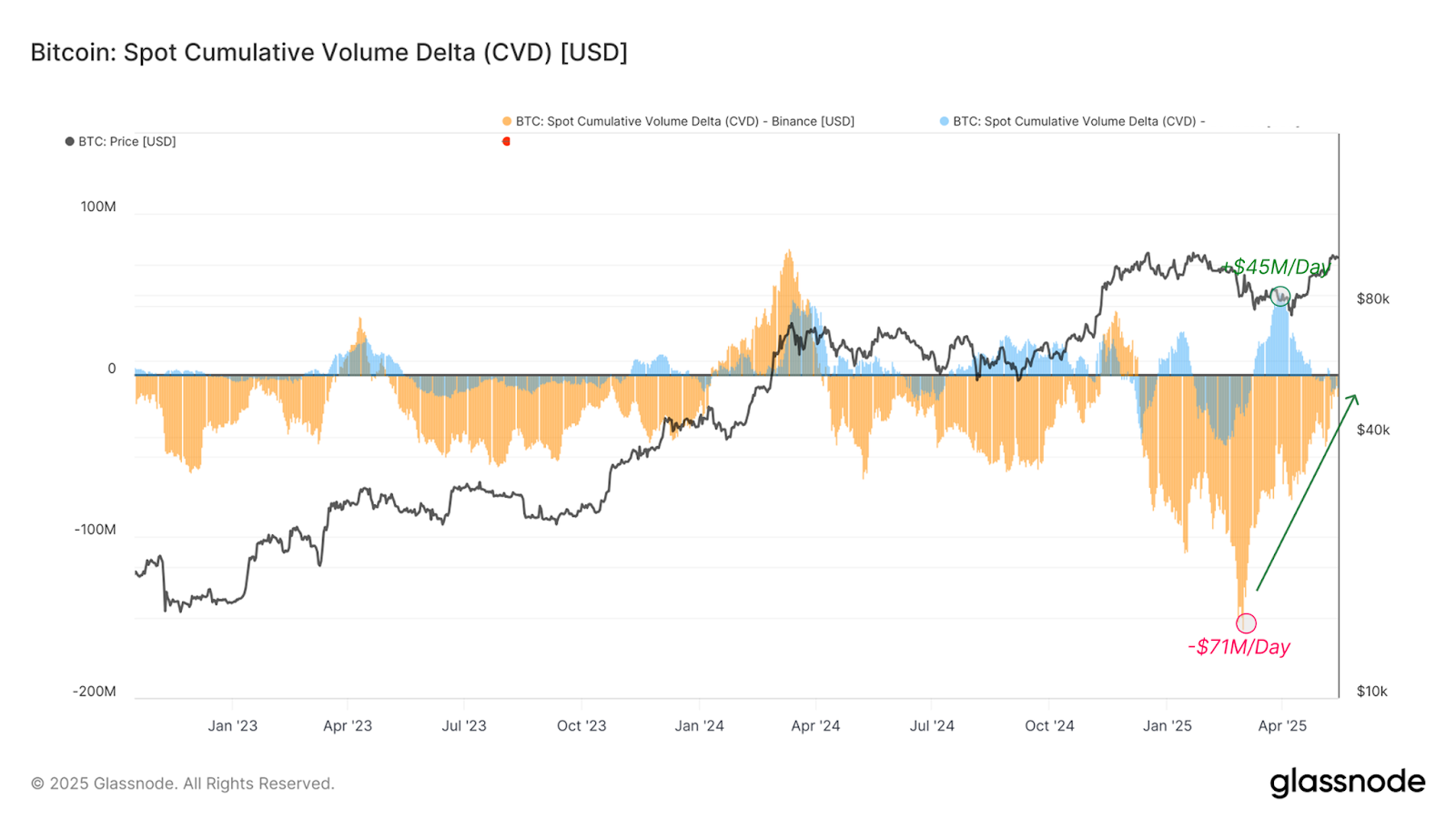

The rally has been clearly spot-driven, characterised by impulse moves higher following short, well-defined consolidation phases. This pattern suggests healthy accumulation and strong underlying demand rather than speculative excess. Spot Cumulative Volume Delta across major exchanges has remained positive, reinforcing the view that real buyers—rather than leveraged traders—are dominating the market.

Meanwhile, derivatives positioning has been reactive, with open interest fluctuations highlighting a transition period marked by short squeezes and liquidation-driven resets. The result is a healthier foundation, with speculative froth cleared and momentum now underpinned by genuine capital flows.

With Bitcoin just off its All-Time High, and spot premium remaining elevated, the current range-bound price action may simply represent a period of stabilisation before a potential breakout. While short-term pullbacks are still likely, the broader trend remains firmly constructive.

That said warning signs continue to flash across the US economy, as inflation cools but deeper structural risks begin to surface. The Consumer Price Index rose just 0.2 percent month-over-month in April, and is up just 2.3 percent on the year—the lowest annual gain since early 2021.

A drop in food prices helped ease the pressure from shelter costs, but the outlook remains clouded by uncertainty over tariffs and trade policy. Despite a temporary truce between the US and China, sweeping import tariffs remain, with more potentially on the way by July. These unresolved trade tensions create significant challenges for businesses and policymakers alike.

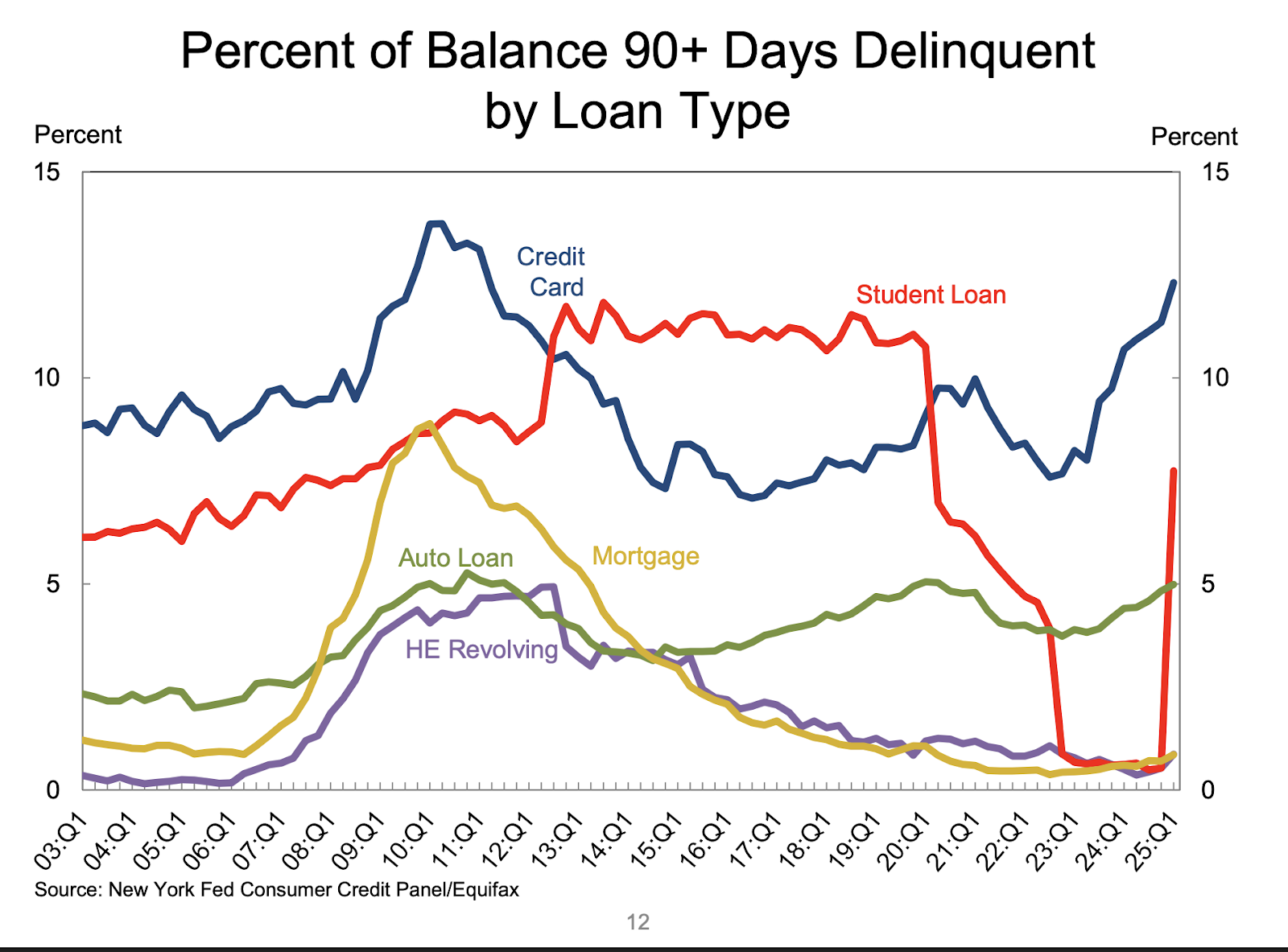

At the same time, financial strain is building at the household level. Recent data from the New York Fed show a rise in 90+ day delinquencies on credit card and student loan balances, underscoring the fragile state of consumer finances. As tariffs begin to bite and inflation risks linger, the combination of slowing growth and rising prices—potential stagflation—could leave the Federal Reserve in a difficult position.

For now, with core services and housing costs still elevated, the Fed is likely to remain cautious. But with economic pressures mounting, the coming months will demand both flexibility and vigilance.

Institutional and corporate adoption of Bitcoin continues to grow, even amid market dips and regulatory uncertainty. Abu Dhabi’s Mubadala Investment Company increased its holdings in BlackRock’s spot Bitcoin ETF (IBIT) during Q1 2025, signalling long-term confidence despite a temporary drop in the ETF’s market value. Since its January 2024 launch, IBIT has led the US market for spot ETFs, drawing over $45.5 billion in inflows and managing $65.4 billion in assets.

In Latin America, Brazilian fintech Méliuz became the region’s first public company to adopt a Bitcoin treasury strategy. After purchasing 274.52 BTC worth $28.4 million, its total holdings now exceed 320 BTC. The move was backed by shareholders and was followed by a 116 percent surge in the company’s stock, reflecting strong investor support for crypto-based financial strategies.

Meanwhile, the legal landscape remains tense. A US judge rejected a joint request from the SEC and Ripple to ease penalties and lift restrictions, citing procedural errors due to the case being under appeal. The decision stalls a potential settlement in a landmark case that could shape the future of crypto regulation in the US. Together, these events highlight both the momentum and the hurdles facing crypto’s growing role in finance.

The post appeared first on Bitfinex blog.