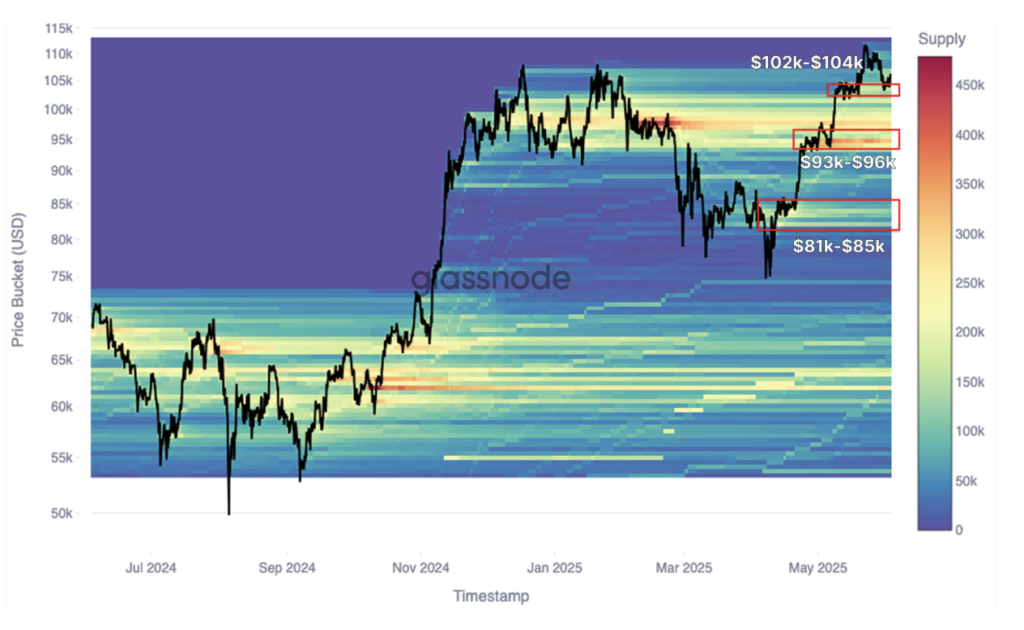

On-chain indicators now point to rising sell pressure as older holders begin to distribute. The Spent Supply Distribution (SSD) quantiles and Short-Term Holder (STH) Cost Basis bands offer a clear roadmap. The SSD 0.95 quantile at $103,700 marks the first support zone, followed by $97,100 (STH Cost Basis) and $95,600 (SSD 0.85), with $83,200 as the key risk-off level. These levels are crucial as they reflect cost basis zones for large holders and recent buyers, serving as potential demand re-entry points or liquidation triggers.

In a nutshell, Bitcoin is now at a crossroads—balanced between structural support and waning bullish momentum, waiting for its next macro cue.

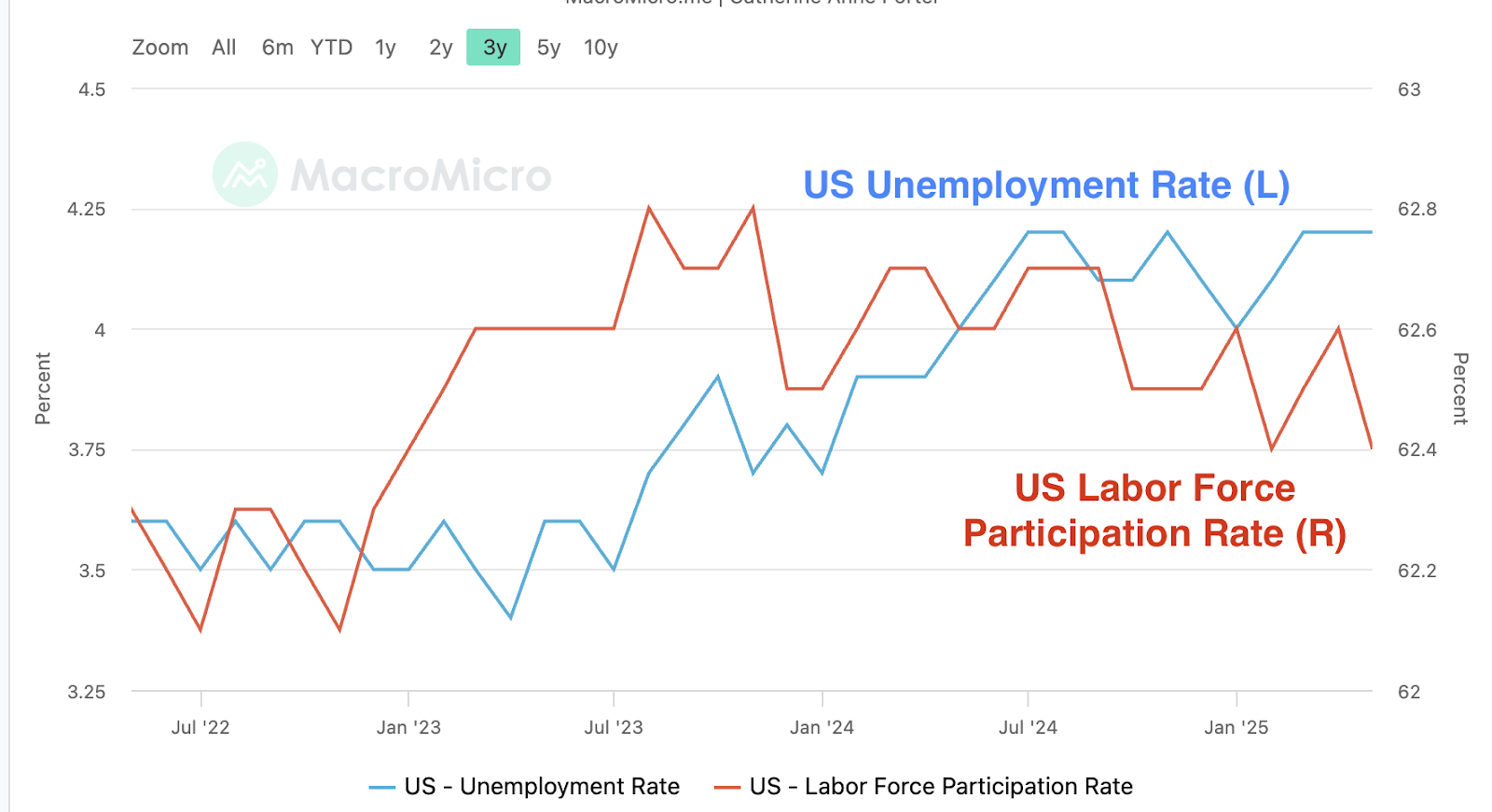

The US macroeconomic landscape continues to show signs of strain as job growth slowed in May, reflecting early pressure from ongoing trade tensions and tariff uncertainty.

While wage gains remained solid, a shrinking labour force and downward revisions to past employment data suggest the labour market’s resilience is beginning to erode. At the same time, both the manufacturing and services sectors contracted, driven by rising input costs and declining demand, underscoring the widespread impact of tariffs across the economy. Construction spending has also declined for three straight months, and inflationary pressures are mounting as businesses struggle to absorb higher costs.

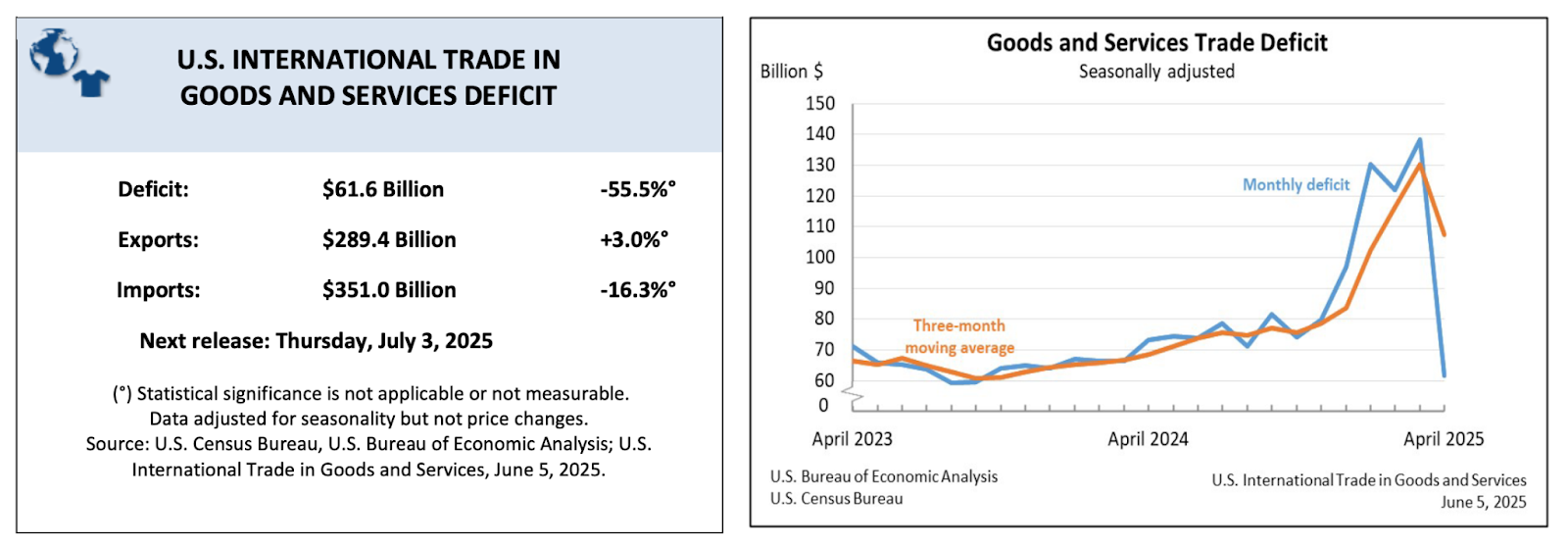

On the trade front, the US deficit narrowed due to falling imports—particularly from China—but this decline signals weakening demand rather than strength, raising concerns about future inventory shortages and inflation. Meanwhile, investor appetite for long-term US debt is faltering, with auction data and futures markets pointing to skepticism about fiscal stability.

Crypto adoption is accelerating on multiple fronts, with IG Group becoming the first UK-listed company to offer spot crypto trading to retail investors. Partnering with Uphold, IG now enables direct purchases of bitcoin and other tokens, marking a shift from speculative derivatives to true asset ownership. This move coincides with the UK Financial Conduct Authority’s proposal to lift its ban on crypto exchange-traded notes (cETNs) for retail investors, signalling broader regulatory support for digital assets. Meanwhile, Japan’s Metaplanet announced a ¥850 billion ($5.4 billion) equity raise to aggressively expand its bitcoin holdings, aiming for 210,000 BTC by 2027—underscoring Asia’s growing role in institutional crypto adoption.

The post appeared first on Bitfinex blog.