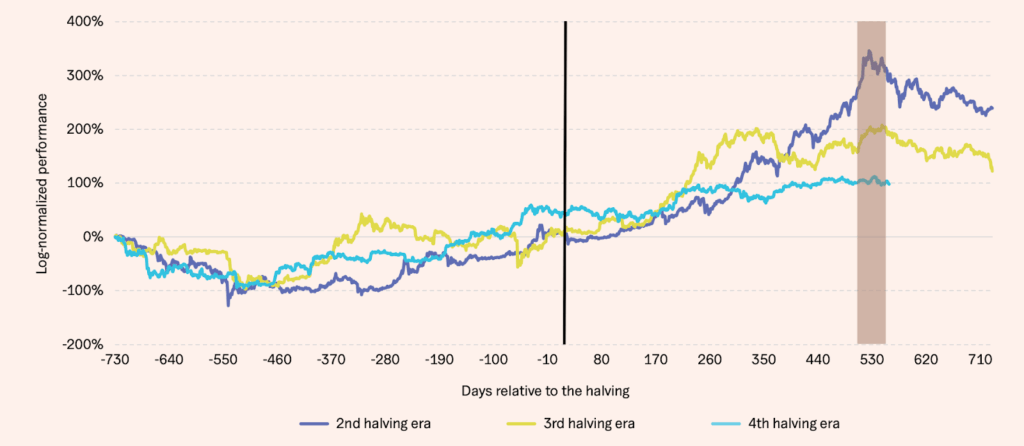

This shift was evident in 2025. Despite halving models implying a completed cycle, Bitcoin avoided the deep drawdowns of prior eras. Structural inflows from ETFs, corporates, and sovereign-linked entities absorbed multiples of annual mined supply, compressing volatility and accelerating recoveries. Drawdowns since 2024 have remained materially shallower, reflecting a market now dominated by patient, long-term capital rather than speculative retail flows.

At the macro level, BTC’s role alongside traditional hedges did however strengthen. Persistent fiscal deficits, rate cuts amid above-target inflation, and rising sovereign debt risks revived the hedge narrative. Gold led this move in 2025. So what of 2026? Firstly, consistent with historical patterns in which gold outperforms at macro turning points, we believe BTC will follow with a lag.

Secondly, liquidity will increasingly drive BTC performance. Heavy Treasury issuance in 2025, prolonged quantitative tightening, and front-loaded fiscal programmes have lengthened the global liquidity cycle. Now as issuance moderates and QT tapers into late 2025 or early 2026, liquidity conditions are likely to turn more supportive for BTC.

Thirdly, Institutional adoption continues to deepen. Crypto ETPs are now the primary access point for digital assets as regulatory barriers fall and sovereign interest grows. With Crypto ETP AUM just over $200 billion today, we expect it to exceed $400 billion by end-2026, reinforcing Bitcoin’s shift toward a mature, macro-sensitive asset with longer and less volatile cycles.

The US economy enters 2026 after a prolonged adjustment from the post-pandemic inflation shock. In 2025, growth cooled without breaking, inflation eased but remained sticky, and the Federal Reserve cautiously pivoted toward gradual easing.

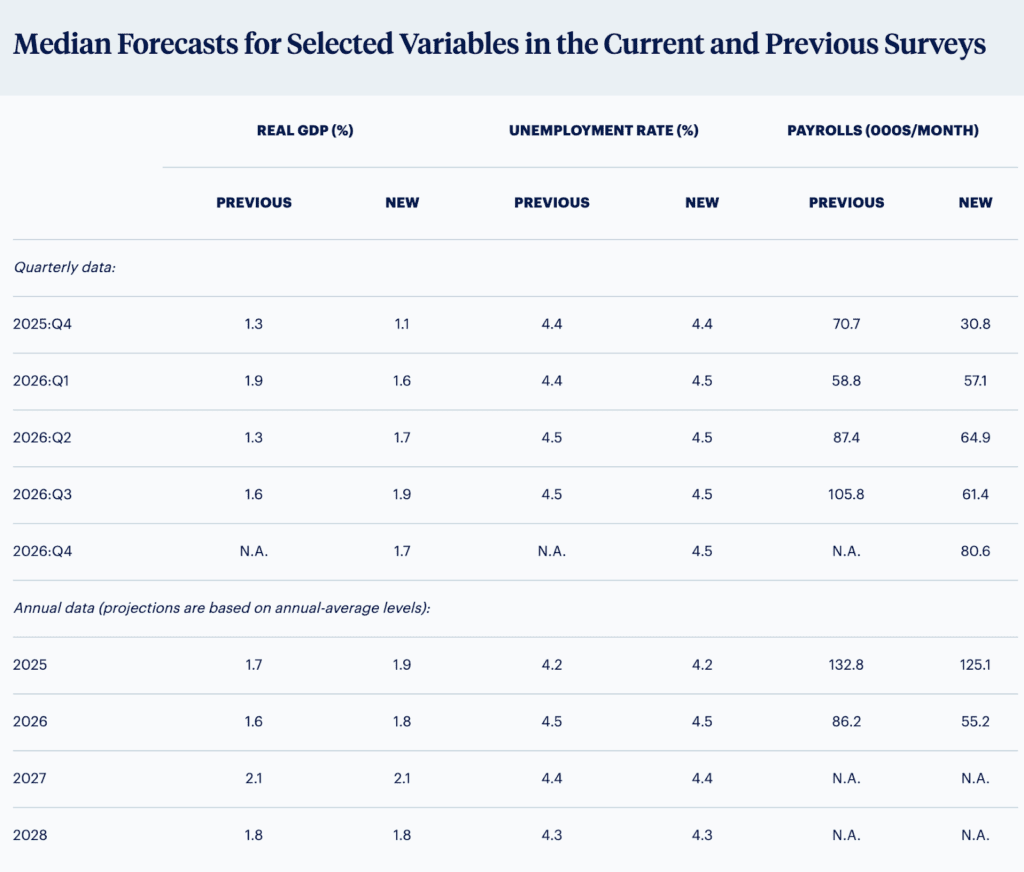

Labour market conditions softened meaningfully. Hiring slowed, wage growth eased, and unemployment drifted into the mid-4 percent range, driven by weaker demand for new workers rather than widespread layoffs. Data revisions confirmed weaker-than-initially reported job growth, consistent with a late-cycle, low-momentum environment. Looking ahead, the labour market is expected to remain soft but stable in 2026, with unemployment broadly holding near current levels unless consumer demand weakens more sharply.

Inflation continued to ease in 2025, but unevenly. Goods prices cooled, while shelter and services kept headline inflation near 3 percent and core measures above the Fed’s 2 percent target. PCE ran modestly lower than CPI, though persistent services inflation and renewed tariff pressures posed upside risks. We expect inflation to gradually ease in 2026, with potential near-term stickiness before moving closer to target toward year-end.

Monetary policy adjusted cautiously. After holding rates steady for much of 2025, the Fed began easing in September, delivering three quarter-point cuts by December while maintaining a data-dependent stance heading into 2026.

At the same time, the Fed ended its balance-sheet runoff and initiated technical reserve-management purchases to stabilise money markets, actions aimed at maintaining financial plumbing rather than signalling aggressive easing. The current Fed forecast as indicated in the dot plot suggests there will only be one more cut in 2026, but we believe that there is considerable room for more loosening and that pressure will build for more rate cuts to be implemented. With unemployment drifting higher, job creation slowing, and inflation continuing to ease, albeit remaining above target, we see scope for a more accommodative path. Our base case is two to three additional interest rate cuts in 2026.

Financial markets have largely embraced the transition to looser monetary policy, despite weakening labour markets and sticky inflation. US equities advanced to record highs in 2025, supported by relative disinflation, policy easing, resilient corporate earnings, and sustained enthusiasm around AI-driven productivity gains. Treasury yields moved lower, particularly at the short end, as expectations shifted toward a slower economy and further rate cuts, resulting in a modest steepening of the yield curve. Looking ahead, key risks include inflation surprises, slowdowns in China and Asia, or renewed trade/policy shocks. But as of late 2025, markets appear priced for a benign 2026: solid growth (2–2.5 percent GDP), easing inflation and continued, but cautious, Fed easing. Under these conditions, we expect further gains in stocks (with S&P targets in the 7,500–8,000 points range) and lower Treasury yields (10-year sub-4 percent). Investors remain watchful of the Fed’s path: a more aggressive cut cycle could push stocks even higher and yields lower, whereas any sign of inflation stickiness could rebalance expectations.

Overlaying these macro trends is a significant shift in trade policy. The Trump administration’s aggressive tariff regime sharply raised effective import taxes, compressed trade volumes, and narrowed the trade deficit, while also contributing to price pressures and global market volatility. Although the pace of escalation slowed later in the year, tariffs remain elevated by historical standards and are likely to persist into 2026, introducing ongoing uncertainty for inflation, corporate margins, and global growth.

As 2025 draws to a close, we look forward to a new year where we expect to see BTC re-visiting its all time high ($126,110), underpinned by further loosening monetary policy, increasing liquidity and the ongoing weight of continued crypto adoption.

Thanks for being with us during 2025, and we hope you have appreciated all the insights we have provided during the course of the year, just as much as we have enjoyed giving them to you. We will be back in the New Year.

In the meantime, many happy holidays from Bitfinex.

The post appeared first on Bitfinex blog.