How to set up your Market Maker bot

Market making consists of trading the difference between the bid (buy price) and the ask (sell price), also known as the spread, of a cryptocurrency pair. The market-making bot will continuously trade the spread of any selected market.

It is a very common practice among high frequency traders. This trading strategy will place buy and sell orders in specific places of the order book to trade the spread quickly. Choose the market, and the market making bot will do the rest.

Select and configure your Market Maker bot

In the following paragraphs, you will learn how to set up your Market Maker bot in less than five minutes. Let’s get started!

But before we start learning step by step how to set it up, notice that not all the steps are strictly necessary to get your bot up and running. Only the options with the symbol (*) will be required, which is your exchange (unless you are paper trading) and the market that you would like to market make.

1st step. Go to “View all your hoppers”, create a new trading bot and click on Market Maker bot.

2nd step. Let’s begin with the basic configurations! Section Config → Basic settings. Make sure you name your first market maker bot. You can also set a cooldown period if you would like your market maker bot to stop trading for X amount of time after a trade.

3rd step. Exchange*. In this section, you can select your exchange, as well as testing the trading strategy in paper trading mode.

Once you have selected your exchange and copy-pasted your API keys, the funds available in your crypto exchange will be displayed in the trading bot.

4th step. Market and Pricing. The first configurations of the market maker bot itself. This section is going to be divided in smaller steps since it’s the core of the bot:

Market

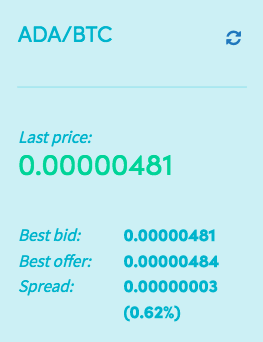

Select the market you would like to market make. Depending on the market that you choose, the blue box next to it will show the last price and the spread difference.

Want to learn a trick on how to select the best market for the bot? Check out the section Charts and click on markets. A table with all the markets showing their spread will display the spread of every single market in your exchange. Then, you can make sure to select the market with the spread you want to target.

Strategy

This is not a required field. Normally, market making doesn’t consist of having a strategy that determines when to buy, it just places buy and sell orders to profit from the spread of a market.

However, whether your strategy signals a buy, neutral or sell, it will be used to determine if the market is in an uptrend, neutral or downtrend. Therefore, you can create slightly different market making strategies for each market condition. Let’s dig a bit deeper.

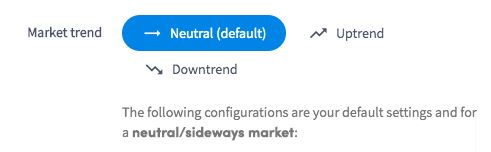

Market trend

By clicking on the three different options, Uptrend, Neutral (default) and Downtrend, you can alter the following aspects of your market making strategy. And remember(!), uptrend configurations will take over when the strategy signals a buy, downtrend ones when the strategy signals a sell, and neutral when the strategy doesn’t signal buy or sell:

Order sequence

With this option, you can choose the order in which the orders will be placed. You can choose between: Buy and sell (orders) at the same time; Buy first, then sell (order); Sell first, then buy; Do not buy/sell (do not place orders).

Order positioning

This allows you to position the market making orders differently depending on three factors: Percentage higher ask/lower bid; Order by position in order book; One satoshi better than given position. We will analyze every option more deeply in the order layers section

Minimum spread %

Here you can enter the minimum spread percentage you would like to get with your orders. If left empty, the hopper will not check for a minimum spread.

Order layers

The last section of this key and interesting step. Basically, this option allows you to tell the hopper how many market making orders it can place at the same time in different layers.

For example, if you create three layers, the first order will be closer to the price (lower spread difference); the second one a bit further than the first one (larger spread than the first layer); the third order further than the second one (larger spread than the second layer). This lets the user create different market making orders that will aim for different profits.

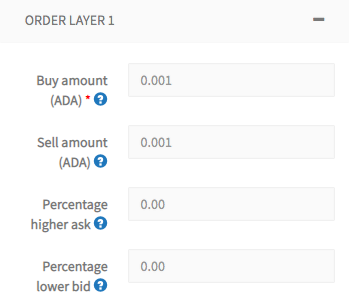

What can you find in the Order layer box? Basically two things, the buy and sell amount, and the position it will have in the order book (that you selected in the option Order positioning).

These are two of the three types of order layers boxes that you can have. Both have in common the Buy and Sell amount, but the last two options vary depending on what you selected in Order positioning.

Percentage higher ask/lower bid

you will see the first box. In Percentage higher ask, you can set a specific percentage above the current price where the sell order will be placed. On the other hand, Percentage lower bid indicates the percentage below the price where the buy order will be placed. The difference between the buy and sell order will be the spread that you are targeting and, therefore, profit.

Order by position in order book

The second box will be displayed. By having chosen this option in Order positioning, you can select in which position of the order book the buy and sell order will be placed. If the Bid position (buy order) is 2, it will be located in the second position of the order book (second until it reaches the price). Likewise, if the Ask position is 3, the sell order will be placed in the third position.

5th step. Autocancel. The autocancel settings offer several ways to cancel an order automatically. These are:

Only cancel unfilled orders.

If enabled, only market making orders with both, the buy and sell order, unfilled can be canceled. If the buy order has been filled but the sell hasn’t, the order order won’t be canceled.

Do not cancel partially filled.

If enabled, the market making orders that have been partially filled (only one of the two orders have been filled) won’t be canceled.

Cancel after period of time.

If enabled, market making orders will be canceled after X amount of time. You can configure different autocancel times for neutral, uptrend and downtrend conditions.

Cancel on trend change.

If enabled, market making orders will be canceled when the trend changes its direction. How do we know when this happens? The strategy that you have selected (if selected), will determine a trend change when it signals buys, sells and neutral.

For example, by enabling Cancel on trend change from uptrend to neutral → cancel all orders, what will happen? The strategy was signalling buy and it has just changed to neutral (no buys or sells) then, all the market making order will be automatically cancel.

Cancel on percent change.

If enabled, the trading bot will cancel all pending orders when the price changes more than percent that specific percentage in the time span selected.

Cancel on depth

If enabled, orders going “deeper” in the order book, that is going later in the queue due to there are better bids or asks, can be canceled when they are after a X position in the order book.

For example, the market maker bot located orders in the second position of the order book. Then, other traders are placing better orders (closer to the price), so the order initially placed goes later in the order book. If you set the depth limit on 5, the orders will be canceled once the orders are located after the fifth position of the order book.

6th step.

Stop loss. If enabled, you will be able to set a range for which the Market making bot won’t trade.

With the Stop-loss ranges, you can set an upper and lower limit price to stop trading once the price of the selected market is not within that range. For example, say that you choose the market ETH/BTC.

The current price is 0.021. You would like your bot to trade only once the price is between 0.025 and 0.019, then you would set those values as the limit prices, and once the price is not within those limits, the bot won’t trade.

You can also configure two optional parameters. The first is Cancel market makers. When enabled, this option will cancel all market makers orders once a stop loss is triggered. The second one is Allow revert/retry, if enabled, this will retry the cancelled orders according to the trading bot’s configurations.

7th step.

Revert and Backlog. If enabled, this option will retry/revert all failed market maker orders. This section can be configured with different options. Let’s analyse them one by one

Move failed to backlog

If enabled, all failed market maker orders will be moved to your backlog

Automatic match backlog

If enabled, market maker orders moved to the backlog will be automatically matched together only if it will result in a correct and successful match: same amounts, same price or profitable.

Revert cancelled orders.

Select if you would like to revert cancelled and failed market maker orders. If, for example, a sell is successful and a buy order is cancelled, the buy order will be placed again at a different price and the profit/loss will be recalculated. Here you can select three options: Do nothing; Revert buy/sell orders; Retry buy/sell orders.

Maximum loss

his option will be available if revert buy/sell orders and retry buy/sell orders are enabled.

You can choose how to revert/retry orders depending on the type of market.

For example, if your strategy is currently signalling neutral (or uptrend or downtrend), you can choose among the following options: Do not revert/retry; Buy/sell for BBO; Buy/sell according to trend config; Sell for best offer, buy with config; Buy for best offer, sell with config; Buy for best bid, sell with config; Sell for best bid, buy with config; Buy best offer, sell with config.

And this is it! Many steps and options right? Don’t let them scare you, most of them are very optional and for very specific needs. In fact, in order to start market making you would just need to select your exchange and the market you would like to trade.

After seven steps, your market making bot will be more than ready to target and profit from the spread of any market you select. Together with the normal trading and arbitrage bot, the market maker bot completes a full range of automated trading tools that will let you profit from the volatile crypto market.

A whole range of possibilities that you can automate with an Hero subscription. Start trading crypto automatically to trade any cryptocurrency, any time.