Crypto Trading 101: Locking In Profits Like A Pro

There are 2 main ways to lock in profits in the crypto market, among several others, that every serious crypto trader must follow. Knowing when to cash out of your crypto holdings is equally important or even more important than when you entered the market.

#1 Use a Fixed Take Profit

First and foremost, using a fixed take profit is one of the simplest and most effective ways to cash out on a trade that goes in your favor.

A fixed target can be anything from a key resistance level, an old swing high, a big round number, or a fixed % away from your entry.

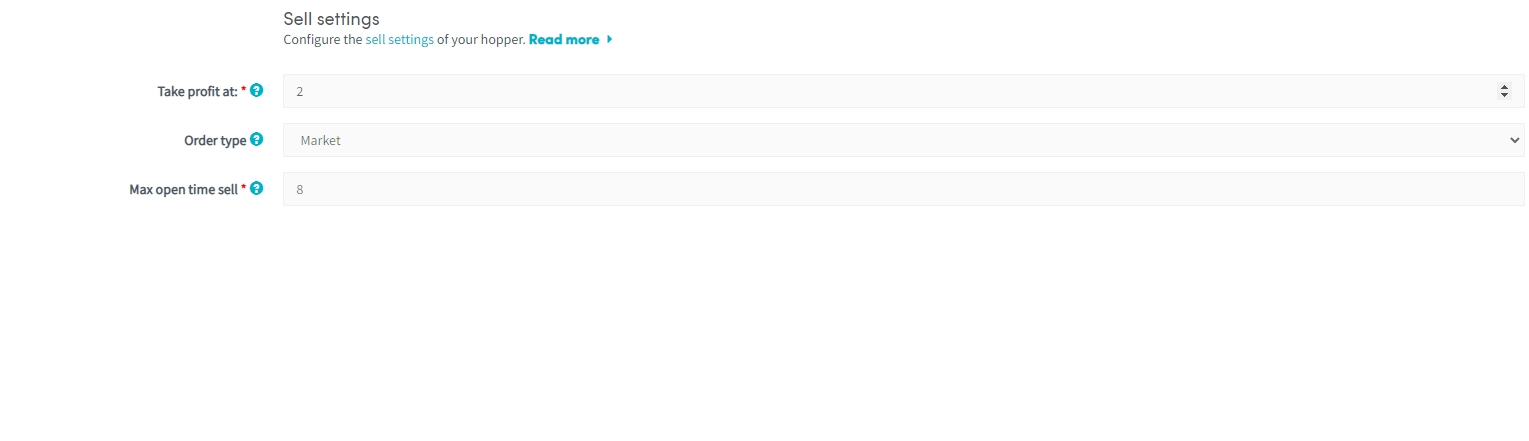

Set Take profit on Cryptohopper

With Cryptohopper, it’s possible to set a Take Profit at. Within your configuration, you can set a percentage for your bot. When a trade goes in your favor, it will sell quickly.

Read more about Take profit here.

#2 Trail Your Stop-Loss

The most practical way to lock in profits is to trail your stop loss until the market stops you out. If you keep trailing your stop loss as the market moves in your favor, it will be very difficult not to build your crypto trading account in the long run.

This take-profit strategy has many advantages. The greatest benefit is that you can potentially make a lot more money when there is a strong uptrend, as you will follow the trend until the end.

However, the only drawback is being stopped out prematurely by an unwanted price spike, which you’ll need to accept as it will occur from time to time.

If you’re in a winning position but don’t know where to lock in profits, this strategy may be best suited.

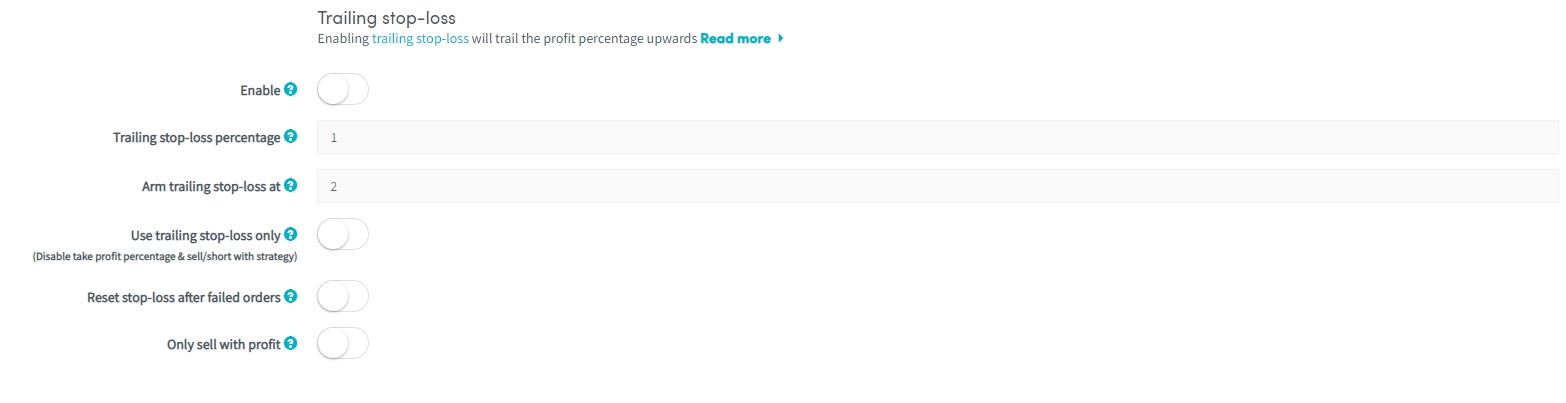

Trailing Stop-loss on Cryptohopper

Cryptohopper offers both types of stop-losses, so you can choose which one works best for your trading strategy.

With a trailing stop-loss, you can set a percentage or dollar amount that you want to trail the market by.

For example, if you have a long position in Bitcoin and you want to trail the market by 5%, you would set your trailing stop-loss at 5% below the current market price. If Bitcoin falls 5% from its current price, your stop-loss will trigger and sell your Bitcoin at the new lower price, locking in your profit.

If Bitcoin continues to rise, your stop-loss will rise with it, giving you the opportunity to make even more profit. With a hard stop-loss, you simply set a price at which you.

Read more about setting up your Trailing Stop-Loss here.

Bottom line

When it comes to trading, locking in profits is essential if you want to be successful. However, it's not always easy to do. With these tips, though, you should be able to lock in profits like a pro in no time. Just remember to practice patience and discipline, and you'll be well on your way to becoming a successful trader.