Why You Should Fully Automate Your Trading Strategy

If you’ve ever seen finance depicted on the big screen, you undoubtedly have an impression about how the system works.

Busy day traders bustle around crowded trading room floors, striking deals and making tons of money. It’s the action scene of so many financial dramas that it can start to feel like it’s the way the system actually works.

Of course, as so often happens, what’s depicted in the movies is much different than what happens in real life, especially when it comes to investment banking.

Today’s investment market is dominated by a different, less visible type of action. Automated trading, a catchall term for many types of algorithmically-driven trading strategies, is the name of the game.

For instance, JP Morgan estimates that only 10% of trading is executed through human-based stock selections, and it’s estimated that, on any given day, 80% of all stock grades are machine-led, which represents a significant shift in the nature of investing.

In the past decade, investment juggernaut Goldman Sachs has automated 99% of their equity trading jobs, making computer engineers a more typical component of their investment apparatus than actual bankers.

As The Wall Street Journal reported in 2017, under the declaratory headline “The Quants Run Wall Street Now,” “Up and down Wall Street, algorithmic-driven trading and the quants who use sophisticated statistical models to find attractive trades are taking over the investment world.”

This technologically driven investment strategy is incredibly effective, bolstering profits by applying a data-driven approach to something that can easily veer off course when things like emotion, intuition, and past experiences get in the way.

In many ways, the rise of automated trading in traditional markets coincides with the emergence of a new investment asset, cryptocurrencies. Now, as these nascent digital assets have positioned themselves alongside more conventional investment vehicles, it’s time to apply this same automated trading approach to the crypto market as well.

Crypto Is Ripe for Automation

Cryptocurrencies are a burgeoning investment class with hundreds of unique tokens that collectively comprise a market cap that exceeds $300 billion.

Although the movement started, in part, as a rebellion against financial institutions, the market is now comprised of forward-thinking individuals and profit-minded institutions. With Bitcoin providing better returns in 2019 than just about every other typical asset class, it’s no wonder that everyone is looking to get involved.

Of course, Bitcoin isn’t a typical investment class. For one, its values are famously volatile, making and breaking millionaires within minutes or hours.

Consequently, the emotion that can mar even the best traders is amplified in crypto markets. This phenomenon is so prevalent that the crypto communities parlance inherently accounts its appearance.

The term “HODL,” a misspelling of the word “hold” is intended to connotatively encourage investors not to sell their positions when turbulence becomes tough to stomach.

Computers don’t care about volatility, and automated trading strategies can help investors manage these market changes to maximize profit and to minimize the impact that overreaction or wrong reactions can have returns.

Automated trading is already assisting investors to navigate volatility in traditional markets, and it can do the same thing for those participating in the crypto field.

Meanwhile, as a nascent investment field, it’s populated with people that don’t have the investment prowess necessary to turn a profit. "

Even experienced financers from traditional markets don’t have considerable experience with cryptos because the field is so new that everyone is learning together.

With features like copy trading, investors can use automated trading strategies to mimic the moves made by those experienced in the crypto space, allowing them to participate while learning the ins and outs of the industry.

Cryptocurrencies are a unique asset for the digital age, and it makes sense that those investing in this digital asset would benefit from the other technologies that can make the investment process more seamless and profitable than just going it alone.

Tools of the Trade

Investors in more established markets have many tools available to execute an automated trading strategy, and more resources are continually becoming available to people of all experience levels and budgets.

Now, as institutional and individual investment levels are at their zenith, many of those same things are being made available for crypto users also.

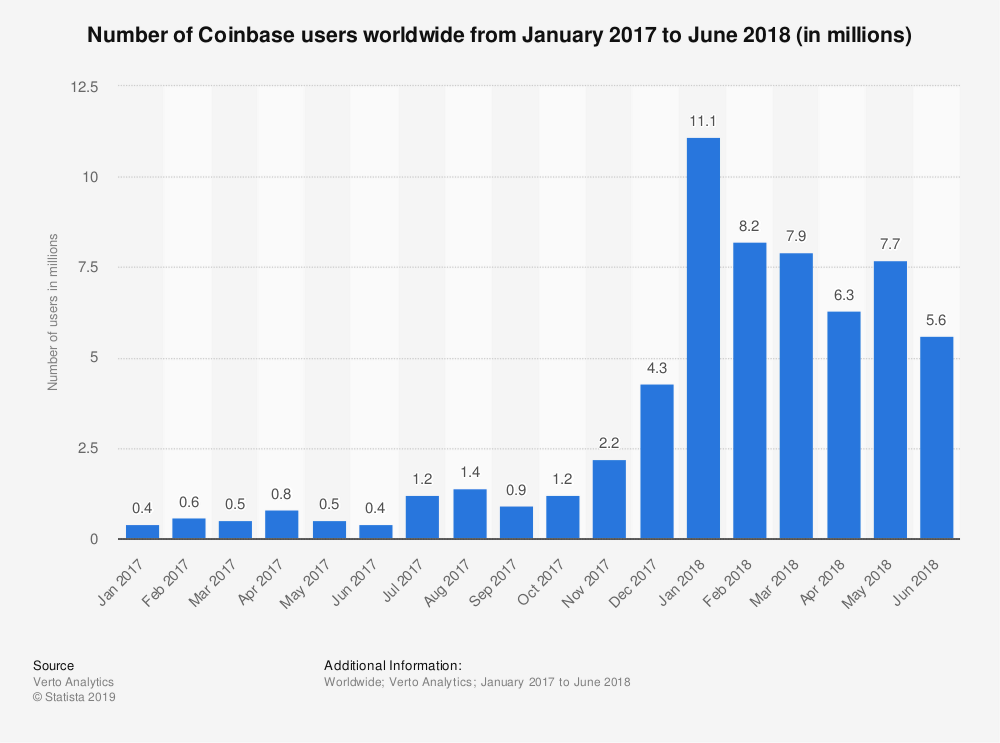

For example, Coinbase has emerged as a mainstream crypto trading platform with a user base that outpaces many more established companies offering more mainstream investment services.

By bringing a crypto investment app to the homepage of millions of smartphones, they made investment services broadly available to a significant population.

For automated trading, Cryptohopper’s trading bot equips investors to deploy numerous algorithmic or copy trading strategies that can help them capitalize on this movement.

For the uninitiated, Cryptohopper’s paper trading functionality allows anyone to practice with various automated strategies before incurring the risk of live investments.

Moreover, short positions, mirror trading, and trailing stop-loss are all available with Cryptohopper’s trading bot.

To put it simply, the platform is bringing much of the automated trading functionality that allows mainstream investors to be successful in the modern stock market to the crypto space where amateur and experienced investors alike can use it to bolster their trading strategy.

Conclusion

It’s clear that cryptocurrencies are going to play an integral role in the future of investment finance.

As such, they should be approached with the same sophistication and prowess as more established markets, which, in 2019, means applying automated trading strategies to investment opportunities.

Not only will these help traders manage the volatility and uncertainty of crypto markets, but it gives any investor the ability to compete with other traders who are invariably adopting this strategy.

Investment banking might not happen as it does in the movies, but that doesn’t mean that there isn’t plenty of excitement in today’s digital-first approach.

Anyone looking to build wealth by using the most capable technology available should focus less on the big screen and more on the platforms that are preparing investors for success in the digital age.