HTX Solidifies Position as a Top-Tier Exchange with Elevated Authority Rankings

In Kaiko’s exchange ranking, HTX scored the second-highest globally in “Business” and “Technology.” Its “Security” performance also received high recognition, positioning HTX among the industry’s top exchanges.

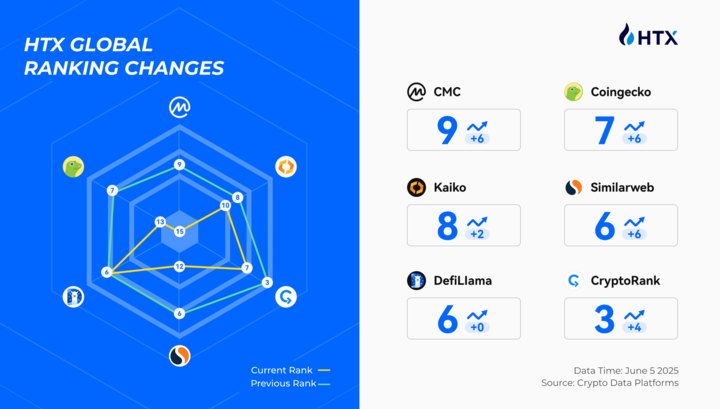

This upward trend is mirrored across other authoritative crypto data platforms. HTX’s CoinGecko ranking soared from 13th to 7th. Its jump from 15th to 9th on CoinMarketCap (CMC) solidifies its reputation as a top-tier exchange for global Web3 users. HTX also holds the 6th position on DefiLlama (North America-focused) and the 3rd on CryptoRank (popular in the CIS region). HTX’s consistent ascent in global rankings underscores its steadfast dedication to user asset security, innovative product development, strategic global expansion, and robust service infrastructure.

May also saw a notable increase in HTX’s trading activity. Active traders grew by 11% MoM, trading volume surged by 33% MoM, and the platform’s asset balance rose 11% MoM, marking four consecutive months of positive growth. This highlights growing user confidence in HTX’s trading environment, resulting in more consistent capital inflows.

HTX Sharpens Its Edge in New Asset Listings, Product Innovation, and Industry Research

HTX listed 23 new assets in May, covering stablecoins, meme coins, RWA/DeFi, and InfoFi/AI sectors. USD1, issued by WLFI, made its global debut on HTX and quickly gained traction as one of May’s most discussed projects on social media. Meanwhile, SYRUP (Maple Finance), a key RWA/DeFi player, witnessed an impressive 117.7% surge after its May 8 listing. B2, the first meme coin to use the USD1 pool, posted a 40% gain. Other projects, like SOON and NXPC, maintained high social media discussion during their listings by leveraging strong community engagement and platform traffic.

HTX rolled out several key product enhancements in May to improve the user experience. These optimizations included launching SEO-optimized Token Detail pages, adding support for custodial sub-account functionality, and implementing multi-asset collateral for margin trading.

In May, HTX Ventures, the global investment arm of HTX, released “Industry Insights: Crypto Challenges and Opportunities Amid Macro Noise”. This insightful report offers a detailed analysis of key trends and opportunities shaping the current crypto market cycle. Concurrently, HTX Research, the research arm of HTX, published “The New Macroeconomic Landscape and Bitcoin Outlook: An Analysis of Liquidity, Risk Appetite, Policy Dynamics, and Investment Strategy”. This comprehensive publication dissects the global macroeconomic environment’s influence on the Bitcoin market, assisting global investors navigate the new market cycle’s potential risks and opportunities.

HTX Prioritizes Security and Transparency to Foster a Trusted Trading Environment

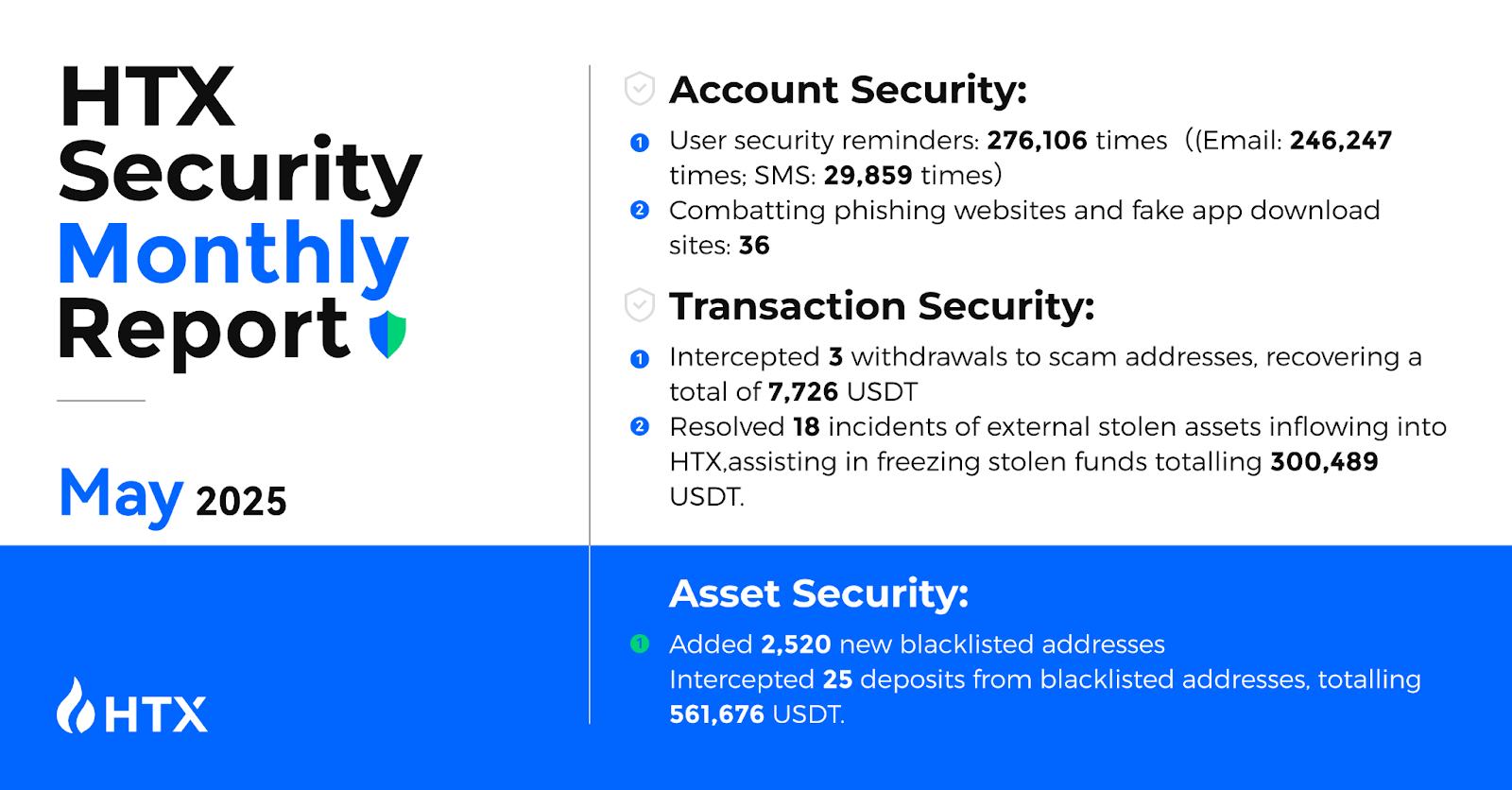

Security remains a paramount focus for HTX, with increased measures implemented in May to protect user and platform assets. See details below:

HTX remains committed to user asset safety and transparency, evidenced by 32 consecutive months of publicly disclosed asset reserve data. The latest Merkle Tree-based report for June confirms that the platform’s overall reserve ratio remains above 100%, with USDT reserves recording positive growth for the third straight month.

Throughout May, HTX’s customer service team served 138,423 users, resolving 37,851 issues across key areas like P2P trading and on-chain deposits/withdrawals. The team maintained a user satisfaction rate above 83%.

At the midpoint of 2025, HTX is accelerating its journey toward becoming a top-tier global crypto exchange, driven by clear strategy, steady progress, and a spirit of innovation.

The post first appeared on HTX Square.