Flows remain the central driver of price: US spot ETFs saw their heaviest week of outflows since April, with Bitcoin ETFs seeing $1.18bn of net outflows while Ethereum ETFs lost $197m in a single day.

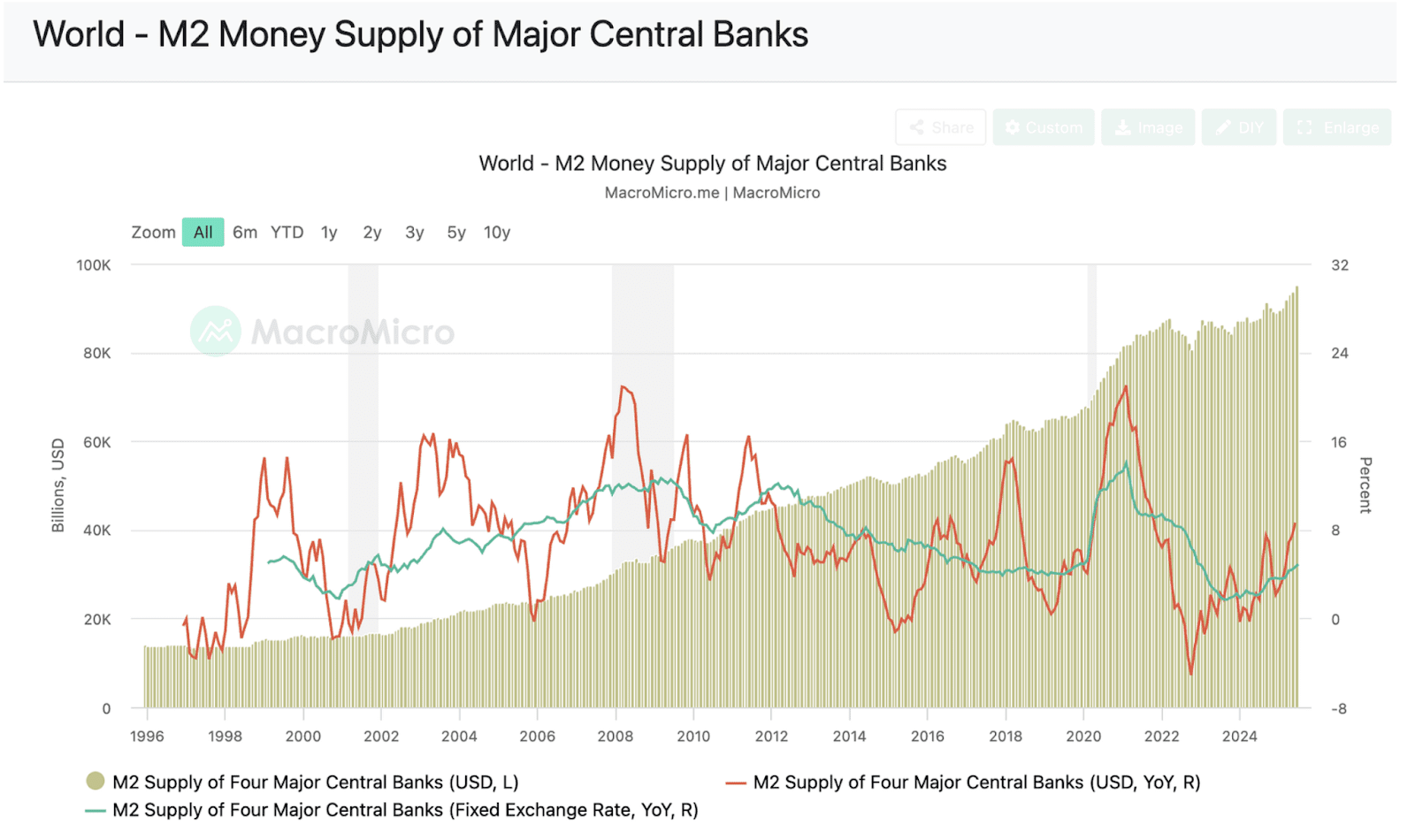

Yet treasury accumulation has stepped in to absorb supply, keeping net structural demand resilient. With global liquidity still trending higher and ETH corporate treasury balances expanding beyond $10B, the long-term backdrop remains constructive. BTC looks set to trade range-bound in the near term, while ETH leads rotation and altcoins await broader vehicles to unlock sustained inflows later in the cycle.

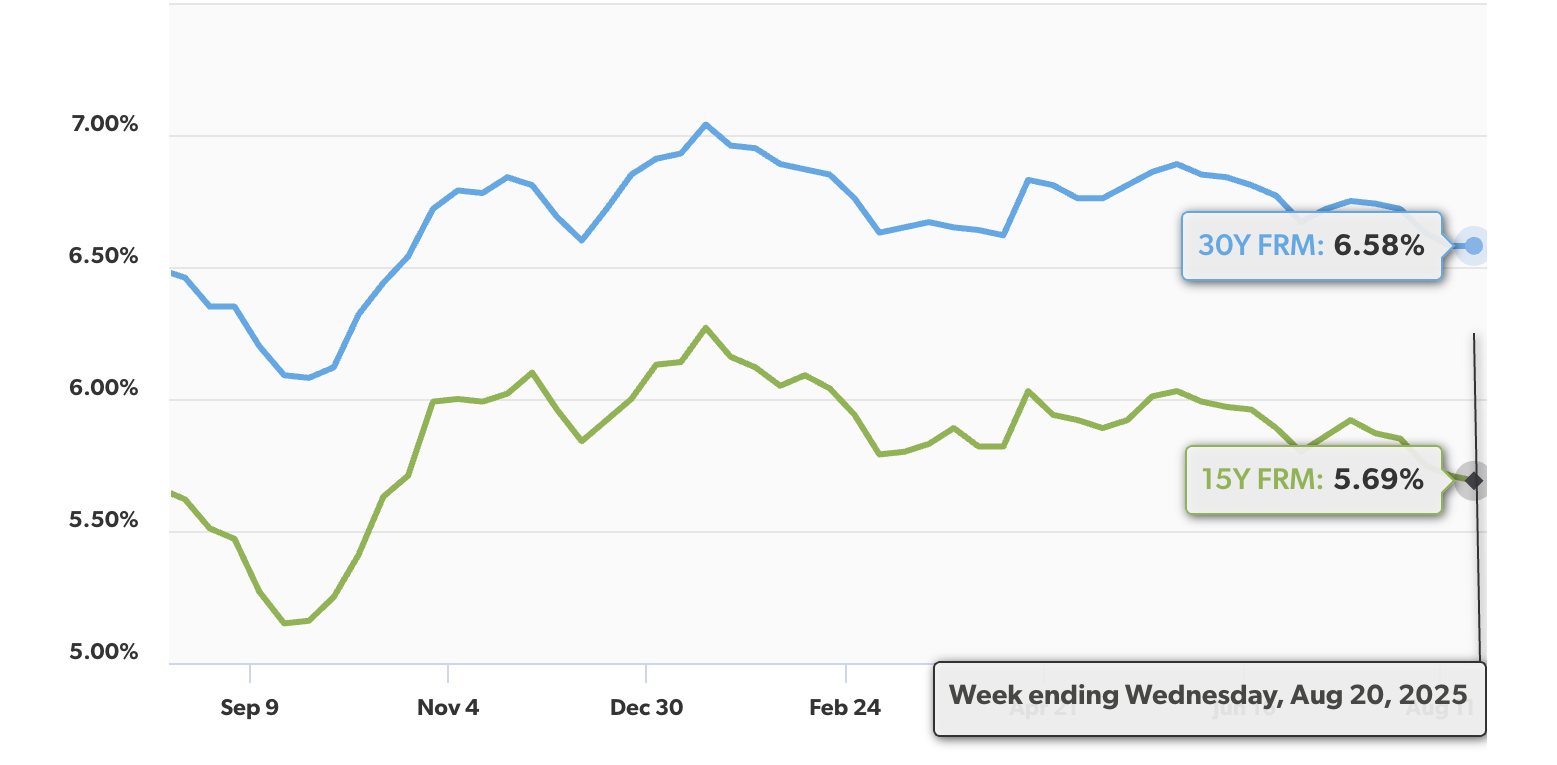

Federal Reserve Chair Jerome Powell’s Jackson Hole speech boosted markets with expectations of a September rate cut. Still, he stopped short of firm commitments that he would do so, stressing the Fed’s balancing act between inflation and employment. While Treasury yields fell and equities rallied, Powell signalled a more cautious stance than in past cycles, suggesting cuts may be limited. Meanwhile, the US housing market showed resilience with a July rebound in multifamily construction, though permits fell to a five-year low, reflecting builder caution.

Mortgage rates have eased slightly but remain elevated, keeping affordability strained. Beyond housing, stronger business activity in both manufacturing and services suggests economic momentum, but rising input costs and higher consumer prices point to persistent inflation pressures.

In parallel, the crypto industry saw significant moves: Thailand launched a pilot crypto-to-baht programme to boost tourism, SharpLink Gaming expanded its Ethereum holdings past 740,000 ETH, and the CFTC widened its “ Crypto Sprint” to advance US digital asset regulation in coordination with the SEC.

The post appeared first on Bitfinex blog.