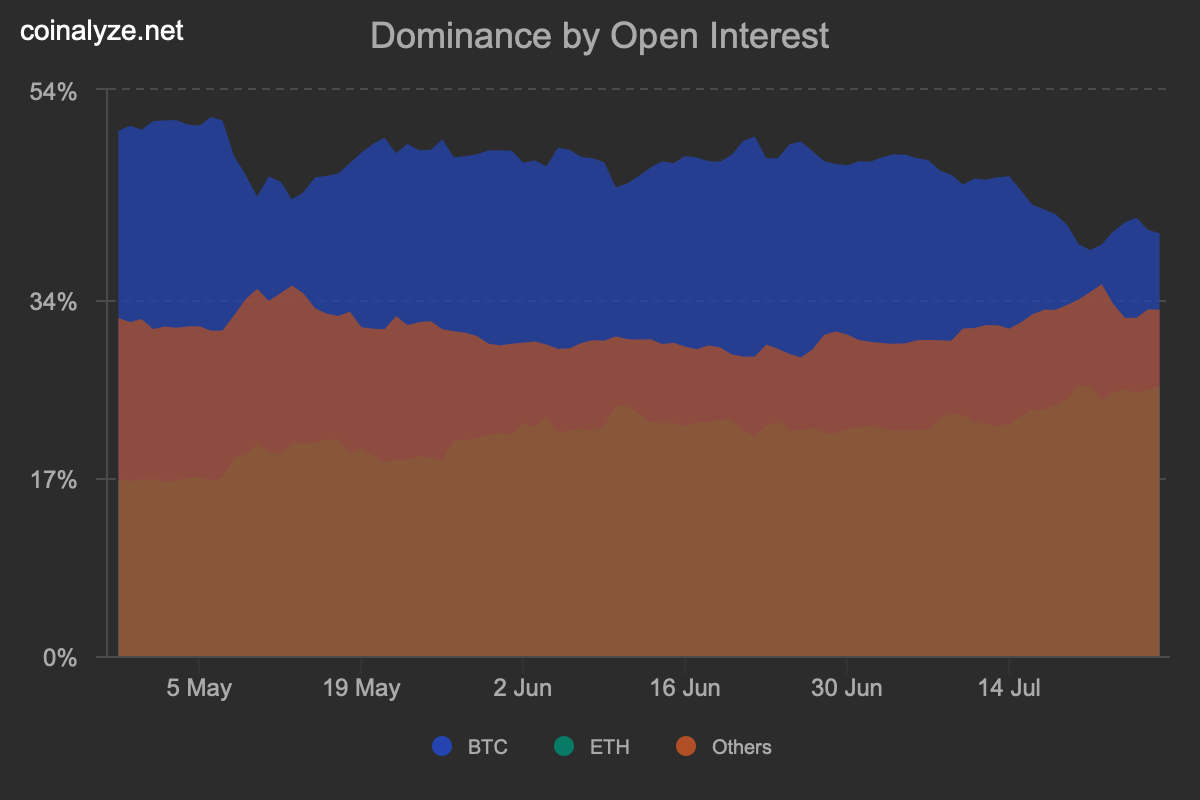

Under the surface, risk appetite continues to rotate aggressively into altcoins. Ethereum’s open interest dominance has risen from 17 to 26 percent, while Bitcoin’s has declined to just 41 percent, a sharp drop from 51 percent in April. Although total altcoin open interest dominance remains steady in the low 30s, its composition has been fluid, driven by fast-changing narratives and listing activity. The combined open interest across major altcoins such as ETH, SOL, XRP, and DOGE has surged from $26 billion to $44 billion in just four weeks, reflecting a clear return of speculative capital.

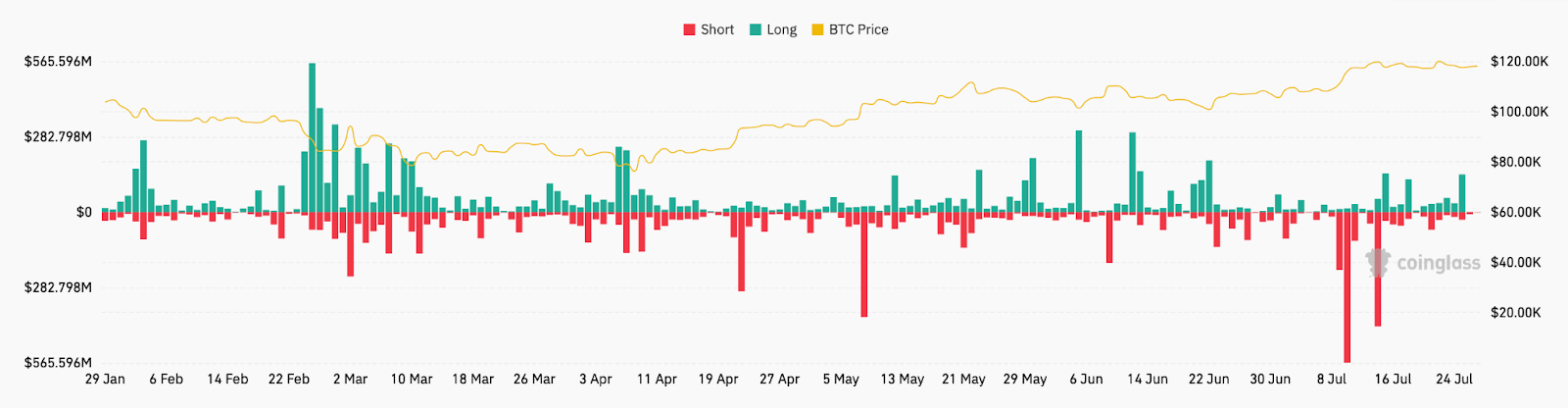

The market is now at a critical juncture. Bitcoin’s structural strength remains intact, with support levels holding and ETF demand steady, but the growing concentration of leverage in altcoins leaves the broader crypto complex vulnerable to sharp deleveraging events. As speculative positioning builds, the risk of cascading liquidations increases, especially if macro headlines turn negative or if price momentum stalls.

Recent data shows the US economy’s rebound is masking deeper weaknesses. Business investment is slowing, with durable goods orders falling 9.3 percent in June and core capital goods down 0.7 percent, as tariff uncertainty disrupts planning. A front-loaded surge in equipment spending early this year has faded, and Q2 GDP growth—forecast at 2.4 percent—is largely driven by temporary inventory and trade adjustments rather than real demand.

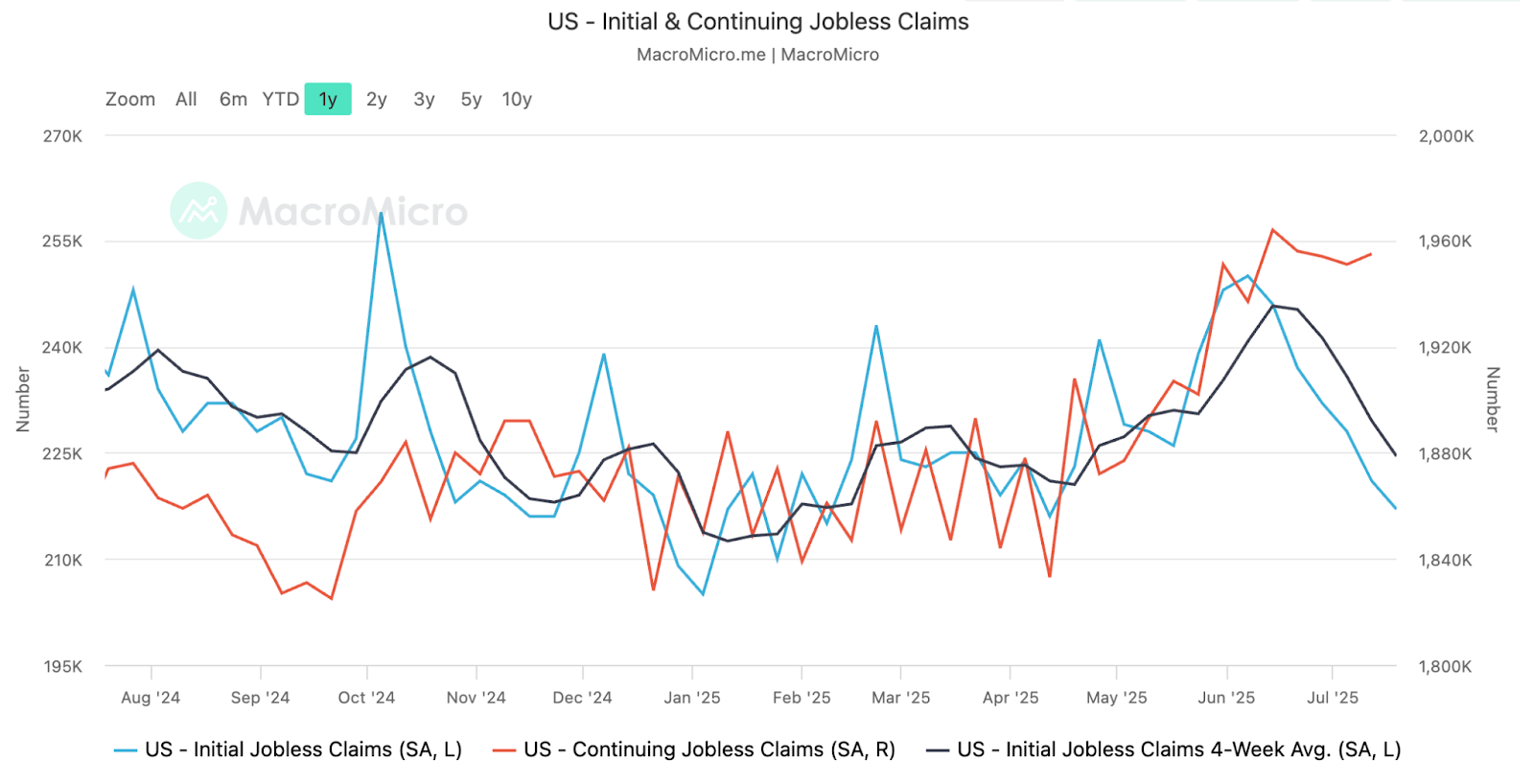

Meanwhile, jobless claims dropped to 217,000, the lowest in three months, but continuing claims rose to 1.955 million, signalling difficulty in re-employment. Companies are pausing hiring amid tariff uncertainty and uneven demand. Housing activity remains weak, with new home sales up just 0.6 percent in June and inventory at its highest since 2007. The labour market isn’t collapsing, but is quietly cooling, and the Fed is unlikely to cut rates further until clearer signs of economic deterioration emerge.The US crypto corporate landscape is witnessing a surge in Ethereum- and Bitcoin-focused treasury strategies, signalling a deepening institutional shift. BitMine Immersion and the upcoming Ether Machine IPO have together cemented Ethereum as a rising treasury asset class, with BitMine now holding over 566,000 ETH and Ether Machine preparing to go public with 400,000+ ETH in yield-generating infrastructure. Meanwhile, Trump Media’s $2B Bitcoin bet adds to the trend, though concerns linger over revenue shortfalls and a reliance on crypto appreciation to justify valuations.

The post appeared first on Bitfinex blog.