This rebound aligns with our earlier view that the market is approaching a local bottom from a time perspective, even though it is yet to be seen whether we have seen a bottom in terms of price. However, with extreme deleveraging, capitulation among short-term holders, and emerging signs of seller exhaustion, we believe the groundwork is in place for a stabilisation phase to commence.

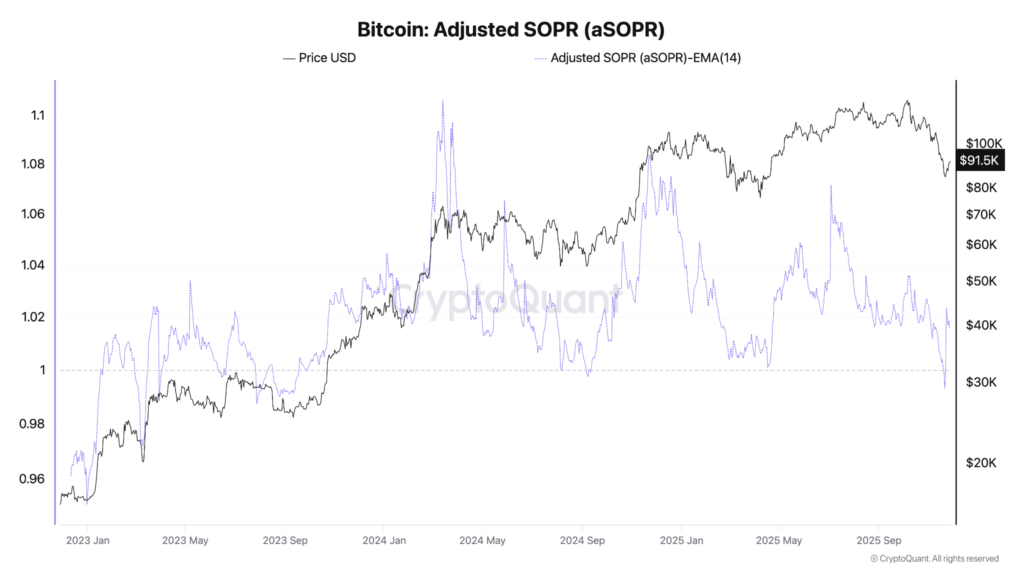

On-chain metrics further reinforce this thesis: the Adjusted Spent Output Profit Ratio has fallen below 1 for only the third time since early 2024, matching the same loss-realisation dynamics observed at prior cyclical lows in August 2024 and April 2025.

The depth of current loss-taking is also evident in Entity-Adjusted Realised Losses, which have surged to $403.4 million per day, exceeding the losses measured by this metric at previous major lows.

This level of realised losses typically signals that capitulation is nearing completion, rather than the start of a deeper decline. Meanwhile, derivatives data paint a similar picture of a controlled reset: total BTC futures open interest (OI) has declined to $59.17 billion, well below its $94.12 billion peak, indicating that leverage has been flushed out in an orderly fashion.

The continued contraction in OI alongside rising spot prices suggests short covering rather than renewed speculative risk-taking, reinforcing the view that the market is transitioning into a more stable consolidation regime, with reduced fragility and the potential for a sustained recovery base to establish itself in Q4.

Recent US macroeconomic data revealed a growing divergence between softening consumer activity and strong business investment. Retail sales slowed sharply in September, rising only 0.2 percent, while the GDP-relevant control group slipped into negative territory. Elevated prices, many influenced by tariffs, and fading income growth weighed on households. At the same time, wholesale inflation firmed, with PPI up 0.3 percent on the month and energy costs surging 3.5 percent, indicating that upstream price pressures remain sticky. Consumer sentiment has meanwhile deteriorated, with the Conference Board’s Confidence Index dropping to 88.7, as households grow more cautious about the job market and pull back from big-ticket purchases.

In contrast, US businesses are accelerating spending. Core capital goods orders, an important gauge of business investment, rose 0.9 percent in September, matching August’s momentum and far surpassing expectations. Companies are ramping up investments in AI, automation, and productivity-enhancing equipment, even as tariff uncertainty weighs on parts of the manufacturing sector. This surge in business investment has helped underpin a robust growth outlook, with the Atlanta Fed’s GDPNow model estimating 3.9 percent annualised GDP growth for Q3. The contrast between cautious consumers and confident corporations highlights a widening divide in economic behaviour, leaving the Fed to navigate December’s policy meeting with limited visibility and increasingly uneven signals across the economy.

The past week highlighted a clear shift toward deeper institutional integration of Bitcoin. BlackRock’s latest SEC filing showed its Strategic Income Opportunities Portfolio increased its IBIT holdings by 14 percent, bringing total exposure to 2.39 million shares. The move underscores how even traditionally conservative bond funds are now using Bitcoin ETFs as diversification tools, coinciding with growing structural support for IBIT, including a proposed increase in options position limits to accommodate larger institutional strategies.

At the same time, ARK Invest continued to lean into crypto despite sector-wide liquidity pressures. ARK executed more than $93 million in single-day purchases, adding to positions in Coinbase, Circle, Block, and its own ARK 21Shares Bitcoin ETF. With Coinbase now over 5 percent of ARKK, the firm’s aggressive accumulation reflects long-term confidence in digital assets even as crypto equities face sharp monthly declines.

Reinforcing this institutional momentum, Texas became the first US state to publicly invest in Bitcoin, allocating $5 million to IBIT as part of its new state-level Bitcoin reserve program. While modest in size, the move is symbolically significant and marks the beginning of a transition toward direct BTC custody once infrastructure is ready.

The post appeared first on Bitfinex blog.