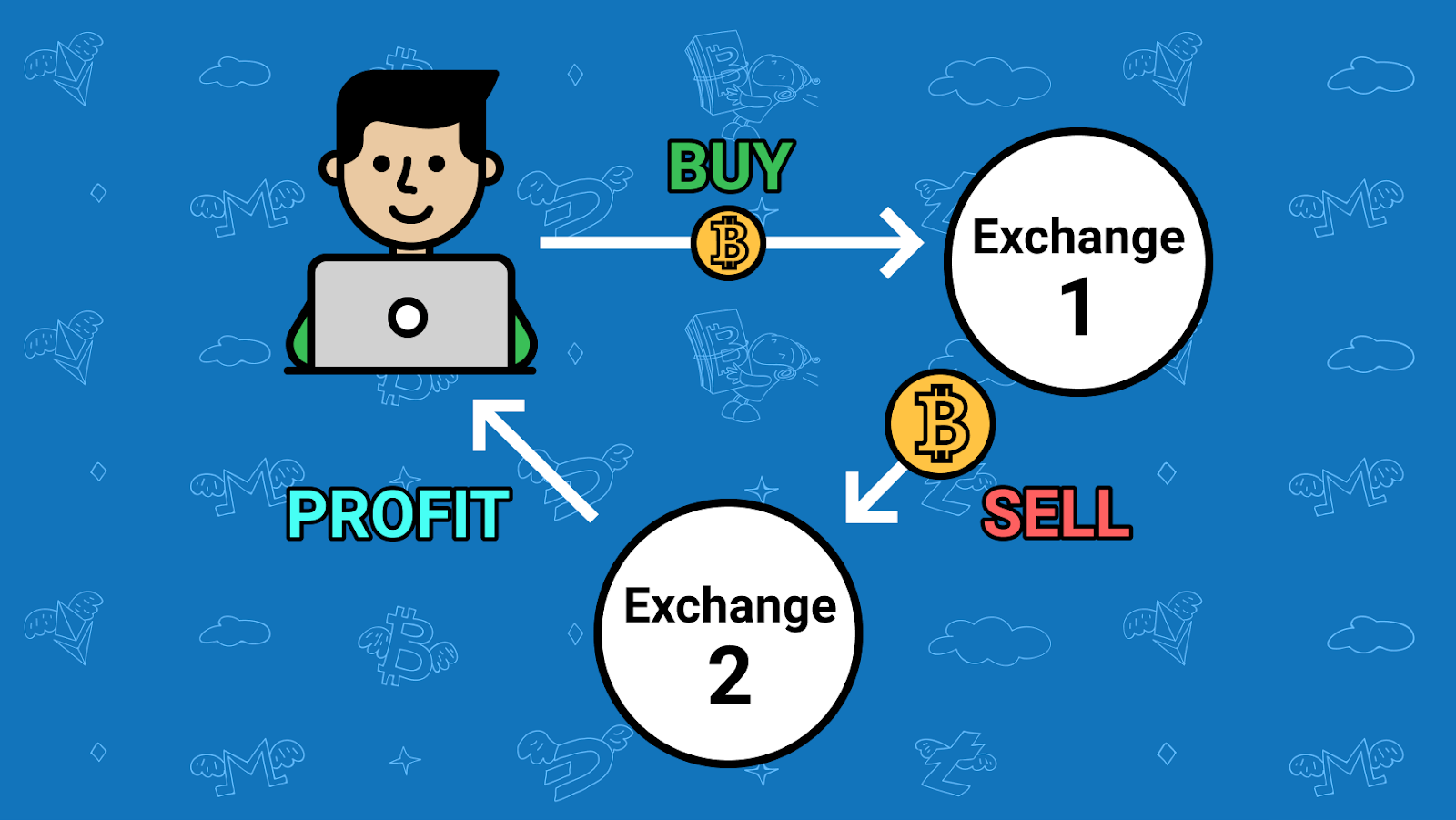

While arbitrage has long been practiced in traditional financial markets, there appears to be more hype surrounding arbitrage opportunities in the virtual assets industry, particularly due to the industry’s decentralized nature and the higher occurrence for pricing differences across exchanges. As some exchanges have much larger trading volumes than others, the price of an asset could vary widely between one exchange and another.

A well-known example of an arbitrage opportunity presented itself back in 2017, when the price of Bitcoin (BTC) on Kraken was $17,212, in contrast to just $16,979 on Bitstamp. Given this scenario, a trader could potentially earn a $233 profit by buying BTC on Bitstamp and selling it immediately on Kraken.

In the virtual assets industry, where hundreds of thousands of tokens are traded 24/7, plentiful arbitrage opportunities exist that could be harnessed to the benefit of eagle-eyed and quick-acting traders. There are also a several apps available that can be used to scan and track the prices of BTC or other virtual assets across multiple exchanges.

There are three main arbitrage types – spatial arbitrage, spatial arbitrage without transfer, and triangular arbitrage. We shall now use the Huobi Token (HT), the platform token issued by Huobi Global that has recently undergone impressive an impressive price climb, as an example to show how these three types of arbitrage can be carried out.

Spatial arbitrage– This simply involves trading HT across two different exchanges when a price difference is spotted and is the most straightforward form of virtual asset arbitrage.

Spatial arbitrage without transfers— In order to avoid risks and transfer costs posed by spatial arbitrage, some traders could choose to go long on HT on one exchange while going short for the same token on another until prices converge. This helps traders avoid transfer times and fees between exchanges although they would still be subject to trading fees.

Triangular arbitrage — In triangular arbitrage, traders capitalize on pricing inefficiencies among different virtual asset trading pairs. An arbitrage opportunity would appear when three assets do not have equivalent conversion rates. For example, a trader could start off by trading HT for an asset that is undervalued in contrast to HT on the same exchange, and then trade the second asset for a third which is overvalued in contrast to HT. The trader will then complete the circuit by trading this third asset for HT, and end off with having more HT than he initially started with.

Arbitrage can be profitable if conducted correctly, and traders should always take note of a few key points. Firstly, asset prices can fluctuate at an astonishing rate, and this could lead to losses if the market moves against you. Transaction costs and exchange fees must also be taken into account, for these could result in profit erosion.

As always, conduct due diligence and tread lightly.

The post appeared first on Huobi Blog.