Sweatcoin vs StepN

Much has happened to the once promising StepN since our previous deep dive into its ecosystem. Since then, the announcement of the ban on China users in May, coupled with the current bear market sentiment, has sent the prominent move-to-earn (M2E) app StepN reeling. While the industry critiques the M2E space for its unsustainable business model, StepN continues stepping up its efforts through its many developments and revamp of its game design.

In a similar vein, Sweatcoin, a reputable web2 fitness app, rebranded to Sweat Economy after its recent debut in the web3 space through its Token Generation Event (TGE). This event converts Sweatcoins into SWEAT, a utility token minted on the NEAR blockchain, thereby officially marking Sweatcoin’s position as an M2E project.

Despite bearish sentiment towards M2E, both existing and new industry players continue to hold faith in the M2E industry and deliver consistent upgrades to keep their projects relevant. In this piece, we look into StepN’s new developments, and whether they could restore the M2E industry’s confidence. This deep dive would also further explore Sweatcoin and how Sweat Economy distinguishes itself from StepN, as well as whether Sweat Economy is able to tackle similar sustainability issues that face StepN.

Where is StepN Now? — Revamped In-Game Designs and MoreIn May, we did a deep-dive into the StepN ecosystem, how it fared, and considered the steps StepN could take for a promising future. Since then, a number of reasons have led to a significant fall of StepN. These reasons include users’ speculative activities, an oversupply of NFTs from relentless minting, insufficient new users, as well as falling token prices of GMT and GST. StepN has, however, kicked off its revamp, ranging from changes in its in-game designs and tokenomics. Efforts have also been made to curb speculative activities, control the supply of NFTs, acquire new users, and introduce more utility to prop up GMT.

You may find more details on the basic gaming rules and mechanics of StepN here.

StepN’s announcement of the ban on China users in May, coupled with risk-off sentiments induced by the liquidity crunch experienced by Celsius and other CeFi lenders, led to plunging GMT and GST prices. Fear of a worsening situation prompted users to sell their NFTs in exchange for more liquid tokens. As a result, StepN’s NFT sneaker floor price saw a sharp decline. In the face of nosediving tokens and NFT prices, users who failed to sell tokens before the drop faced tremendous losses and started to lose faith in the ecosystem. In response to the falling prices and user exodus, StepN announced an action plan in a bid to make a turnaround in early June.

Reducing Speculative Activities and NFT Supply

Limit Cross-Realm Energy Bridge to Contend With Speculation

As of the time of writing, StepN exists in three different realms, SOL, BNB, and APE (Ethereum chain). Each realm is a duplicate of the same game that runs on a different blockchain. Although the rules and mechanics of the game remain the same across the realms, its utility token economy is isolated from other realms.

StepN users share a common account across three realms, with each additional sneaker in any realm earning 2 energy points that can be used interchangeably among the three realms to reward GST or GMT tokens for movements. As such, some users saw an opportunity to purchase sneakers in SOL Realm, where it is much cheaper than the sneakers in the BNB Realm. They would then consume earned energy points in BNB Realm, where it provides a higher rate of reward than the SOL Realm. Due to this, the BNB Realm was quickly awash with speculators after its launch, and minted lots of sneakers in a short period of time. As the demand from real users was unmatched by the outsized supply, the exit of mercenary capital could easily lead to a sharp drop in NFT prices. .

As a response, the StepN team limits a maximum of one energy point that is able to be bridged from each existing realm to a new realm. This prevents and stops the aforementioned scenario as users would have to buy sneakers and accumulate points within respective realms to earn the rewards. This measure is likely to be effective in closing this cross-realm loophole that caused the earlier fallout of the BNB Realm, and in the long-term, allow other new realms to avoid a similar fate.

Curb Relentless NFT Minting and Reduce NFT Supply

The table below reflects updates announced on the various in-game designs for reducing NFT minting and controlling the NFT supply (sneakers).

New Developments | Details | How It Reduces NFT Supply |

Minting Scroll (announced on Jun 8) | The minting scroll acts as a permit to mint a new sneaker. | The minting scroll needs to be purchased from NFT marketplaces or from Mystery Boxes. As such, this adds costs to minting and cuts into speculators’ profits. |

Recycling Sneakers (announced on Jun 8) | Five pairs of sneakers of the same quality can be synthesized into a sneaker of a higher quality. | Five-in-one recycling would reduce the existing supply of classic sneakers, as five sneakers would be burned to generate a new higher quality sneaker. |

Dynamic Minting (announced on Jun 8) | The upgraded dynamic minting requires a base number of GMT to be consumed for each minting. Before the upgrade, GMT is not required if the GST price is above a specified threshold. | Upgraded dynamic minting requires mandatory burning of GMT for each minting, regardless of GMT prices. This adds minting costs to reduce the speculative minting of a sneaker in each realm. |

Rainbow Sneakers (announced on Aug 8) | The rainbow sneaker is a new type of sneaker where holders are entitled to GMT earnings, but does not have a minting function and is unable to restore HP. | As such, should users choose to purchase rainbow sneakers, it will help control the NFT supply as new sneakers can not be minted from rainbow sneakers. |

Source: StepN; compiled by Bybit

As analyzed in the above table, the new developments address the NFT oversupply in the bear market through the addition of minting costs and reduction of existing sneaker supply. This would successfully deter speculative users who usually sell the sneakers at level 5, as it reduces their profit margins. However, this also impacted real users who plan to use such sneakers on a long term basis, as such, the team has carefully weighed the extra costs and added more in-game elements of luck, such as random airdropping of Mystery Boxes and Rainbow Sneakers, to retain real users.

Attempts at Maintaining an Inflow of New Active Users

In July, StepN introduced the APE Realm, which operates on Ethereum. APE Realm stole the spotlight with its free airdrops to Bored Ape Yacht Club holders. Although creating new realms on top Layer 1 chains seem to be effective in onboarding new users onto its platform, it is simply not sustainable. In the long term, StepN still has to figure out how to revive user dynamics in its existing realms.

Attempts to Boost Prices of GST and GMT

New Developments | Details | How It Props Up GMT or GST |

Health Points (HP) (announced on Jul 23) | Sneakers are subjected to HP reduction for every energy point consumption on the sneaker. Sneakers with less than 100% HP cannot be listed in the marketplaces, and restoring HP requires burning GMT and GST. | The HP system creates another form of sink mechanism for the tokens, which could potentially reduce the circulating supply of GMT, and GST. |

DOOAR (announced on Jul 14) | GMT introduced DOOAR, a self-developed cross-chain DEX, for trading pairs including GMT and GST. | Trading fees charged from DEX trading are diverted from third-party DeFi protocols to StepN, which would contribute to GMT earnings, GMT burning, or future GMT staking. GMT earnings and staking boosts the return for GMT holders and, in turn, acts as a tailwind for the GMT price. |

GMT Burn (announced on Jul 12) | GMT Burn refers to the quarterly burning of GMT tokens. | Quarterly burning of the circulating supply of GMT would prop up the unit price due to the fall in circulating supply, assuming the demand for GMT remains. |

The above measures mostly cater to pushing up GMT’s price, largely leaving GST out. This was illustrated by the divergent price movement of GMT and GST, where GST has underperformed GMT remarkably since May. We will dive deeper into the token performance in the later sections.

Future Plans

The StepN team’s regular updates on Medium keep the community up-to-date with their efforts to revamp the ecosystem. In the future, the StepN team aims to cooperate with more retail brands and sponsor offline events. They also plan to add social-fi elements to in-game designs, as well as release physical merchandise. Also, StepN wants to become a super app with more embedded DeFi functions and enhanced DeFi composability with protocols.

Performance and Conclusion

With continuous efforts from the StepN team, we will review its token and ecosystem performance below.

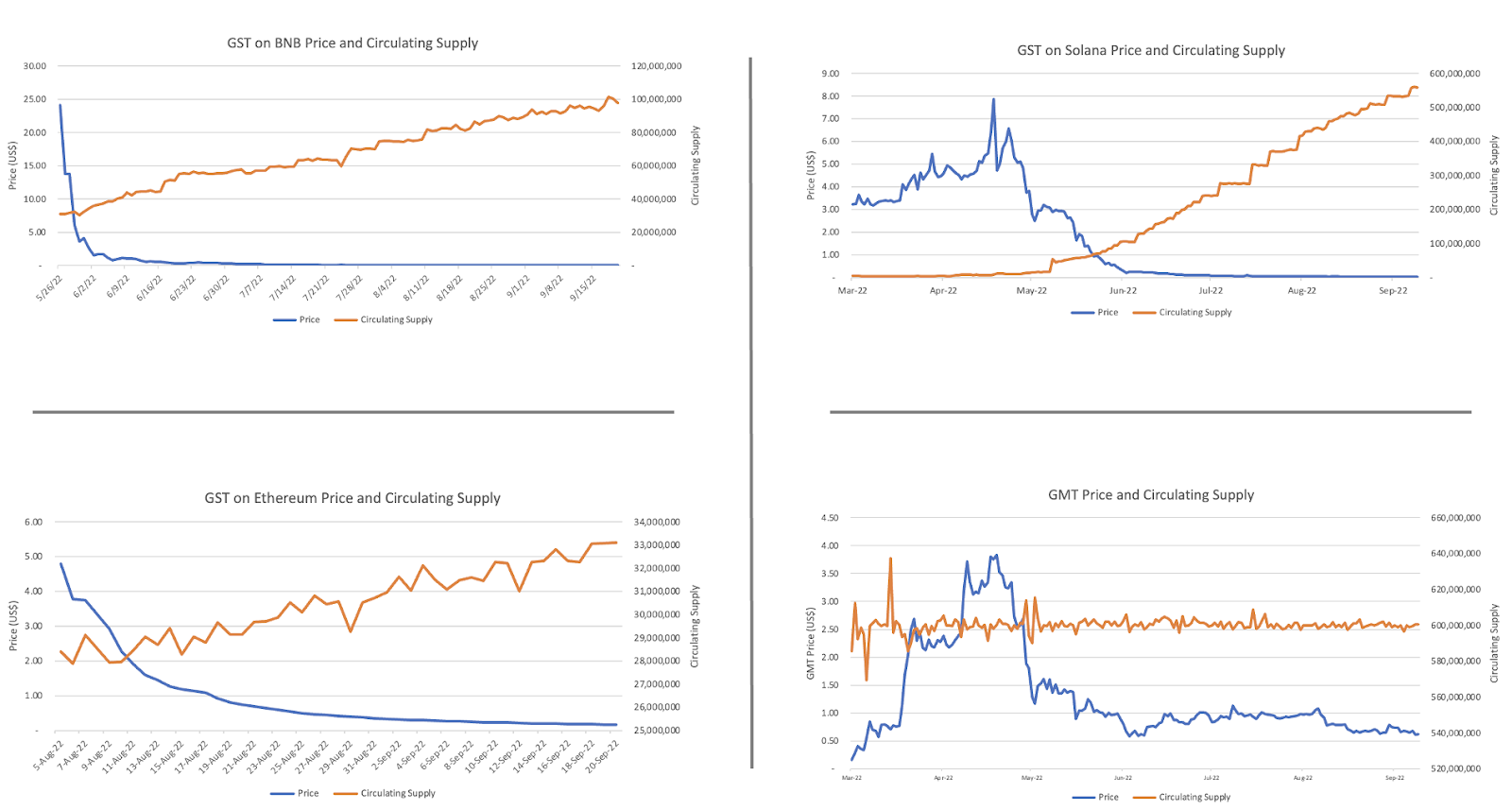

Price and Token Supply

With the ever-growing circulating supply, GST prices on Solana, BNB Chain, and Ethereum have flatlined. GMT’s price, on the other hand, holds with its stable supply thanks to GMT burns and other sink mechanisms in place. It’s apparent that action plans to prop up GMT have worked. However, the same cannot be said for GST. With most of the rewards being distributed in GST, the sink mechanisms for GST fails to offset the excess minting of the token in all three realms. In the long term, as long as there are insufficient new users to spend GST, the abundant supply of GST will continue to drive GST prices lower.

NFT Supply

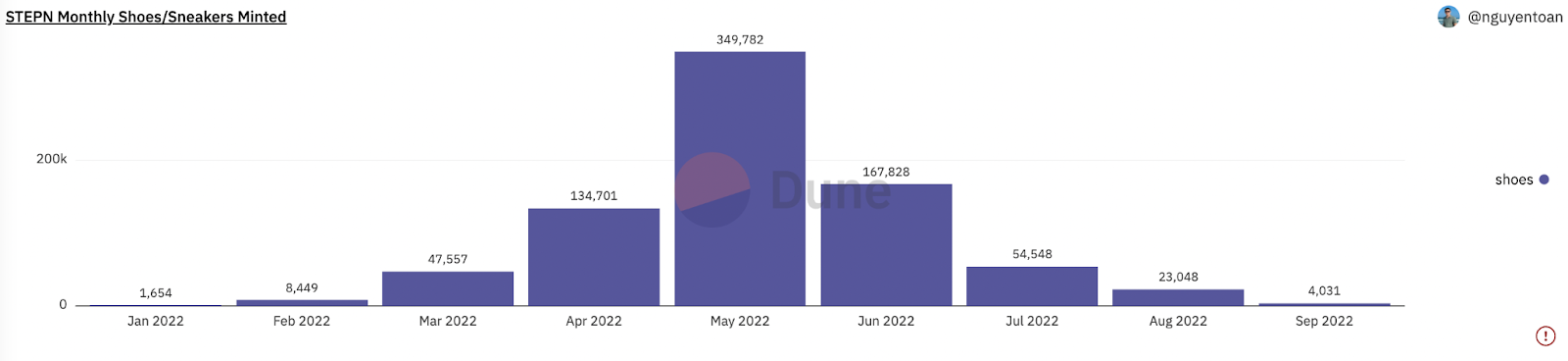

Sneaker Minting on Solana

Source: Dune Analytics (data as of Sept. 21, 2022)

NFT Floor Prices on Magic Eden

Source: Magic Eden (data as of Sept. 21, 2022)

The StepN team’s efforts in curbing sneaker minting have pushed up NFT floors temporarily in early June, but subsequently, continue to fall as the risk-off sentiments took the reins.

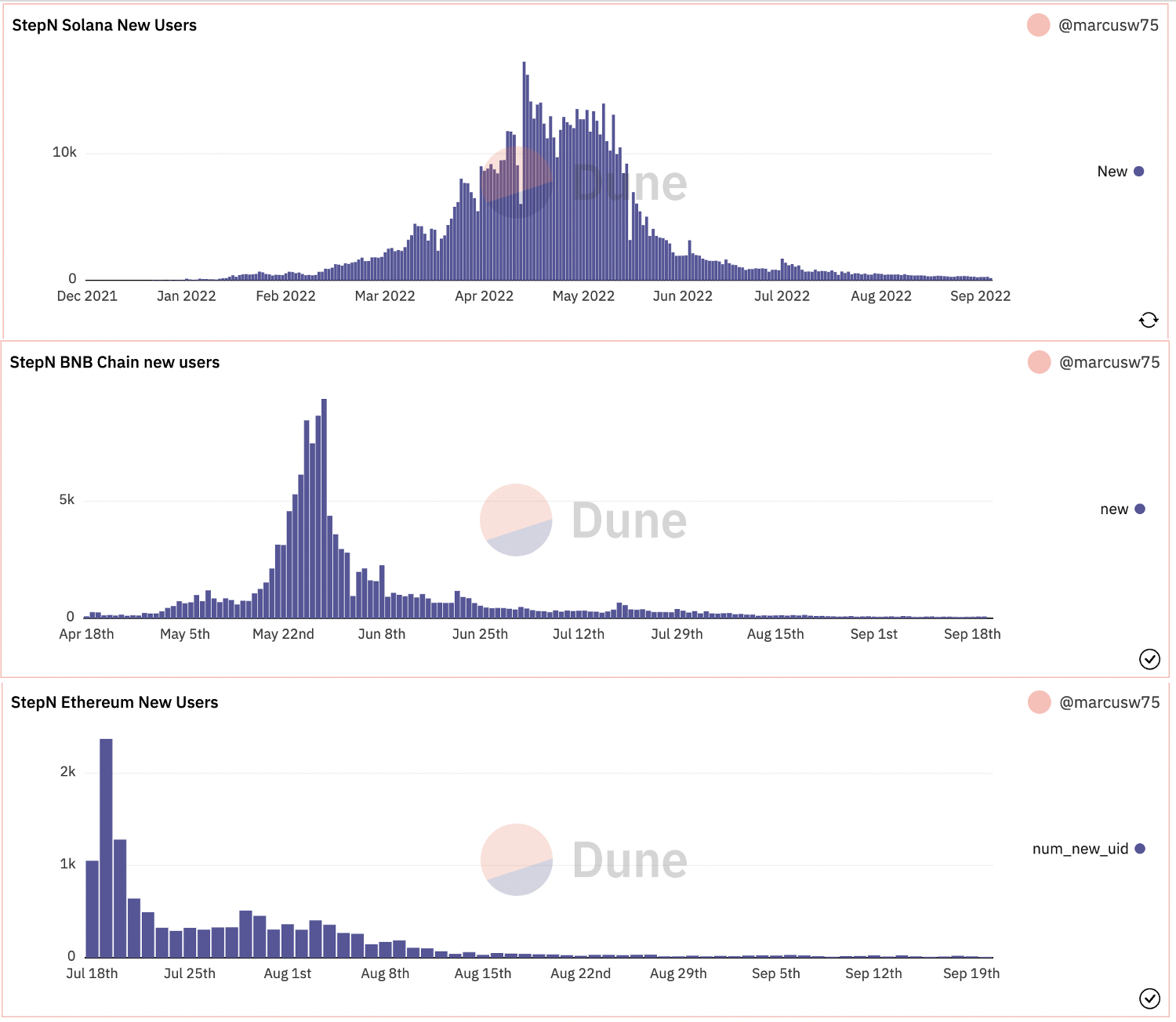

Users

Source: Dune Analytics (data of Sept. 21, 2022)

The above graphs indicate that new users across all three realms have been declining, with its current activities coming primarily from existing users. Despite the clamp-down on NFT minting, having a steady inflow of new users remains critical to push up NFT prices. The ever-dropping NFT floors from Magic Eden reflect how the current supply is possibly largely exceeding new user demand.

Conclusion

Despite StepN’s efforts to revamp its in-game designs and tokenomics, weak demand from new users, coupled with lackluster GMT and plunging GST prices, reveals that the bear market effect has taken a toll on StepN’s growth. Despite the StepN team’s efforts to curb excessive NFT minting and successfully prop up GMT prices through token burning, the efforts primarily work on the supply front. Moreover, it proves to be insufficient in ushering a turnaround for the StepN ecosystem in the current bearish climate, perhaps we would have to wait for a reversal or market sentiment before we can start to see the fruits of the team’s labor.

Sweatcoins — Is Sweat Economy Next StepN?Sweatcoin, SWEAT, and Sweatcoin Economy

Sweatcoin was founded in 2016 by Oleg Fomenko and Anton Derlyatka. It started its humble beginning as an app that rewarded people for moving with Sweatcoins. The Sweatcoin app currently has over 120 million registered users, and finally made its debut in web3 following the Token Generation Event (TGE) on Sept. 12, 2022. The TGE rebranded Sweatcoin to Sweat Economy and launched SWEAT, an ERC-20 and NEP-141 token, on the Near blockchain. After downloading the Sweat Wallet App, its existing 100 million users can convert their existing holdings of Sweatcoins 1-on-1 to SWEAT with a vetting period of 24 months. In the wake of TGE, the first 5,000 steps reward users SWEAT and mint Sweatcoins for steps exceeding 5,000.

You may find more details on Sweatcoin here.

The Sweatcoin App was successful in acquiring users. Beginning with over 100 million users from web2 enables Sweat Economy, the rebranded GameFi ecosystem on Near, to easily bootstrap liquidity.

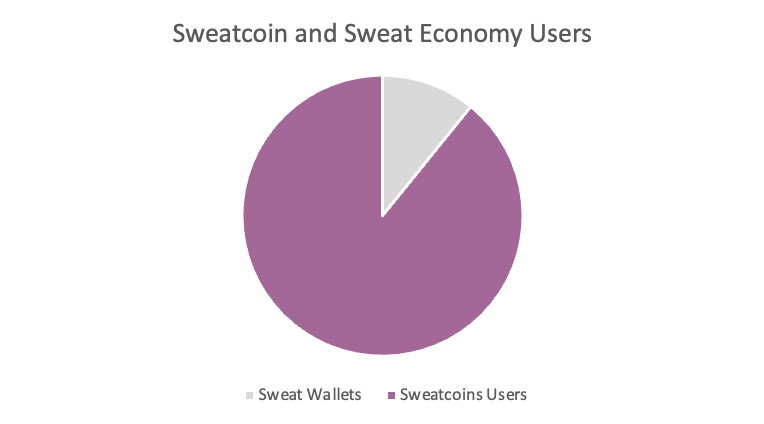

Source: Sweat Economy (data as of Sept. 20, 2022)

Among the 120 million registered users, 13 million users have registered Sweat Wallets after TGE. For comparison, StepN currently has approximately 1 million accumulated users.

Having successfully onboarded 13 million users and possibly more to come, Sweat Economy has seemingly dwarfed StepN and other M2E players at inception.

Sweat Economy vs. StepN

Playability and User Base

Sweat Economy has simple in-game playing rules. Users can conveniently walk to earn without even opening the app. Comparatively, StepN is designed with more sophisticated rules and dynamic elements that include sneakers, gems, sneaker boxes, etc. As such, StepN possibly brings more entertainment to users and, in turn, demands more engagement from users.

However, according to future roadmaps, more games such as LegZ will be launched on the Sweat Wallet App to engage users. This could possibly enhance its playability, but only time will tell whether it can be successfully delivered.

Sweat Economy has a significantly larger user base than StepN. However, since most of it were onboarded while it was still a web2 app, Sweat Economy’s users remain less crypto-native compared to StepN’s user base.

Tokenomics

Sweat Economy operates on a single-token system, relying only on SWEAT, while StepN runs a dual-token system with one governance token, GMT, and one utility token, GST. Mainly used for monetary rewards, GST absorbs a larger part of inflationary pressure on the StepN ecosystem. However, with one single token within Sweat Economy, SWEAT plays both roles and faces the same inflationary pressures as GST. Drawing from historical price trends, governance tokens (GMT) outperform utility tokens (GST) due to less token inflation pressure. If this hypothesis holds, SWEAT might underperform GMT in the future as SWEAT would be continuously minted to users, thus adding to its circulating supply.

Source: Sweat Economy Litepaper

With a capped daily inflation rate and yearly diminishing minting rewards, Sweat Economy seems to have put in more deliberate thought and effort into controlling SWEAT’s token supply. In comparison, while GMT is subject to a halving of token rewards every three years, GST does not have similar restrictive features. Simply put, SWEAT supply might be better controlled than GST, as users' unpredictable activities on StepN has caused unpredictable token prices, which adds to the volatilities of GST’s token supply.

Unlike GMT and GST, SWEAT seems to lack sufficient sink mechanisms for its token. As mentioned previously, StepN has designed a series of complicated token sinks for its tokens, such as sneaker repair, the HP system, etc. SWEAT on the other hand, only has inactivity fees and reward redemption for its main sink mechanisms as of the time of writing.

Similar to GMT, Sweat Economy is committed to buying back SWEAT from the secondary market using its profits or allocating profits to SWEAT staking. This would, in turn, push up SWEAT’s price should the repurchase be large in scale. The scale of the repurchase is still uncertain, and we will be keeping a close eye on more details in this regard.

With the above differences in tokenomics, the SWEAT price likely grinds lower as more tokens are gradually released to the market. Currently, it still seems that if all remains status quo, SWEAT’s circulating supply is likely to inflate and weigh down on its unit price due to the lack of sophisticated designs and sink mechanisms to contend with inflationary pressure. As such, it would be interesting to see how Sweat Economy would respond to these issues as they grow and develop further as a web3 project.

Sustainability

Source: Sweat Economy Litepaper

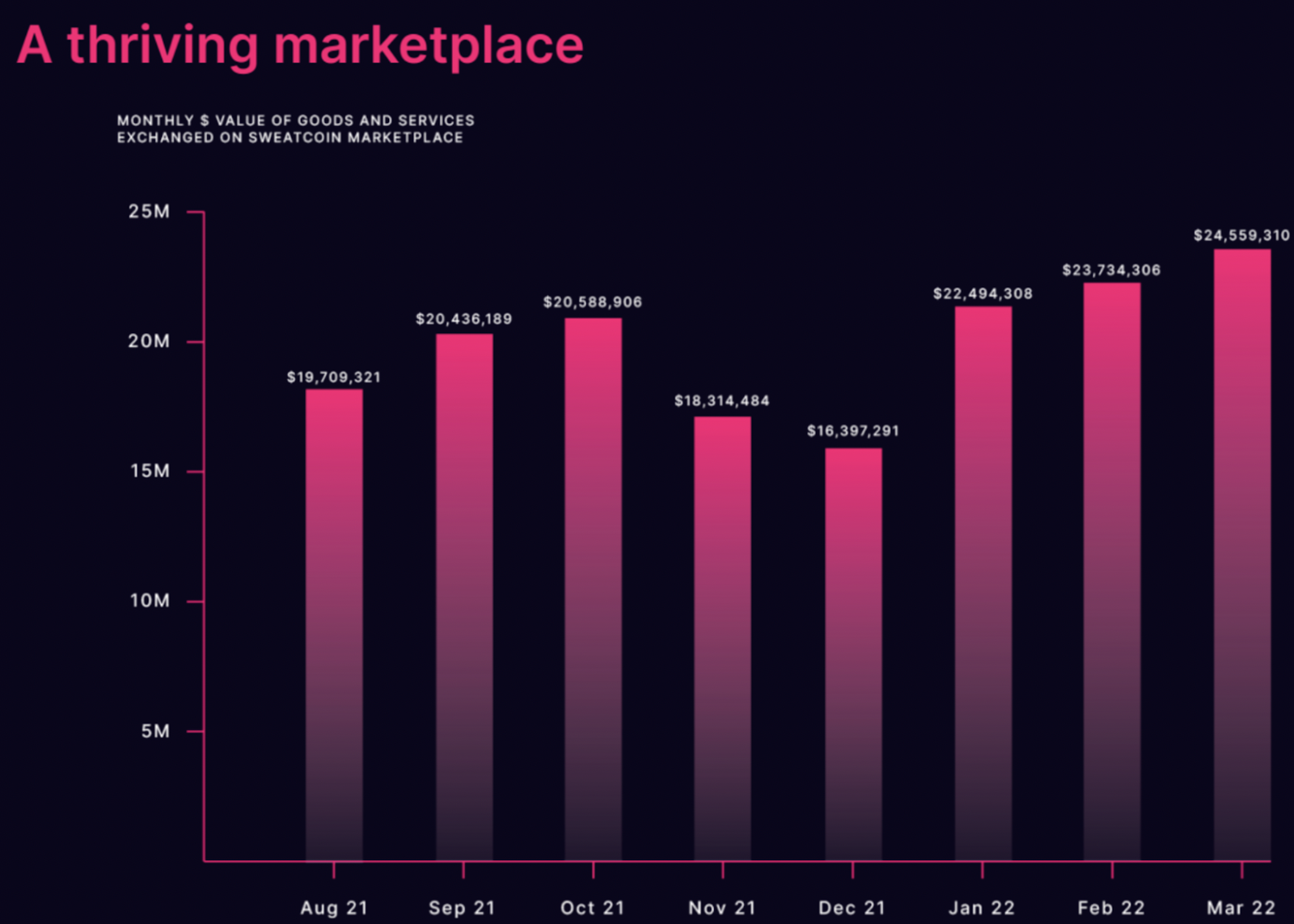

Sweat Economy earns fees from advertisements, and merchandise sales exchanged with Sweatcoins on the Sweatcoin App, while StepN receives income from partnerships with retail brands, NFT sales, and token trading fees. The revenue stream from Sweat Economy is largely related to real-world partnerships and receives advertisement and commission fees based on sales on its platform. As such, Sweat Economy’s monetization may be more profitable than StepN, especially with its vast amount of registered users. Moreover, they currently pay staked SWEAT holders with attractive 12% returns. Thus, it seems that Sweat Economy aims to reach sustainability through sustainable advertisement fees and merchandise sales instead of relying on token inflations like most P2E players.

Apart from the monetization of user engagement (B2B), Sweat Economy might earn trading fees from NFT and token trading on its marketplaces (B2C) in the future, which adds to its revenue stream and, in turn, repurchase SWEAT on the public marketplaces to support the token price.

As Sweat Economy is still relatively young in the web3 space, we would still have to wait and see whether the staking rewards remain attractive to its users and if the advertisement and trading fees collected are able to compensate for token inflations. In the best scenario, repurchases using the platform’s profits should be larger than the token inflations. This way, SWEAT tokens could potentially turn deflationary and reach sustainability.

Conclusion

Sweat Economy fundamentally differs greatly from StepN. The overall in-game design for Sweat Economy is much simpler, attracting users with its 12% staking rewards instead of token rewards. Unlike StepN, Sweat Economy seems to seek revenue streams from advertisements and merchandise sales to reach sustainability, a solution that other M2E games have not adopted. We look forward to seeing if Sweat Economy could break the deadlock faced by StepN and the M2E industry.

However, this potential does not come without concerns about its current ecosystem. A key concern of Sweat Economy is the lack of entertainment and inactive user participation, where most users passively earn token awards without opening the Sweatcoin App or Sweat Wallet regularly. The other concern is that Sweat Economy is centralized and lacks DeFi composability. It remains to be seen if future roadmaps could effectively address these concerns from the industry.

Final ThoughtsIt seems that these two M2E projects have acted on the “bear market is the time to build” sentiment, with StepN continuously providing new upgrades and measures that are theoretically effective, and Sweat Economy attempting to build a sustainable business model in the web3 space.

However, the bear market effect has weighed down on the results of StepN’s upgrades, while Sweat Economy has much room to grow to achieve its desired results. Only time will tell whether these projects can successfully deliver their promises and achieve results towards becoming a sustainable M2E project.