Traders need to set a stop price for a Stop-Market order, and when the stop price is reached, the order will become a market order that will execute at the best available price in the order book.

With this, traders can set the trigger price that executes a market order in advance. This is helpful for planning out trading strategies, and allows traders to take advantage of market conditions when they are unable to be at their computer.

What is a “stop” in trading?

Firstly, let’s go over what a stop is. A trader sets a stop (or stop-loss) when they want to limit loss on a trade, and is usually used by a seller, although a buyer may want to utilize the function to make sure they don’t buy at too high a price or want to be able to react to a market trend when they are unable to be at their computer to conduct a market order.

Difference between market order and stop-market order

For a fuller explanation of what a market order is and how to make one, check out “ How to make a market order ”.

A market order, arguably the simplest trading tool in your arsenal, executes immediately. A market order lets a trader buy or sell an asset at the best price currently available. However, this means you have less control over the exact price at which you buy a token.

A stop-market order, on the other hand, triggers when the stop price is reached. Once the stop price is reached, the order triggers like a market order, which means the price at which you buy or sell is a bit unknown, as the system looks for a matching order in the order book. As mentioned above, the stop-market order is useful when a trader wants to act on a price prediction to either limit a loss or ensure a profit.

Stop-limit vs stop-market

A stop-limit, unlike a stop-market order lets you select a trigger price AND a limit price, giving you more control over the price you buy or sell at. Of course, with a stop-limit order, there is a reduced likelihood of your order being filled.

Pros vs cons

A stop-market order is useful when planning out a strategy and for executing the trade automatically at the stop price, when the trader is unavailable. And even if a token’s price rises above the trigger price when buying, or dips below when selling, your order will be filled.

One of the most important things to consider about a stop-market order, is that when the stop price is reached, it becomes a market order. As mentioned before, this means the price you buy or sell at once this happens is a bit unknown. Meaning that, for example, if you set a stop-market to sell at a certain price, the stop will trigger the market order, but if the price goes down further than the trigger price, your order will be filled at that lower price.

First things first, before trading on Poloniex, make sure your account has enough funds to complete the trade that you want. Poloniex offers a large number of coin wallets into which you can make a deposit. Please remember that only crypto-to-crypto coin trades are supported and some of these coins have a minimum deposit amount. Furthermore, trades must satisfy a minimum amount depending on the trading pair.

From the Poloniex homepage, click on “Trade” on the menu bar.

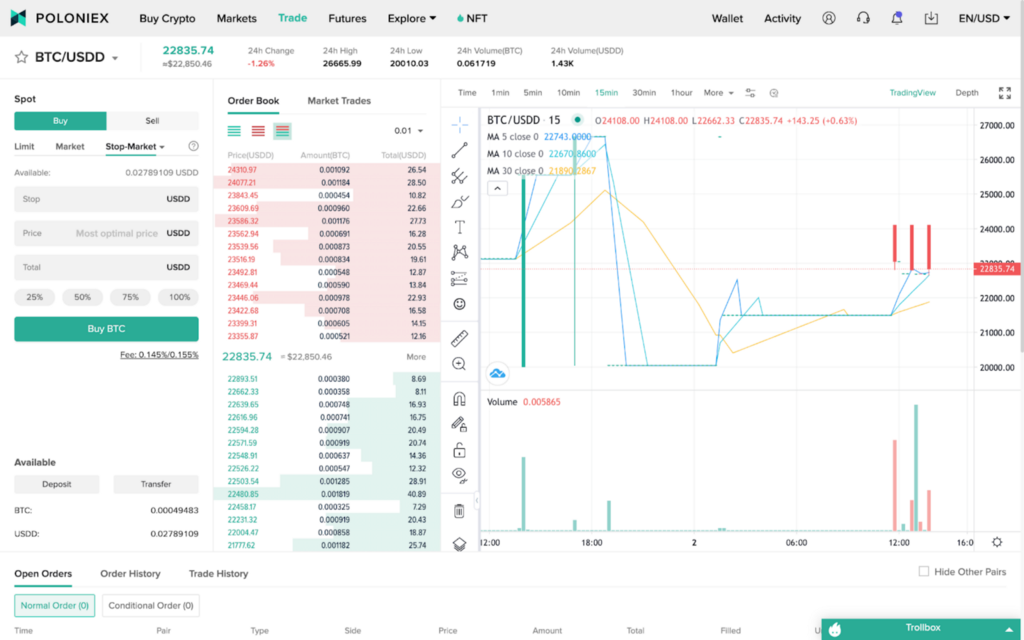

2. From there, you will be taken to the spot market page, where you will be able to select “Stop-market” from the order options on the left side of the page.

Here, like with a market order, the price field will be filled with text that says “Most optimal price”, due to the fact that once the trigger price is reached, the order becomes a market order executing at the best price available.

3. Next you need to set a stop price at which the order will become a market order. Then enter the amount you wish to buy or sell.

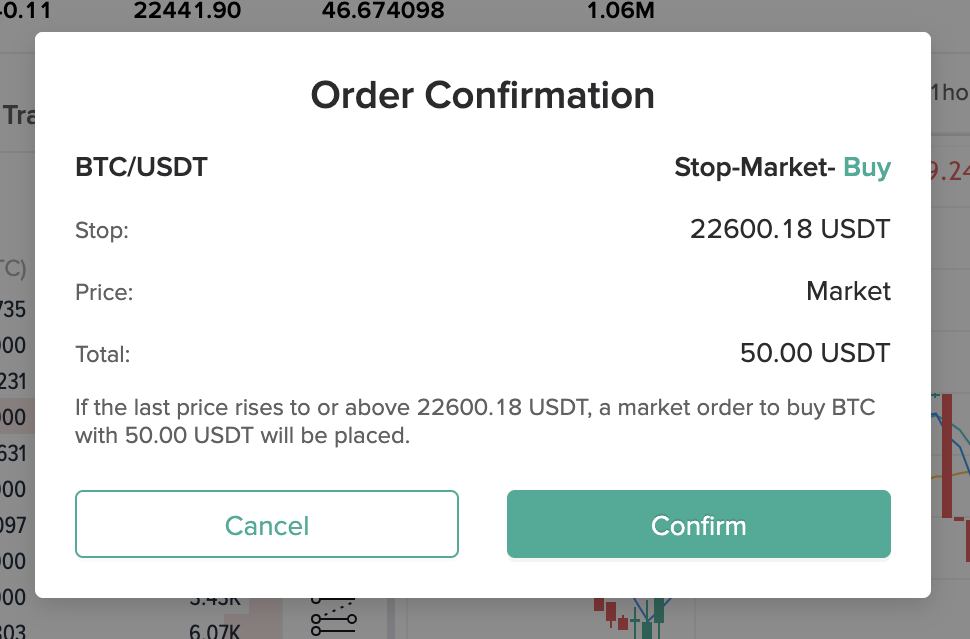

4. All you need to do now is confirm your stop-market order!

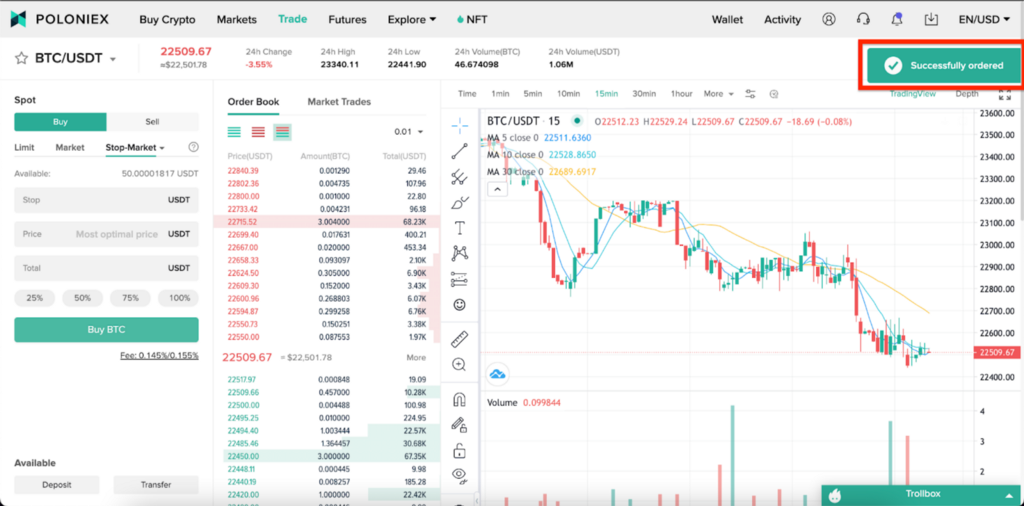

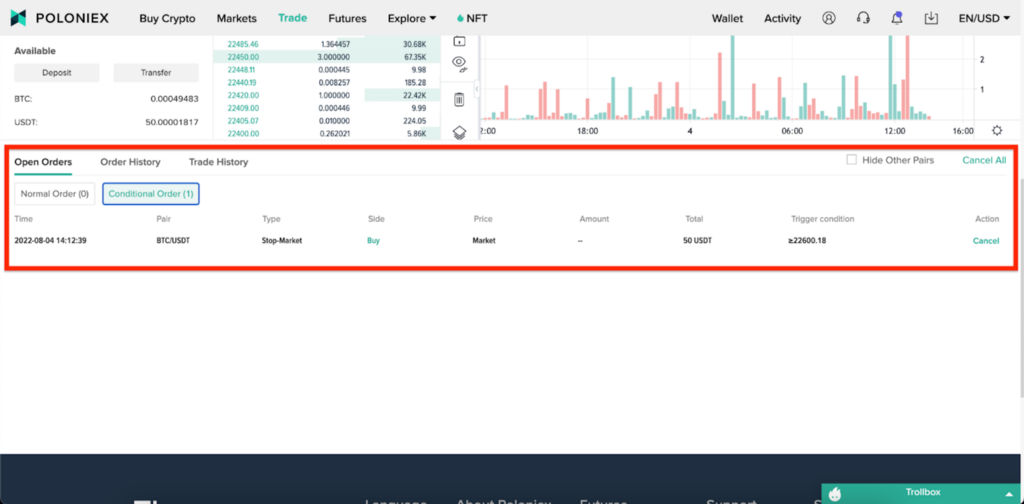

You can find a record of your open order just by scrolling down to your order book and selecting “Conditional order”.

All done! You now know how to take advantage of the new stop-market order function in our New Trading System, and will be able to set out more complex trading strategies.

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.