In the decentralized finance (DeFi) world, your loan is issued by a self-executing smart contract program called a DApp. DeFi DApps operate similar to the financial services apps you download from Android or IOS. Loans, payment services, trading and investment, insurance — there’s a DApp for that!

Think of DApps as virtual vending machines for financial services.

Permissionless— You don’t need to ask permission from banks to buy a Coke, nor do you need permission to get a loan. Once you deposit cryptocurrency as collateral for a loan, for example, the money will be sent instantly to your virtual wallet for a home mortgage or trading account for a margin loan.

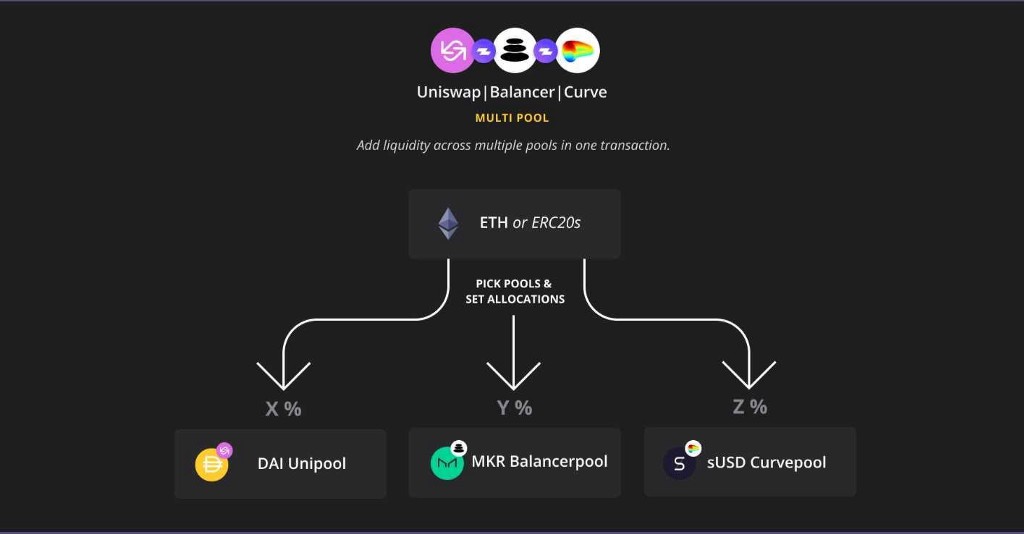

Interoperable — But unlike your apps, in which Facebookers only chat with Facebookers, DApps can talk to one another, and share services and functionality.

Borderless liquidity— This interoperability allows traders in, say, London, Cairo, and San Francisco to pool their liquidity to support swaps, lending, trading, staking and other activities and in exchange earn fees.

Pretty cool, right? This ability to coordinate financial services within and across DApps provides you with powerful cross-platform trading and yield-generating opportunities.

Higher Returns With DeFi Apps

DeFi DApps not only allow you to HODL and speculate on cryptocurrencies. You can also make money from yield-making opportunities like lending, staking, and yield farming. Many DApps throw in rewards, such as earning crypto. Like air miles, for example, you can earn crypto as a percentage of the value you trade.

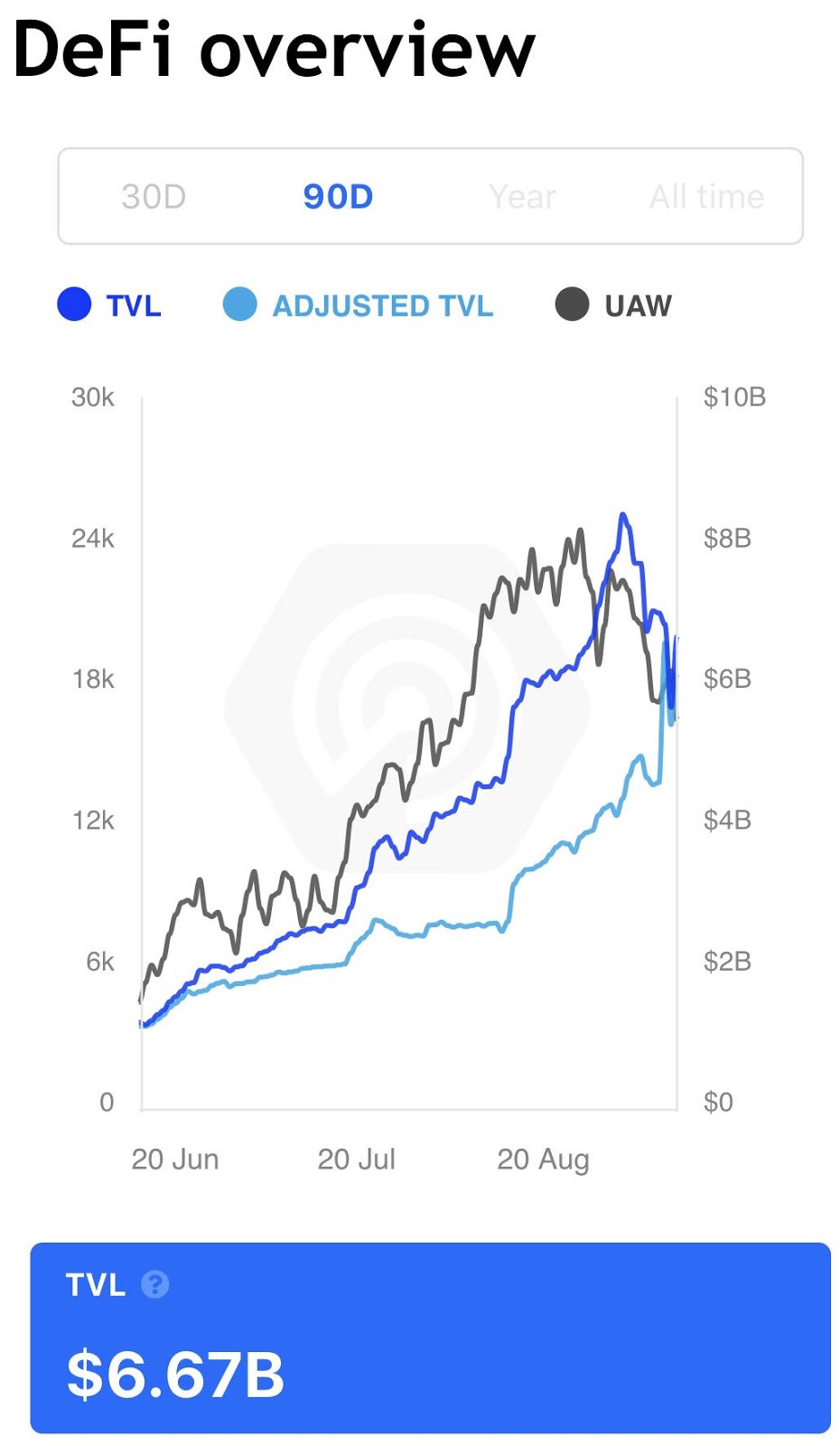

Yield-hungry investors have doubled their investments to over $9 billion across more than 3,000 DApps in the last year, but still a drop in the bucket of the $22 trillion financial services market. As the world’s largest financial institutions trickle into decentralized, open finance, rapid growth will follow. The third largest exchange ICE and fund powerhouse Fidelity have launched programmable money.

These financial powerhouses are not yet running their digital services on DApps. But they will soon. The missed market opportunity is like not placing their apps in the Google Play or iTunes store.

Interoperable DApps

The most powerful feature of DApps is the ability to seamlessly assemble your DApps like legos into one integrated trading interface. Old world financial services, in contrast, try to sell you a panoply of services at a one-stop shop, but each has its own shop door. And if you want to place some trading gains in a higher interest paying market elsewhere, it’s complicated.

To invest in the Fidelity Bitcoin Fund with your foreign exchange trading gains on ICE, you need to log into ICE, close your positions, and transfer the money to your bank account. You can then login into Fidelity, transfer the funds to your Fidelity account, and invest in Bitcoin. And somewhere along the way you need to swap your US dollars for Bitcoin.

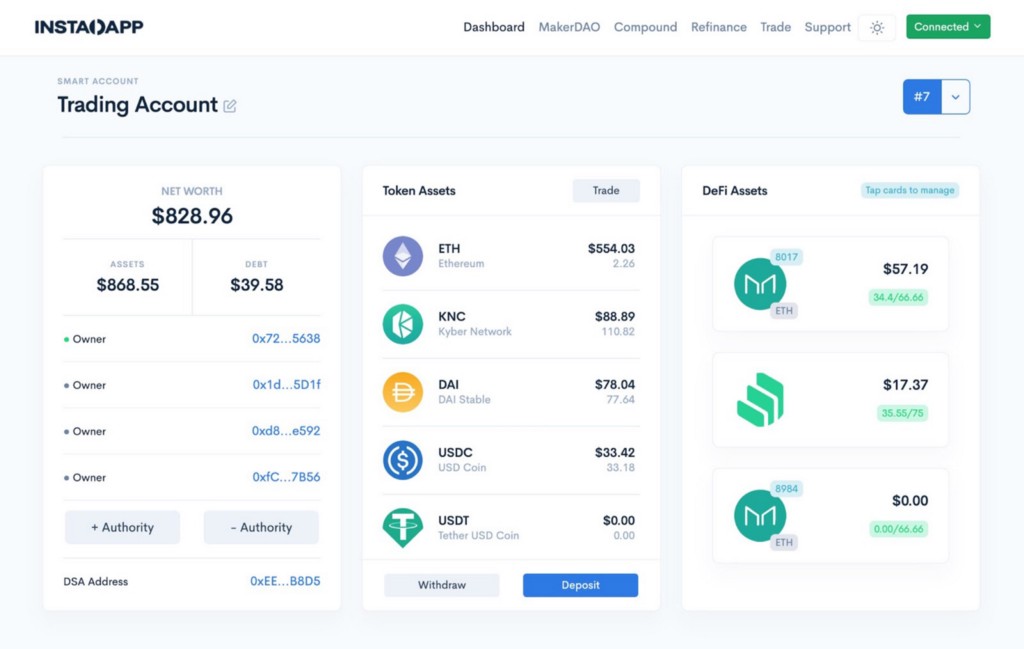

DApps create one world of financial services. You can move seamlessly between accounts on one screen. Close out the forex trade and click on the digital asset you want to invest in. The fiat-crypto swap is automatically executed for a small fee. One dashboard displays your total wallet balance and assets across all platforms. Drill down further by investment type (lending, staking) and DApp platforms.

Yield-Making Opportunities on OKEx

Once connected, DApps do all sorts of high yield flying tricks. Crypto traders have 1.1 active accounts on average. But those dabbling in DApps have many different DApps for trading, lending, staking, and yield farming to seize the highest yielding opportunities in the moment.

Let’s say you want to make money by providing services to your peers on DApps. You could, for instance, earn fees (and possibly rewards and voting rights) by:

Staking coins on OKEx, one of the highest paying staking pools

Depositing ETH into the UniSwap liquidity pool so that others can conduct swaps

Loaning out your DAI to peers who need money on MakerDAO

Yield farming on Compound’s $COMP by investing in governance tokens, giving you voting rights, which can currently be resold for a good markup

How to Become a Lender

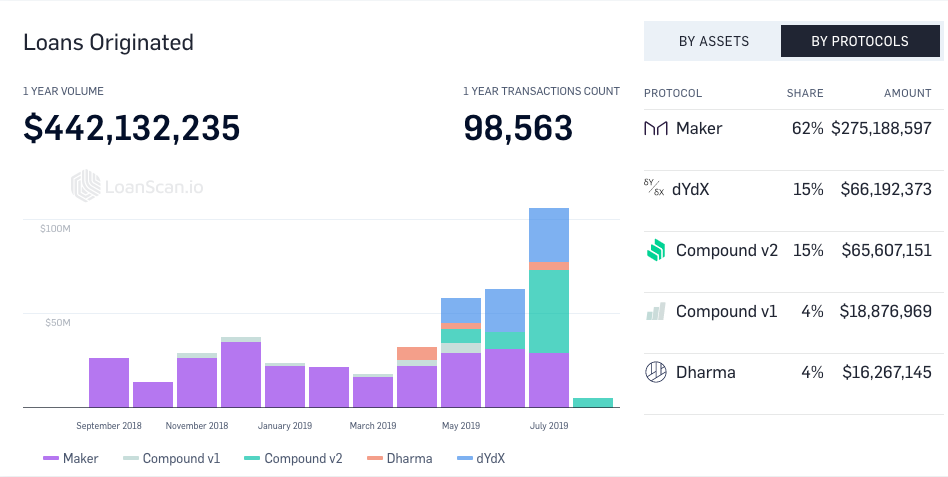

DApps break down walls across financial services. Many lenders have at least three DeFi lending apps (e.g., Compound, dYdX, Fulcrum) so they can choose the one currently paying the highest interest rates. Likewise, they search for the highest rewards across various crypto staking pools.

To lend money to your peers on MakerDAO, from one dashboard, you could transfer a $500 gain from staking in OKEx and $500 from yield farming on Compound into your MakerDAO wallet, where they automatically convert to DAI — the MakerDAO cryptocurrency.

As the lender, you will earn interest on your loan, but you do not have to wait long. Many DApp lending platforms pay out interest daily on each block mined. In the old world, the

financial institutions held your interest for monthly distribution. At night while you’re sleeping, banks invest your money in the overnight markets and make money. In the DeFi world, you can immediately put the interest to work for you, not the bank, in a yield-earning investment.

Hedging Risk in the DeFi World

Some safeguards of the old investment world have not transferred over to the new world. Currently, no deposit insurance is available on DeFi apps. If a DeFi goes bankrupt, the FDIC will not cover you.

But you can still cover your DApps investment risk. By taking the time to learn how to trade derivatives on cryptocurrencies, you can offset your trading risk exposures.

Here’s one way to cover the $1,000 in DAI you have lent to a peer on Maker DAO. The borrower has provided you with $1,000 in ETH as collateral for the loan — cryptocurrency in, loan out. Unfortunately, the borrower defaults on the loan. The ETH price has fallen 30 percent, leaving you $700 in ETH to cover the loan.

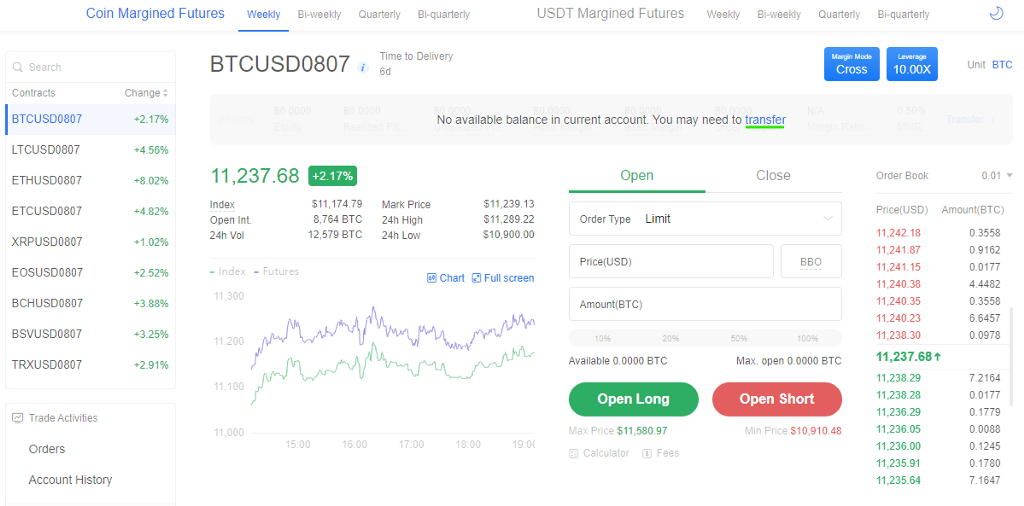

You have many options to hedge your exposure to ETH price fluctuations. On OKEx, we offer futures, options, and perpetual swaps. You could, for example:

Buy a futures contract to sell $1,000 ETH (10, $100 contracts) in 3 months (quarterly contract), for a small fee.

Open a short position, to profit from a decline in ETH.

Use leverage, say 20x, only requiring you to put up $50 in ETH to place the trade.

When the price of ETH falls 30 percent, your short position will move in the opposition direction, netting you $1,300 (not including fees), offsetting the $300 loss.

To access DApps and the DeFi world of open finance, you require a wallet with a DApp browser. Many of the most popular crypto wallets, downloadable from Google Play or iTunes, provide access to DApps.

Extra Resources

How to make an investment with C2C loan on OKEx

Not an OKEx trader? Sign up and start trading today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.