The total value locked in OKB Staking exceeded $200 million on Monday, with more than 16,000 participants. This move significantly lowers the barriers for retail traders participating in DeFi, with no additional on-chain gas costs.

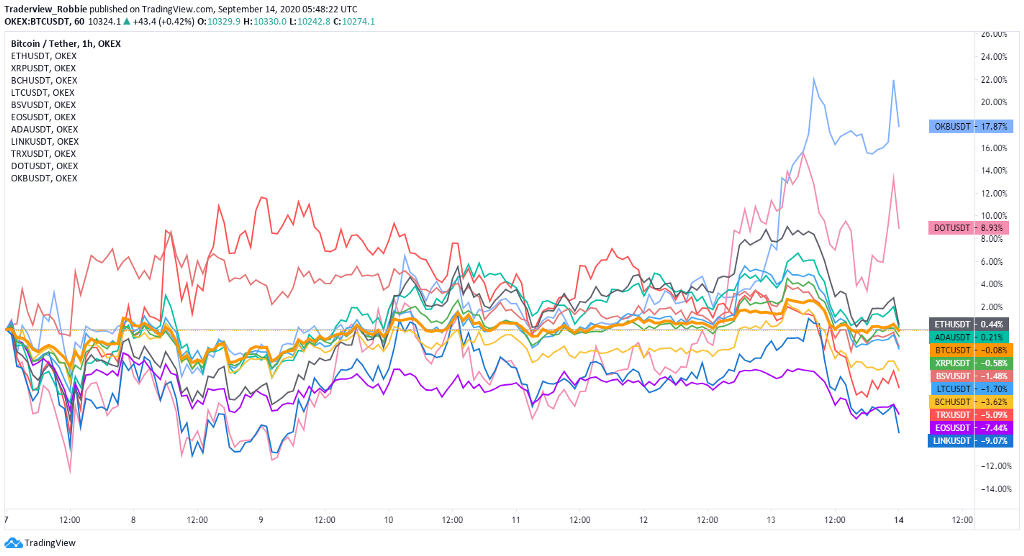

OKB also picked up sharply over the last week due to both increased demand and decreased circulation, surging 17.87% to become one of the leading performers.

Bitcoin (BTC), on the other hand, showed little enthusiasm last week, down a minor 0.08% after testing the $10,000 mark several times. The leading digital currency started a rebound on Wednesday and reached a weekly high of $10,580 early Sunday morning — as per the OKEx BTC Index price — before dropping to close the week at $10,300.

Polkadot ( DOT) was another altcoin that performed well last week, rising 8.93% to take the fifth spot in terms of market capitalization. Chainlink ( LINK), meanwhile, fell to sixth place in the market cap rankings after dropping 9.07%. Ether ( ETH) remained mostly unchanged, up a minor 0.44%, while EOS and TRON ( TRX) were down 7.44% and 5.09%, respectively.

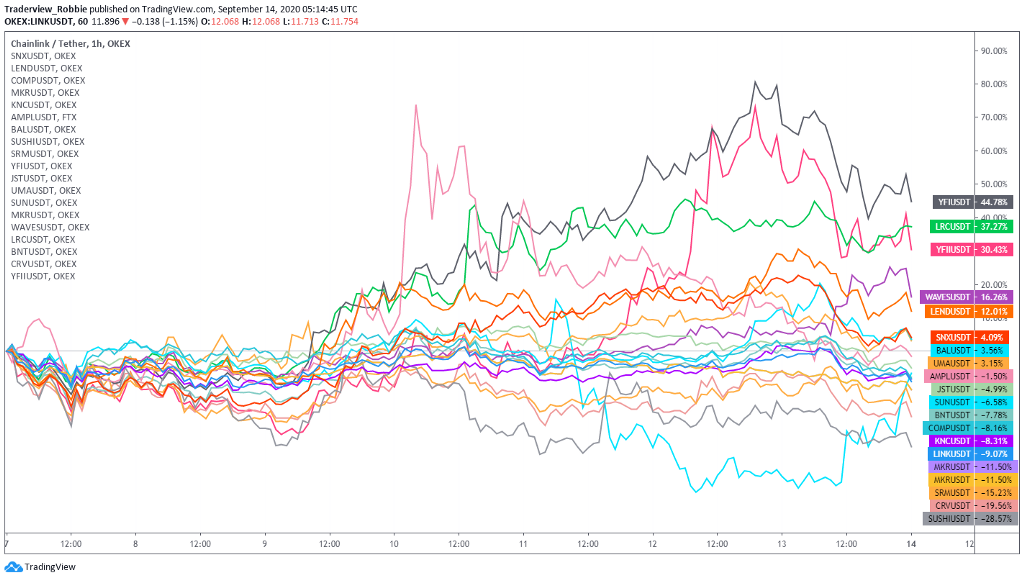

Looking at DeFi tokens, yearn.finance ( YFI) and Loopring ( LRC) outperformed competitors thanks to their upcoming Coinbase Pro listings, giving them weekly returns of 44.78% and 37.27%, respectively. DFI.money ( YFII), a YFI fork, also realized a 30.43% weekly gain.

The worst-performing token in the DeFi sector was SushiSwap ( SUSH I), down 28.57%. SUSHI closed the week at $2.20, down from its seven-day high of $3.50.

The total value locked in SushiSwap has also fallen sharply after it lowered the block rewards this weekend. The TVL has tumbled to $808.3 million — a 42.74% drop over the last 24 hours, as per DeBank’s data. Previously, SushiSwap’s TVL had reached $1.5 billion and was ranked first. It is interesting to note that on Sept. 9, SushiSwap successfully migrated $800 million from Uniswap due to yield farmers seeking SUSHI block rewards.

This time, due to the huge cut in block rewards from 1,000 to 100 SUSHI, the profit-seeking nature of yield farmers led to the withdrawal of liquidity very quickly. Its $14 million worth of buybacks and $2 million in airdrops don’t seem to have helped the price much.

At the same time, we noticed that Uniswap’s TVL surged 62.63% in the last 24 hours. Uniswap and SushiSwap are even more vastly different when it comes to the number of 24-hour users and the number of transactions.

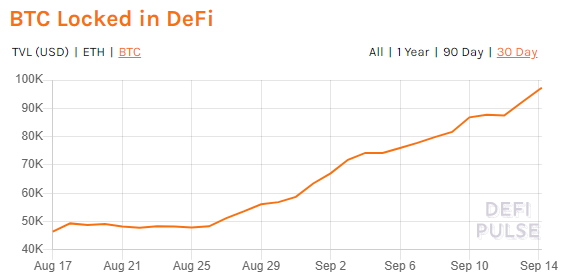

Moreover, due to the high yields on offer in DeFi, nearly 100,000 BTC has been “moved” to the Ethereum blockchain, as per DeFi Pulse data. The most popular BTC to ETH cross-chain project is Wrapped Bitcoin, which accounts for more than 66%, or 53,000, of all cross-chain BTC.

Looking at Bitcoin, we saw CME release the latest (as of Sept. 8) Bitcoin futures position data. Bitcoin fell by more than $2,000 in the time frame corresponding with this report, and the data reflects possible reactions from institutional investors.

Please visit https://www.okex.com/ for the full report.

Not an OKEx trader? Sign up and start trading today!

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.