As with every news cycle, many of the defi stories you read and hear about focus on the negative: with defi, it’s exit scams, untested code, getting rekt, and bubbles. But behind this narrative is an industry poised for explosive growth in a ripe economic environment.

Decentralized finance continually gets fueled by an avid audience of liquidity miners, stakers, farmers, traders, gem hunters, and people who are just here to watch in amazement as a new way of money emerges from the ashes of this year’s economic downturn.

DeFi’s summer of love

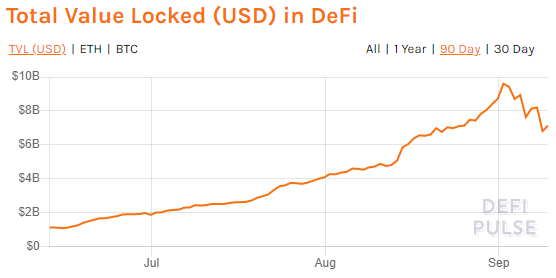

The amount of total value locked in defi protocols rose this summer from $1.132 billion to 7.553 billion during the worst financial crisis in modern history. In that same timeframe, we’ve watched bitcoin’s marketcap dominance fall from 64.92% in June 2020, to today’s 56.4%.

Nobody in the industry believes bitcoin will become irrelevant any time soon. It continues to be the strongest decentralized network and the most respected digital asset worldwide.

But it was also the original defi application. Since its creation, the idea of open source financial technologies to serve everyone squarely has led us down this road. Growth in the decentralization space is moving at a breathtaking pace — with defi tokens leading the way.

What is DeFi exactly?

Decentralized Finance (DeFi) is a system of open source financial software tools that enables developers, creators and entrepreneurs to create applications. Because of the open nature of the technology, these innovators can use existing technologies to copy and expand on, build on top of, or even create interoperable side chains that connect these different defi platforms.

Generally, defi applications have similar characteristics (though each is unique):

Open to all — Anyone globally with an Internet device is welcome to participate.

Steeped in high tech — Uses tech such as blockchain ledgers and automated smart contracts.

Community driven— Meaning a global pool of participants or users has an active say in how the protocol runs.

Geared toward autonomy — The technologies available today have allowed developers to build systems that minimize (if not eliminate) the need for 3rd parties or central authorities. Think financial systems without the Fed, governments, central banks, or even major payment processors.

Transparent and verifiable — Since open public blockchain ledgers are behind the emergence of defi tokens, all users can verify and see transactions on the blockchain explorers of these crypto coins.

Able to use a crypto token — Such tokens, issued mainly off the Ethereum Blockchain, can be used to increase engagement, reward participants for using the platform, in promotions, to supply liquidity, and in many other ways (some yet-to-be-invented!).

Note: While there are multiple platforms for building decentralized applications (Dapps), Ethererum is currently the main source of growth and expansion when it comes to building defi tokens and protocols. Other Dapp platforms include Waves, EOS, NEO and Steem. All defi platforms represent the infrastructure for a new, digital financial system.

Decentralization vs. Centralization

When first entering the defi markets, it’s important to understand what exactly decentralization means.

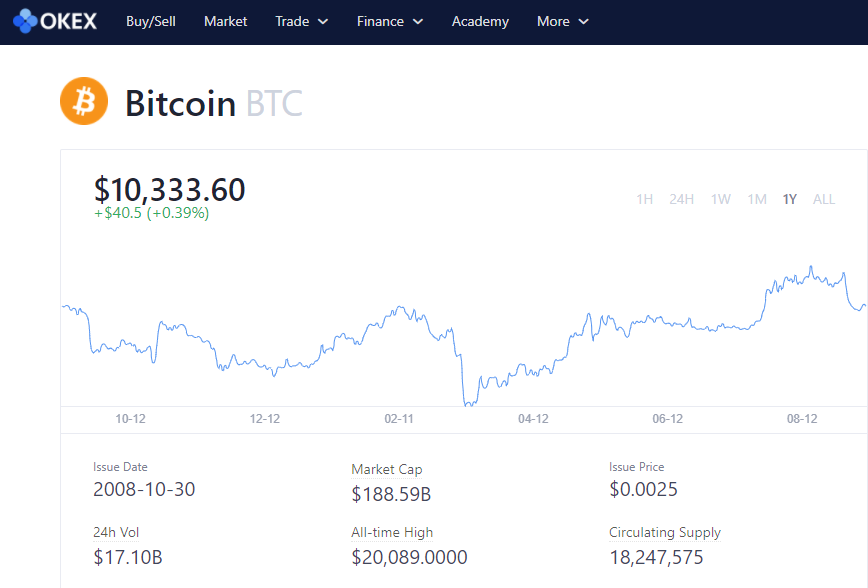

When bitcoin first came onto the scene about 11 years ago, it offered a first real glimpse of decentralized money. This peer to peer financial application, devised by the anonymous Satoshi Nakamoto, allowed anyone in the world to send money to someone else with just an Internet device. So it was decentralized in the sense that it ruled out centralized 3rd parties such as banks and governments.

But another feature of decentralization is how the network itself is run. Instead of bitcoin’s transaction ledger being managed and stored at a central location by a specified leader or CFO, bitcoin runs autonomously on thousands of computers that run its software in real time (nodes) from anywhere in the world, without a designated leader.

To get a feel for this, imagine your bank. It keeps a centralized ledger to track all bank transactions, from savings account deposits to bank to bank loans. But you as an account holder only see a very limited data set — your personal transactions. The rest of the data is stored by the bank’s management team privately and centralized servers. Bank depositors cannot see what the bank is doing with their money.

How Bitcoin gave us Defi

With bitcoin, all users of the network are essentially “the bank” and can see all transactions (without personally identifying data) in real time. Not only that, every transaction is verified to be true and non-duplicated by a decentralized system of thousands of miners and node operators who are incentivized to play by the rules, earning bitcoin for their part in running the ‘bank’.

As the world’s first defi application, bitcoin laid the groundwork for the future of decentralized finance. In the past ten years, innovators and believers of a better way have been in deep building off this foundation to create new and exciting ways of economy that are inclusive, fair, community driven, profitable, and open to all. That is the true meaning of defi.

Why endure a financial system that benefits a few, when you have access to a system that benefits everyone in the ecosystem?

DeFi tokens defined

The fuel that flames the defi industry is most certainly the defi token. These crypto coins have just recently been separated from the general listings of cryptocurrencies to receive their own category. Most defi protocols have a defi token that may be used in crypto markets and platforms in a number of ways, including:

Incentivizing liquidity, which essentially rewards participants for using a token on an exchange.

By staking tokens, defi users set aside a number of defi tokens to be lent out and receive a token reward for doing so.

Trading — traders love defi tokens as they’ve loved most cryptocurrencies. Due to their relatively new nature, defi tokens still involve much volatility, creating many opportunities for profit.

Building up an audience — promotions and contests with defi token rewards play an important role for defi builders in bringing in new users.

Types of DeFi

While innovation in defi is only just beginning, some of the applications that have gained popularity in 2020 include:

Liquidity farming — Protocols like Uniswap and SushiSwap pool together tokens into automated smart contracts. Their users can do token swaps, earn fees from adding to a pool, or even list their own defi token. Liquidity farmers look for these types of applications to ‘farm’ the fees, earning largely passive crypto income.

Staking — Staking defi coins was one of the original decentralized token ideas. Users set aside a number of tokens in a dedicated crypto wallet, such as with Synthetix. Then they earn more crypto just for holding their tokens there. Originally, staking helped networks become more secure and viable. Staking today has also evolved to where the pooled tokens become collateral for other defi applications, such as lending.

Lending — Defi lending platforms pool resources to provide loans to others without intermediaries. They also allow users to receive interest token payments when they stake their own tokens, thus contributing to the pool of lending resources. Lending protocols like Aave enable participants to earn interest on their staked deposits and also borrow from the pool.

Decentralized exchanges (DEXes) are trading exchanges that run on open, public blockchains. They use a peer-to-peer network with an algorithmic consensus mechanism in place, as with IDEX or Kyber Network, instead of being run and owned by a company.

Automated market making (for defi) — Decentralized exchanges have had an overarching problem that has stunted their growth — lack of liquidity. Especially at first, DEXes were just very new and somewhat technical to navigate. As they evolve to meet mass markets, automated market makers help them to pool order books. In this way, traders are interacting with an automated smart contract instead of another trader or broker, making it easier and a more streamlined process to trade on a DEX. Decentralized exchanges, along with defi tokens, have exhibited significant growth in trading volume during 2020.

DeFi Tokens having a HOT summer

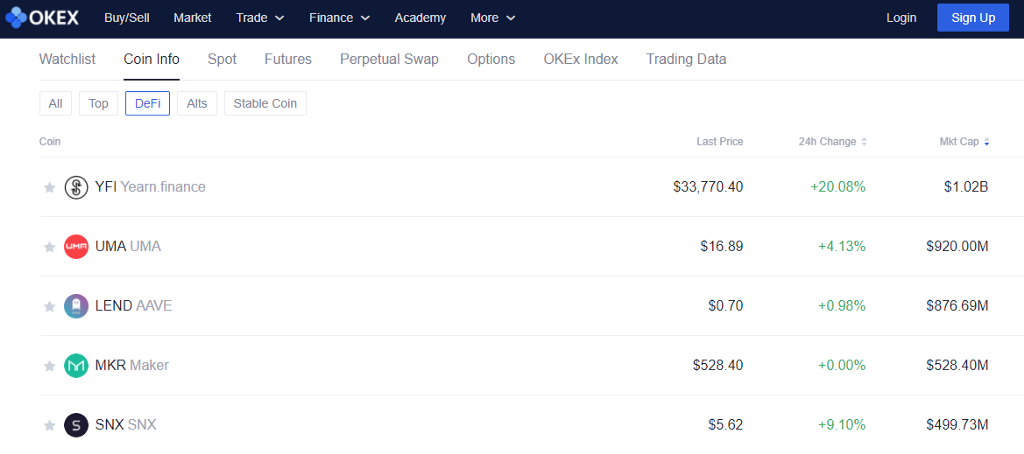

Even as the summer of 2020 winds down, DeFi coins are still very hot. According to OKEx crypto exchange, each of the top 3 leaders have billion dollar marketcaps (or close to it).

#1 — Chainlink (LINK) — Chainlink is a decentralized oracle network that connects smart contracts in real time from on-chain to off-chain protocols for the purpose of verifying exchange data without the use of one centralized exchange. Current marketcap: $4,390,363,135

#2 — In the second slot is Yearn Finance (YFI), a lending and liquidity protocol that pools liquidity with other defi projects including Curve, Aave and Compound. Yearn’s marketcap recently topped $1 billion.

#3 — To round out 3rd place is UMA, a defi platform allowing any two counterparties to devise and implement their own financial contracts. UMA’s current marketcap sits at just under $1 billion.

Special mentions

Just recently, ShushiSwap forked another defi project called Uniswap, which is a swap protocol for defi tokens that provides a market maker (liquidity builder) for DEX coins. By forking Uniswap, SushiSwap copied their code. But they also added a defi token to the mix, enticing most of Uniswap’s users over to their platform, where they could potentially earn more crypto.

YAM was another summer favorite with the crypto community. Its goal is to create an “elastic supply” of defi coins with a community-governed treasury to stabilize crypto prices.

Curve launched in 2020 to enable users to trade stablecoins with lower fees. It was also one of the pioneers in yield farming and now has seven liquidity pools for staking to earn different cryptos.

Maker was one of the earlier defi projects built on Ethereum. Until this summer, when people thought of defi, Maker was the most prominent name. This particular defi protocol enables lending and borrowing of crypto without a third party. It uses two defi tokens, MKR and DAI (a stablecoin) to help regulate the value of their loaning pools. Users lock in their crypto collateral and earn DAI for holding it there.

Why the Defi Movement is not just the ‘next round of scams’

People in the industry have had mixed feelings about the year in defi. With everything else that’s going one, defi has given us all a healthy dose of caution along with all the thrills. But while projects are evolving and the defi industry rises as a major (collective) player, there will inevitably be a good share of projects that capitalize on the FOMO.

Just as with the 2017–2018 ICO phenomenon, crypto enthusiasts and traders must be vigilant in their research because in this industry, ‘you are your own bank’. This means you are in charge of your gains or losses, how you secure your money, and which projects you determine are worthy of your attention.

But the general focus for defi followers is the continuation of innovative financial economies that are available to all and which attempt to improve upon our current system. Whether or not you believe in the validity of defi token projects like Kimchi and PIzzaHut, you can’t look at the incredible amount of creativity in the defi space today without thinking that, even with some sidetracks, we are all heading somewhere amazing.

OKEx and the DeFi community

OKEx is excited to be in the middle of the world’s biggest shift in how the world interacts with and views money. As a crypto exchange enabling trading for dozens of defi tokens, OKEx continues to build upon the open finance ecosystem it has already helped to flourish.

OKEx’ focus on community is always in the forefront. Just recently they held an Elite Trader Contest where thousands of trading teams competed to win huge prizes. The winners were determined based on profits they made trading on OKEx.

The OKChain Decentralized Exchange (DEX) is currently running its testnet. Those who want to test it out are provided with tokens to give it a try.

Dozens of defi tokens are already available on OKEx for trading.

You can currently stake bitcoin as well as a variety of altcoins and defi tokens to earn crypto on OKEx.

Coming soon, OKEx users will also be able to borrow COMP on the platform. Currently you can loan directly to other OKEx users and earn interest through their C2C Loan program.

In the future, OKEx users will have access to even more open, transparent financial products and services as we make our way together through the defi universe.

Not an OKEx trader? Sign up and start trading today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.