The Top Two Issues Facing Cryptocurrency Traders Today

In 2019, cryptocurrency is more than just a niche financial category reserved for Bitcoin’s true believers. It’s an expansive investment ecosystem that includes everything from direct investment in digital currencies like Bitcoin to supporting crypto projects by investing in utility or other functional tokens.

It has many expressions, and crypto investors have never had more opportunity to participate in this burgeoning ecosystem than they do today.

There are dozens of crypto exchanges offering compelling and competing services, creating a dynamic opportunity for investment that meets the needs and desires of individual investors.

Meanwhile, even many traditional financial institutions are getting involved, offering derivatives products that provide the crypto curious an easy on-ramp.

In short, whichever crypto investment product you are looking for, you can probably find it.

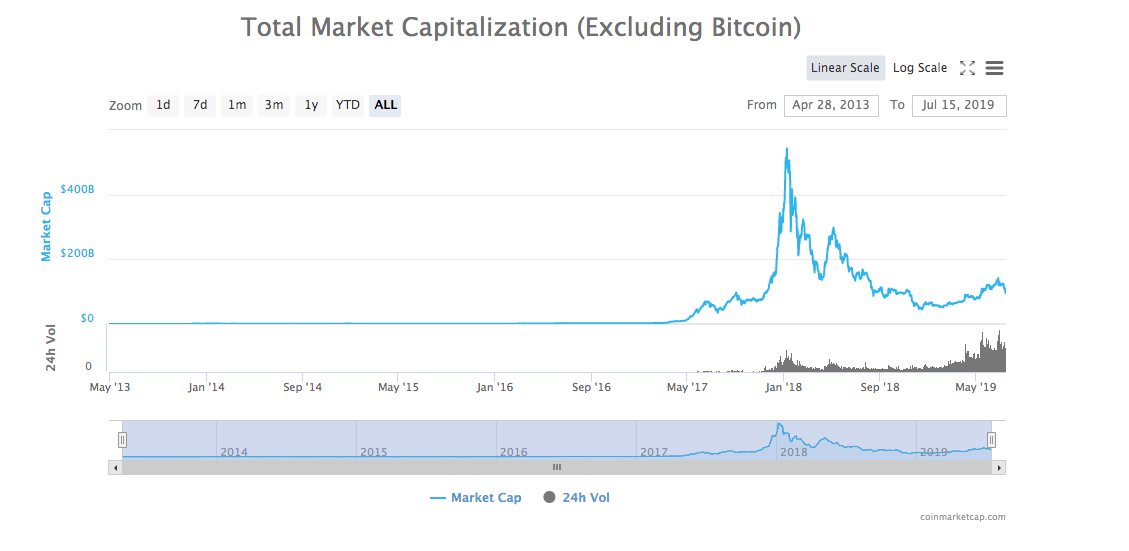

Collectively, these opportunities are encouraging participation, pushing the price of cryptos back into the headlines, while more than doubling their market cap this year.

However, despite years of growth and maturation, traders still encounter problems that prevent this investment category from reaching its full potential.

For many people, the list of problems is nuanced and long, but many issues ultimately reflect two complications: muddy messaging and a transition toward automated trading.

By understanding these issues and possible solutions, it’s possible to bring broad improvements to the crypto investment experience.

Muddy Messaging

Cryptocurrencies tend to operate in extremes.

They have both adoring fans and dedicated detractors who are unquestionably incredulous of the nascent investment vehicle.

Since Bitcoin broke onto the proverbial mainstage in 2017, many people, especially from among the financial elite, were quick to criticize the technology.

JP Morgan Chase CEO Jamie Dimon famously called Bitcoin a “fraud,” and Bill Harris, the former CEO of PayPal, called Bitcoin “a colossal pump-and-dump scheme...best suited for one use: criminal activity.”

To put it mildly, the criticism has been pointed and consistent.

Unfortunately, these assertions have created confusion about who is using cryptocurrencies and how they are applying them to their portfolio.

What’s more, the muddy messaging surrounding crypto investment clouded the reality that crypto markets are improving in many ways. The report revealed that

The Bitcoin spot market has improved.

Large asset managers are entering the space.

Custodianship is becoming an easy solution.

Often, that message is missed because of confusing sentiments about what’s really happening in Bitcoin markets.

Healthy debate, criticism, and contemplation are all important elements of an emerging asset class; however, mixed messaging only makes things more difficult for would-be investors.

Inequality and Automated Trading

To be sure, automated trading is having a significant impact on crypto markets and those who participate in them.

Once dominated almost exclusively by individual investors, institutions have made significant inroads into crypto markets, bringing their cadre of advanced technology along with them.

For example, JP Morgan Chase estimates that just 10% of their trading is executed through manual stocking picking.

Instead, the industry is turning to algorithms to make timely decisions that derive profits from rapid price changes from investment assets.

JP Morgan is not an outlier. They are the norm. It’s estimated that up to 70% of all stock trades are algorithmically driven.

In many ways, it’s the most natural expression of finance in the digital age, but it can artificially create winners and losers based on access to the most prolific technology. As these technologies enter the crypto space, they are disrupting an established ecosystem dominated by individual investors, making it more difficult to compete on a level playing field.

For example, several crypto exchanges are offering colocation, the process of placing the investor’s server in the same location or cloud as the exchange, which allows those with access to execute trades up to a hundred times faster, a significant difference when the timing is everything.

Automated traders thrive when they have the best technology, the most access, and the most prolific opportunities, none of which are inherently contingent on trading skill or expertise, which can undermine the fairness ethos that is at the core of the crypto movement.

Automated trading isn’t inherently wrong, but unequal access is. New products, like Cryptohopper’s automated trading platform, can help restore fairness to crypto traders of all sizes. Offering affordable access to powerful features like mirror trading, paper trading, backtesting, and trailing stops, Cryptohopper equips individual investors to compete with the resources of more prolific trading operations.

Noting the role of automated trading bots in today’s crypto investment arena, EXMO, an international cryptocurrency exchanges, writes, “Well done bots can be a tool that helps to stay ahead of the curve when it comes to market movements. They can perform transactions based on the parameters of developers or parameters set by you.”

When everyone has access to powerful tools to enact their financial strategy, crypto investors can participate with confidence, knowing that a more powerful computer processor isn’t undermining their work.

Automated trading isn’t likely to abate anytime soon, so restoring this fairness is an important component of a thriving investment ecosystem.

2019 has seen a resurgent interest in cryptocurrency investment. Even amid a general boon for most major investment vehicles, cryptocurrencies have been a way for investors to derive new profits in novels forms.

As market forces smooth out the creases caused by muddy messaging and the automated trading movement, cryptocurrencies will be poised to continue their ascendance as the premier financial asset in the digital age.

Check out our last blog: Is High-Frequency Trading Good For Crypto Investors.