A major obstacle that the Ethereum user and development community has faced in recent times has been high gas fees. With Ethereum seeing a huge increase in demand in the past years, gas (transaction) fees have skyrocketed, in some cases with complex contracts being hundreds of dollars for a single transaction. Due to this, it’s made the network unusable to some, as they are simply priced out of using it.

If we have learned from crypto history like with Bitcoin and Bitcoin Cash, we know network usability issues like with fees creates a rift among the users and developers, who may not always see eye-to-eye on how to solve scalability issues.

Increasing the gas limit

Thankfully, to address the high ETH gas fees and alleviate some pressure, miners have increased the network’s gas limit from 10,000,000 to 12,500,000. According to The Block,

The network’s block size is bounded by the amount of gas that can be spent per block, which was previously 10,000,000 units […] Ethereum’s block size varies depending on the gas limits miners signal to the network, which they do by publishing the maximum gas limit they accepted in the most recent block. The Ethereum protocol allows miners to adjust the gas limit, up or down, by roughly 0.1% in each new block.

With the gas limit increase, Ethereum would have the capability to handle approximately 44 transactions per second instead of 35.

With the gas limit raised, it now allows for more capacity per block thereby lowering the transaction fees that have been plaguing Ethereum. This of course is not a final solution, as when there is more demand, the ceiling will eventually be hit again cause another fee spike.

ETH 2

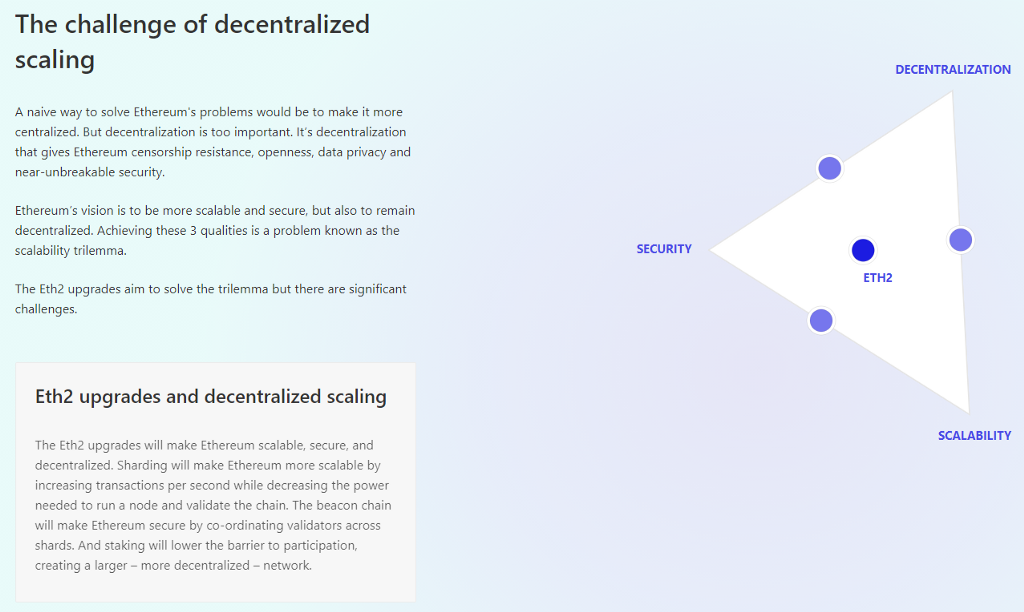

Another way Ethereum developers plan to attack the scalability issues including fees is with Ethereum version 2.0, or simply just ETH 2.

ETH 2 is an upgrade to the Ethereum blockchain. The goal is to increase speed, efficiency, and scalability. It will address bottlenecks within the distributed network, and increase the number of transactions too. ETH 2 has fundamental changes in its structure and design as compared to ETH 1. The major changes coming are proof of stake, sharding, and staking.

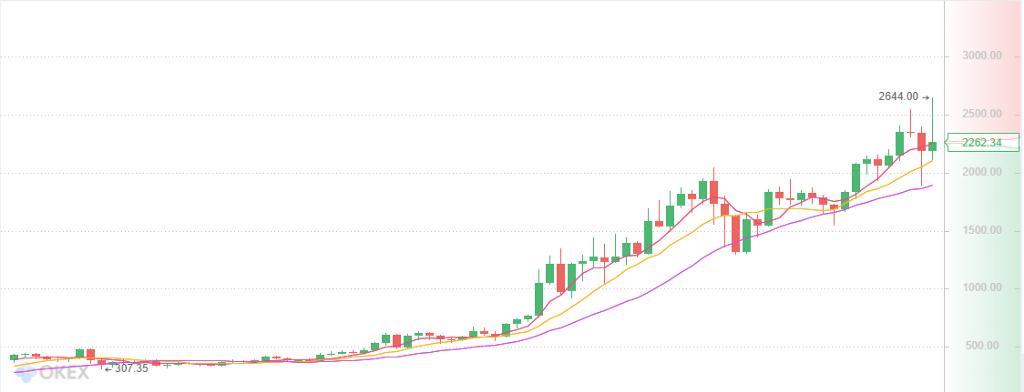

ETH price pauses on the way to the moon

The price of ETH has gone up significantly in this bull run, starting the year off around $700 USD, hitting an all-time high of $2644, and now experiencing a slight pull back and correction of $2262.

According to our Market Insights, the performance of ETH has further bolstered the DeFi market, with its total value locked rising to over $58.6 billion. Nearly every major Ethereum-based DeFi platform has seen a TVL increase such as of Maker, Uniswap, and Aave seeing increases over 5%.

The price of ETH continues to outperform BTC, though the leading cryptocurrency is currently running up to a potential area of selling interest, which is something to look out for.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.