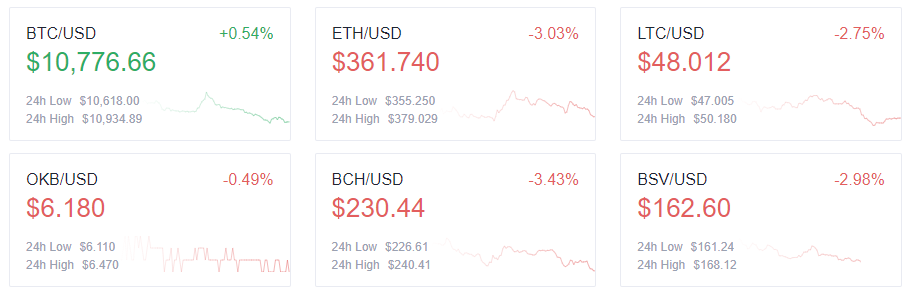

Overnight, Bitcoin (BTC) once again became the primary focus of the cryptocurrency market. The market-leader retraced after hitting a high of $10,950 yesterday afternoon and is currently trading above $10,800 levels, up 0.54% over the past 24 hours.

Meanwhile, the United States stock market also extended its rally. The Nasdaq Composite Index rose 1.21%, and the S&P 500 rose 0.52%. The Federal Reserve is holding a two-day monetary policy meeting and will make an announcement on Wednesday. Market participants primarily want to know if the Fed will continue to keep rates low.

In the cryptocurrency market, major altcoins saw a general decline. Among them, Chainlink ( LINK) dropped by 9.20% and was overtaken by Bitcoin Cash ( BCH) in the market capitalization ranking. LINK broke its $12 support and is currently trading at $10.80. LINK has lost 50% of its value over the last 30 days, though it still maintains the number one ranking by market capitalization in the decentralized finance sector. Its DeFi dominance stands at 30%, as per CoinGecko’s data.

Once again, the biggest loser among major altcoins was TRON ( TRX). The potential sell-off from today’s upcoming unlocking of yield-farming project SUN has caused the market to panic dump. TRX dropped below $0.027, losing more than 40% since Sept. 3.

Ether ( ETH) and Litecoin ( LTC) declined by 3.03% and 2.75%, respectively. On the other hand, OKB was down a relatively small 0.49%. Yesterday, OKEx announced the launch of its second Jumpstart Mining project.

The total cryptocurrency market capitalization is down 1.3% and dropped below $350 billion, as per data from CoinGecko. Meanwhile, BTC dominance surged to 57%.

Top altcoin gainers and losers

MOF/USDT +13.29%

LET/USDT +11.11%

DGB/USDT +8.55%

SUSHI/USDT -26.01%

WNXM/USDT -27.81%

SWRV/USDT -28.47%

Performing worse than the major altcoins were the DeFi tokens, which are almost universally in the red. Ten tokens on the OKEx DeFi coin-list dumped more than 20% overnight.

The top three losers were all DeFi tokens. Swerve ( SWRV) and Wrapped NXM ( WNXM) dumped 28.47% and 27.81%. Even the $14 million worth of buyback did not stop SushiSwap ( SUSHI) from crashing another 26%.

In the last 24 hours, only two altcoins have reaped double-digit returns. Molecular Future ( MOF) and Linkeye ( LET) are up 13.29% and 11.11%, respectively.

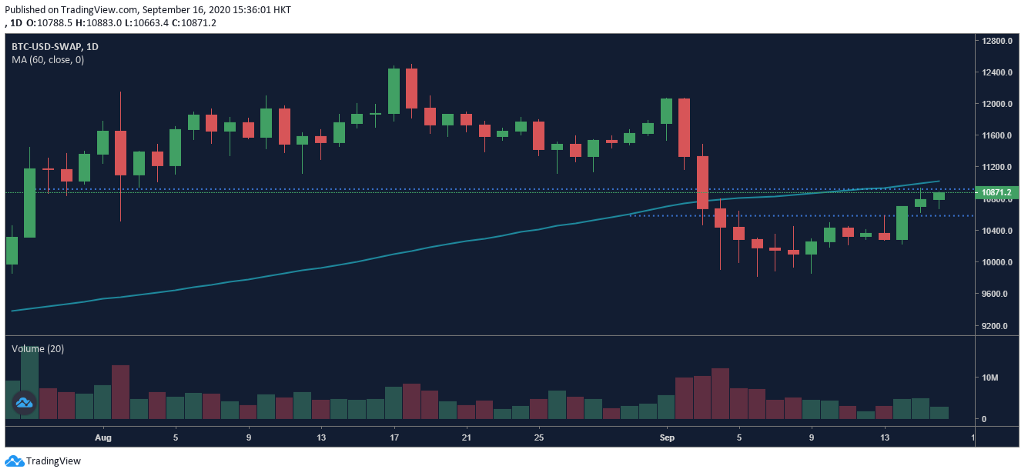

BTC technical analysis

The BTC price has formed support at $10,600 but is running into a significant resistance area near the 60-day moving average. If the support at $10,600 fails, the price could retest $10,200. The intraday threshold is located at $10,750.

While the BTC price is still in a short-term upward pattern, we can see that retail traders are not feeling strong with their longs. The BTC long/short ratio continues to hit new lows and is now at 0.68, possibly the lowest level on record.

Visit https://www.okex.com for the full report.

Not an OKEx trader? Sign up and start trading today!

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

Originally published at https://www.okex.com on September 16, 2020.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.