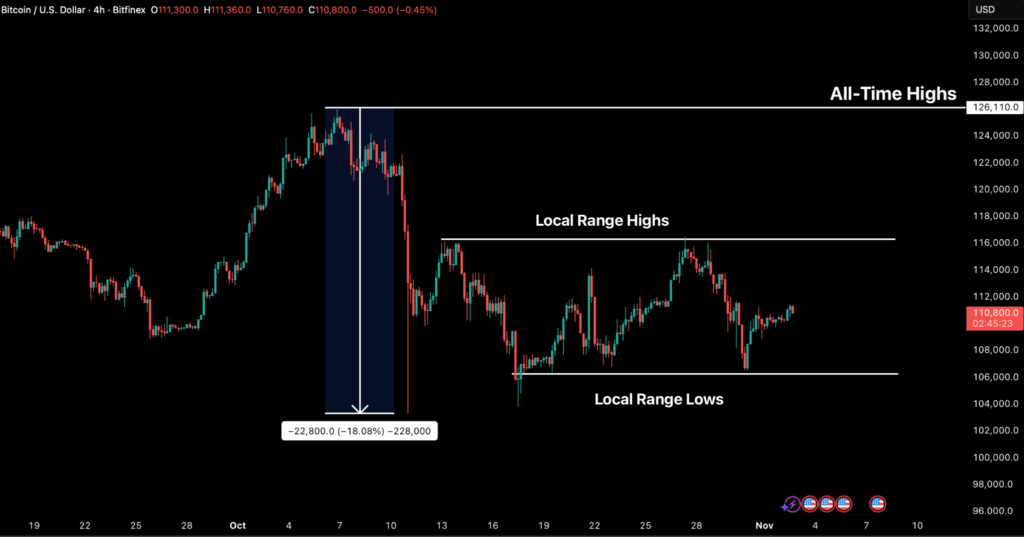

While structural support still remains intact near $106,000, the balance of evidence points to fragility beneath the surface. Analysing the Long-Term Holder Net Position Change metric reveals that this cohort is deeply negative at –104K BTC per month, signalling persistent profit-taking, while the Short-Term Holder Net Unrealised Profit/Loss metric shows waning conviction among recent buyers. Unless ETF inflows or new spot demand returns to absorb ongoing distribution, BTC is likely to remain range-bound, with a risk bias toward retesting the $106,000–$107,000 zone. A sustained break below this level could open the path to $100,000 per BTC, whereas a decisive reclaim above $116,000 would mark the first sign of structural recovery heading into November.

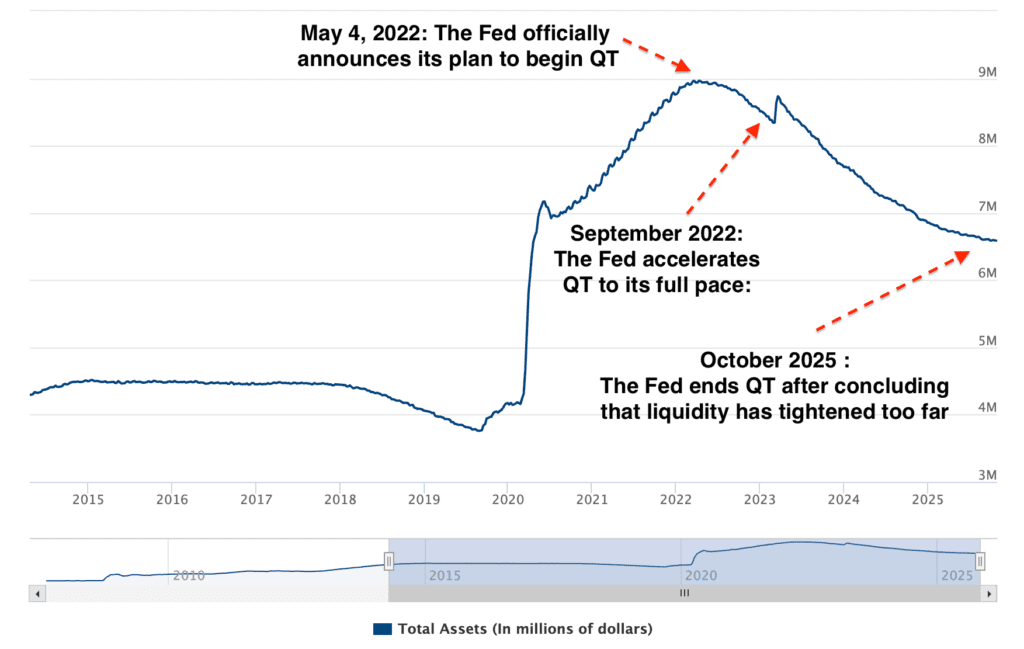

Underpinning the mood in crypto markets is a US economy that is moving into a new stage of policy recalibration as the Federal Reserve shifts from tightening to liquidity management as growth slows and inflation eases.

At its meeting on October 30th, the Federal Open Market Committee ended its balance sheet runoff policy and cut interest rates by 25 basis points to a range of 3.75–4 percent. The move responds to tightening liquidity conditions, as money-market funds pull cash from the Fed’s reverse repo facility to buy Treasury bills, draining reserves from the banking system.

The bond market has been signalling expectations of slower growth and additional rate cuts since the Summer, with 10-year Treasury yields dropping to around 4 percent and 30-year yields to 4.6 percent. More recently, however, the term premium, which is the extra return demanded by bond investors for taking on risk, has turned positive for the first time in years. It reflects the market view that even though recession fears are easing, concerns over fiscal and inflation risks are rising.

The labour market also shows signs of fatigue. According to the Bureau of Labour Statistics, wage growth slowed to 3.7 percent in August from 4.7 percent last year. Consumer confidence has dipped as well: the Conference Board’s index fell to 94.6 in October, reflecting unease among lower- and middle-income households even as equity markets remain strong.

Last Monday, ETHZilla Corporation sold roughly US$40 million in Ether to fund an aggressive share repurchase program, signalling a shift in how crypto-native firms manage treasury assets. By converting part of its ETH holdings into buybacks, ETHZilla aims to narrow the discount between its share price and net asset value, effectively turning its crypto reserves into a corporate finance lever. Just a day later, Western Union entered the crypto arena with the announcement of its US dollar-pegged stablecoin, built on the Solana blockchain in partnership with Anchorage Digital Bank. The launch is indicative of another traditional financial institution modernising cross-border payments by reducing settlement times and costs through blockchain technology. Meanwhile, in Asia, Japan took a bold step toward state-linked crypto integration. Mining hardware producer Canaan revealed a deal with a major Japanese utility to deploy hydro-cooled Avalon A1566HA miners for a grid-stability project. The initiative uses Bitcoin mining to balance renewable energy loads, illustrating how blockchain infrastructure can enhance power grid efficiency rather than strain it.

The post appeared first on Bitfinex blog.