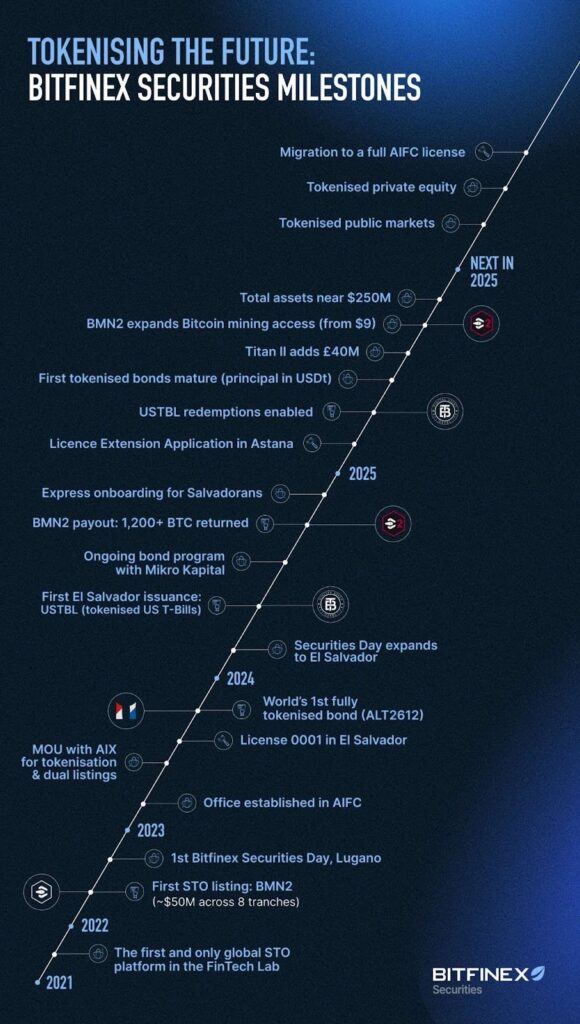

During the event, Bitfinex Securities announced a major step forward in its development by applying to exit the AIFC regulatory sandbox, and transition to a full licence, signalling its readiness to operate under a mature compliance framework. Bitfinex Securities highlighted that it had grown to nearly $250 million in assets under management (AUM) on its platform, a milestone that underscores its growing role in the tokenised securities sector. This move not only reflects Bitfinex Securities’ progress in scaling regulated digital asset markets but also positions it as a key player in the AIFC’s broader vision of fostering innovation and investment in Central Asia’s financial ecosystem.

At the conference, Jesse Knutson, Head of Operations, at Bitfinex Securities spoke on a panel discussing the expansion of tokenised securities, Bitfinex Securities in Astana and El Salvador, and the tokenised offerings on the Bitfinex Securities platform.

He highlighted the long-term vision that initially faced skepticism but is now gaining broader acceptance, as seen by the participation of major global institutions such as BlackRock and Schroders in discussions on digital assets. Knutsen emphasized the significance of Kazakhstan’s AIFC as the firm’s first regulatory home, explaining that the favorable environment motivated them to establish operations there before expanding into El Salvador, where they became the first licensed entity.

Across these jurisdictions, they have facilitated nearly $250 million in tokenised assets, with early products including the Blockstream Mining Note and tokenised U.S. Treasuries. He noted that while initial offerings leaned toward fixed-income products, the coming wave of equity-based tokens will encourage greater trading activity and broaden investor engagement .

Another major highlight of Astana Finance Days was the Bitfinex Securities Networking event, where industry leaders, regulators, and investors were able to meet and build relational bonds for the future.

The announcements and engagements at Astana Finance Days mark an important milestone for Bitfinex Securities, showcasing both its operational growth and its commitment to building a compliant, regulated presence within global financial markets. By advancing toward a full AIFC licence and surpassing $250 million in AUM, the company has demonstrated that tokenised securities are moving from theory to practice, gaining traction as a serious component of modern finance. The discussions led by Jesse Knutson, and the Bitfinex Securities team, and the networking event further reinforced the Bitfinex Securities’ role as a bridge between innovation and institutional adoption.

Looking ahead, Bitfinex Securities’ participation in Astana Finance Days signals more than just its individual progress, it reflects the broader transformation of financial markets in Central Asia and beyond. As regulators, investors, and innovators converge to shape the next era of digital assets, the momentum generated in Astana highlights how tokenisation and blockchain are increasingly central to the global financial conversation. For Bitfinex Securities, this represents both an achievement and an opportunity to continue pioneering the infrastructure for a more open and efficient financial future.

The post appeared first on Bitfinex blog.