Crypto trading 101 - Fear and greed index explained

Learn about the Fear and Greed Index and how it assesses investor sentiment in the cryptocurrency market. Use it as a tool for more informed investment decisions.

What Is the Fear and Greed Index?

The Fear and Greed Index is a tool designed to help you assess investor sentiment in the cryptocurrency market. It provides insights into how emotions can influence the way you value cryptocurrencies.

This index offers you a window into whether cryptocurrencies are reasonably priced at a specific moment. It's calculated daily, weekly, monthly, and yearly, and it operates on the premise that excessive fear can push prices down, while excessive greed can drive prices up.

So, as an investor, you can use this tool to make more informed decisions about your cryptocurrency investments.

How the Fear and Greed Index Works

Investment decisions are often driven by emotions like fear and greed. These emotions can strongly influence when an investor decides to buy or sell cryptocurrencies.

The Fear and Greed Index is a valuable tool that, when used alongside analytical tools, can assist you in evaluating market sentiment.

The Fear and Greed Index is a tool that helps you understand market trends. It works on the idea that fear can lead to cryptocurrencies being undervalued, while greed can drive upward trends. Investors often use this index for investment research or as a way to gauge market timing.

The Fear and Greed Index has a track record of reliably signaling shifts in all financial markets. For example, in September 2008, the equities Fear and Greed Index plummeted to a low of 12 when the S and P 500 hit a three-year low after the Lehman Brothers bankruptcy and the troubles at AIG.

In contrast, the cryptocurrency Fear and Greed Index soared above 95 in February 2021 during the height of the cryptocurrency bull market.

It's essential to understand that while the Fear and Greed Index provides valuable insights, it should not be your sole basis for making investment decisions. Let me break it down further:

Don't Rely Solely on the Index: The Fear and Greed Index is a helpful tool, but it's not infallible. You shouldn't depend entirely on it to decide when to enter or exit the market.

Example from Cryptocurrency: In November 2020, the Fear and Greed Index for cryptocurrencies indicated a high value of 86, suggesting extreme greed in the market. However, the market continued to rise for three more months, experiencing a substantial 250% growth during that period. If you had sold in November solely based on the index, you would have missed out on significant gains.

Market Behavior: The index's reading of "greed" or "fear" doesn't guarantee an immediate reversal in the market. Markets can stay in a state of greed or fear for extended periods, sometimes months. So, if the index indicates "extreme fear," it doesn't mean the market will bounce back immediately; it could take months for a turnaround.

The Fear and Greed Index shares similarities with momentum oscillators like Relative Strength Index (RSI), Money Flow Index (MFI), Stochastics, and Williams %R. These indicators also signal overbought conditions when the market has experienced significant upward movements and oversold conditions when it has seen significant declines.

However, it's crucial to note that, just like with these oscillators, the market can remain overbought or oversold for extended periods. Therefore, you should avoid making decisions based solely on these indicators.

In essence, while these technical indicators provide valuable insights into market momentum and sentiment, they should be used in conjunction with other tools and analyses to make well-rounded investment choices. Relying solely on any single indicator can lead to suboptimal decisions.

The Fear and Greed Index Indicators

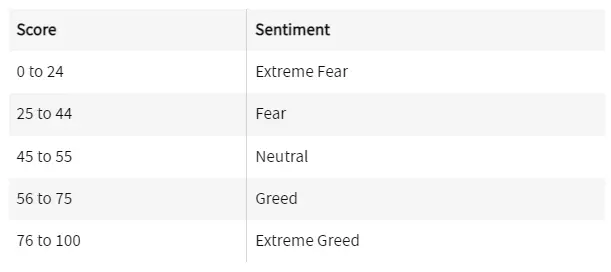

The Fear and Greed Index assesses seven indicators, each rated on a scale from 0 to 100. The index is calculated by averaging these indicators equally. A reading of 50 is considered neutral, while higher numbers indicate greed, and lower numbers indicate fear.

There are various Fear and Greed Indexes available, however the most popular one is one from alternative.

The Crypto Fear and Greed Index from Alternative relies on these inputs:

Price volatility over the past 30 and 90 days

Market volume and momentum

Social media mentions on X platform (formerly Twitter) using coin hashtags

Bitcoin market cap dominance

Google Trends data for Bitcoin-related searches

What Is a Fear & Greed Index?

A Fear and Greed Index is a valuable tool for investors like you to gauge market sentiment and assess whether stocks or cryptocurrencies are reasonably priced.

It's designed on the principle that too much fear can push prices down, while excessive greed can drive them up.

CNN Business has its own index for the stock market, and Alternative.me has created one specifically for the cryptocurrency market.

The Bottom Line

In the tumultuous landscape of cryptocurrencies, the Fear and Greed Index is your guiding light. It deciphers the emotions of fear and greed, offering valuable insights into market sentiment. However, it's essential to use this tool as part of a comprehensive trading strategy, combining it with other analyses for a more well-rounded approach.

And as always, Happy Hopping!