Platform | How To Use Cryptohopper

How to improve your trading experience through relevant features on Cryptohopper, an automated cryptocurrency trading bot.

Automated trading and cryptocurrency trading bots are drawing substantial interest from beginners as well as skilled traders. The rising predominance of digital assets has led traders and investors to seek tools that facilitate an optimum cryptocurrency trading experience and strategy.

In a relatively short span of time, Cryptohopper has achieved the reputation of a reliable cryptocurrency trading robot that provides both novice and expert traders with an array of instruments to guide trading in digital assets.

In this article, we explore the different features available at Cryptohopper and how a trader can use it to their advantage for their preferred strategies.

Cryptohopper: Best Crypto Trading Bot

Cryptohopper provides a unique, secure, reliable, and reputable trading tool that allows users to navigate trading in cryptocurrencies. Basically, Cryptohopper is a trading bot that facilitates automated cryptocurrency trading using advanced ( A.I.) algorithms.

While automated trading is the core of Cryptohopper, a user can access a suite of tools that facilitates a simple, intuitive, and guided experience to buy and sell cryptocurrencies. Users can access thousands of digital currencies, in addition to managing multiple exchange accounts from one interface.

On Cryptohopper, users can easily connect their exchange accounts from prominent cryptocurrency exchange platforms through API integration.

Traders can access their trading bot accounts using any device including desktop, laptop, tablet, and/or smartphone, both online and through the mobile iOS or Android app.

Let’s take a look at how a trader can leverage the features available at Cryptohopper to enable the best trading experience.

Cryptohopper Features

Cryptohopper facilitates an array of different features for automated and semi-automated trading. Moreover, these features can be used for both basic and advanced trading, depending upon a trader’s preference.

Automated Trading

Cryptohopper uses advanced algorithms to constantly monitor cryptocurrency markets and derive potentially profitable trades. A novice trader can access the automated trading features for cryptocurrency trading.

Semi-Automated Trading

An expert trader can access the semi-automated trading tool to enter or exit a trade position by manually defining their parameters. As cryptocurrency markets run 24/7, this feature allows traders to enter or exit at their favorable positions without constantly monitoring cryptocurrency prices.

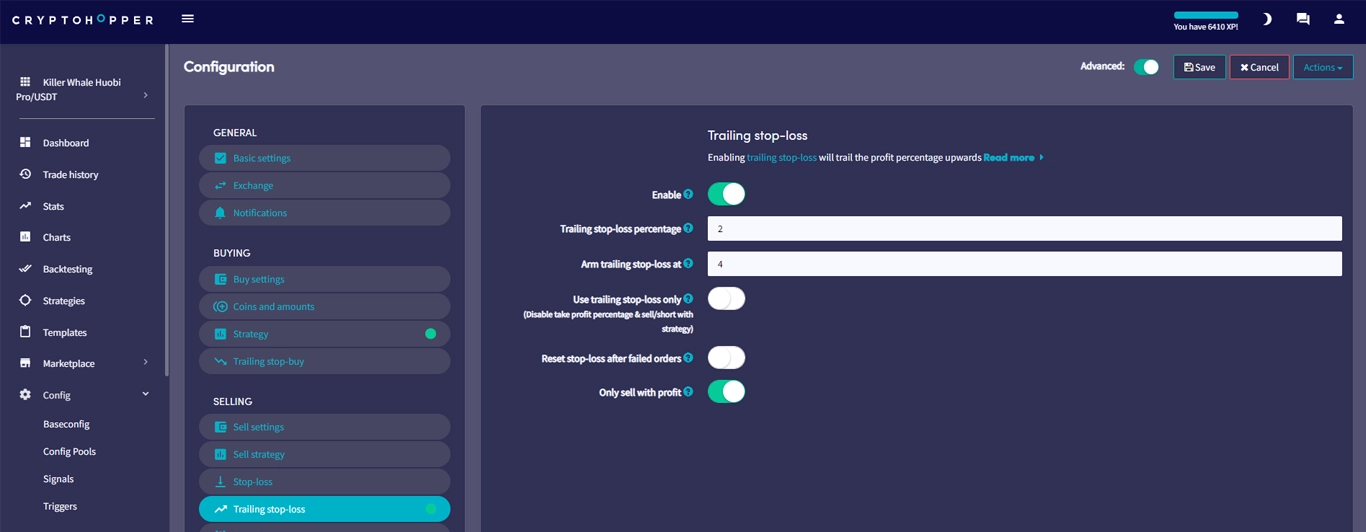

Skilled traders can access features such as trailing stop-loss, take-profit, and stop loss to minimize their losses by setting manual parameters and allowing the trading bot to take automated actions accordingly.

Users can also access different parameters to set buying and selling conditions without having to constantly scan charts or prices. For instance,whilst buying, a trader can use the Trailing-Stop buy (TSB) feature available at Cryptohopper to track the downtrending price of a digital currency, and it will automatically initiate a buy order when the price starts going up.

Mirror Trading

One of the most popular features accessed by traders are the Mirror Trading features. With these features, a beginner can copy the trades of an expert. There are different ways in which these features of copy trading can be used.

Signalers - A trader can subscribe to a Signaler that sends out trading signals which the trading bot uses to automate trading. Alternatively, a trader can semi-copy a signaler by following the same signal but with manual parameters of stop loss and trailing stop loss.

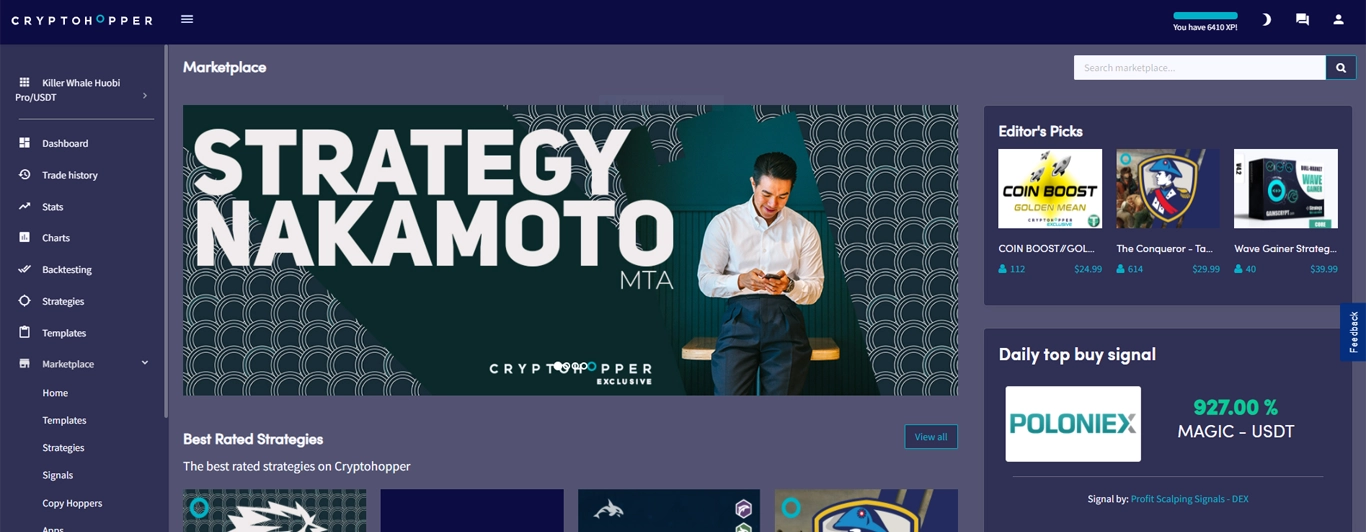

Bot templates - The Cryptohopper marketplace offers a multitude of bot templates for traders to automatically set up their trading. Templates are pre-configured settings for a trading bot to follow. These templates are often accompanied by strategies.

Strategies - The Cryptohopper marketplace offers multiple Strategies that a trader can download in their trading bot. A user can configure their settings of the strategy, that uses technical indicators to analyze and place trade orders. A trader can also backtest this strategy to understand its performance under current market conditions.

Trailing Features

The convenience of trailing features offer an easy experience to open or close a cryptocurrency trade. It constantly tracks the price of digital assets and automatically places an order to maximize the potential for profits.

Trailing Stop-Loss - The Trailing Stop-Loss (TSL) feature adjusts the trailing stop loss when the price of a digital currency is moving upwards. This allows traders to increase their profits by adjusting stop-loss with a trailing percentage.

Trailing Stop-Buy - The Trailing Stop-Buy (TSB) feature tracks the price of a digital currency so a trader can buy at the lowest price. The trading bot automatically initiates an order when the falling price of a digital currency starts moving upwards.

Trailing Stop-Short - The Trailing Stop-Short (TSS) feature is used while shorting the price in the cryptocurrency market. With the TSS feature, the hopper automatically initiates the short position and buys back the same token with reserved funds.

Paper Trading

Cryptohopper offers a paper trading feature that provides a live experience of cryptocurrency trading while practicing strategies and skills without any risks.

A trader can also use the paper-trading option for practicing how specific strategies will perform in the current market conditions without risking the actual capital. Learn how to get started with paper trading.

Exchange Arbitrage

In this feature, the trading bot takes advantage of price differences of the same asset on different exchange platforms due to market inefficiencies.

Traders can simply connect their exchange accounts and allow the trading bot to leverage opportunities through exchange arbitrage. The trading bot buys an asset from one exchange only to sell it on another exchange and take profits from the price difference.

In triangular arbitrage, the trading bot will automatically make three different trades so as to increase the amount of base coin by taking advantage of the price differences between currencies on an exchange platform.

Backtesting

With backtesting, a trader can test their settings, configurations, and strategies so as to analyze their performance under current market conditions.

This tool allows a user to perfect their trading strategies before deploying it on live markets. Cryptocurrency markets constantly change and skilled traders can use this feature to finetune their trades.

Market-Making

Cryptohopper users can access the market making feature to profit from a large spread and/or if a coin does not have enough liquidity.

Cryptohopper offers a simple and intuitive way to create order through drag and drop in the desired place from the order book. It also facilitates automated market-making by changing strategies depending on uptrend or downtrend market conditions.