Important Pro-Tips To Know When Creating An Automated Trading System

In this blog, we will analyze the most critical aspects of an automated trading system. Generally, creating a successful automated trading system is very similar to creating a successful manual trading system. It is essential to have the right strategy and settings for your trading system to be successful.

Lets now dive into creating the right strategy!

Strategy

Your strategy stands at the core of your trading system. Your strategy decides when you will enter the trade and maybe even when you will exit depending on how you set it up.

To find the right strategy for yourself, you need to be aware of who you are and what your preferences are as a trader. Are you someone that wants to see your trading bot buying and selling multiple times in a day, or are you content with trading longer positions a few times a week?

For this example, let’s say that you are someone that prefers to take a few positions a day and prefers to keep them open for a few hours up to one or two days.

Therefore, you will probably look somewhere within the 2 hours to 30 minutes timeframe to time your entry into the market; for our example, we will go with the 1-hour timeframe.

However, before you choose your technical indicators with which you will time the market, it is recommended to jump to a higher timeframe and choose a trend following indicator to determine the broader trend of the market.

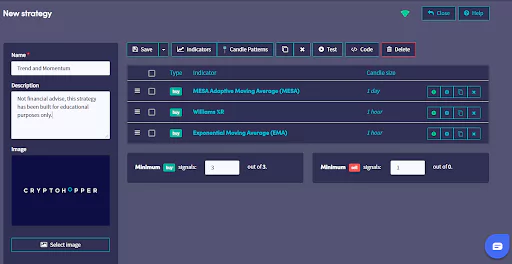

In our example, we will choose the 1-day timeframe and the MESA indicator for this purpose.

The 1-day timeframe is a considerable distance away from the 1-h timeframe, and it can act as a filter, where you only trade when the overall trend is in your favor.

The MESA indicator on Cryptohopper keeps its buy signal or sell signal constantly, which allows it to act as a filter.

Let’s now look at selecting the right entry indicators for you!

For the entry indicators, you must again determine the type of trader that you are. Are you the type which prefers to buy when a coin crashes and is oversold, or when there is strong momentum, or maybe both?

For our example, we will assume that we prefer buying when the price is oversold, but we want some confirmation of momentum (as to not buy a coin when it is dropping, only to have it drop even more).

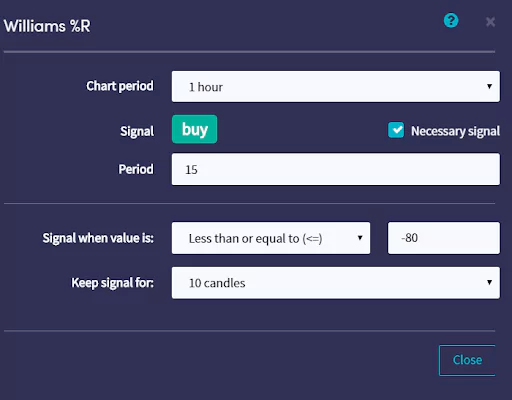

We will use the Williams %R as our indication of when the market is oversold on our specific timeframe.

We will then proceed and use the cross between the 1 and 15 EMA as our confirmation that the momentum is back in our favor.

Let us now proceed to build our example strategy in the strategy section of Cryptohopper!

(This is not financial advise, this strategy has been built for educational purposes only and serving as an example for this blog)

In our example, we have stated that we want to enter a position after William’s %R is oversold, and the crossover between the 1 and 15 EMA takes place. However, these indicators rarely give out signals simultaneously.

We will thus need to enable the option of keeping the signal for up to 10 candles. This option will allow us to enter a position when the EMA crossover takes place even if William’s %R has been oversold 10 candles ago.

Let’s now dive into how you can combine your strategy with the right settings to achieve maximum results!

Settings

The settings are an integral part of your trading system and are just as important as the strategy. Having the wrong settings may make your system unprofitable, or can even lead to substantial losses if the appropriate risk management is absent.

Most professional traders recommend a risk-reward ratio of at least 1:2. This ratio means that for every dollar that you risk, you have the potential of gaining at least 2 dollars. For our example, let’s be even more conservative and choose a 1:4 ratio. We can set-up our take profit target at 15% and our stop loss at 3.7%.

To increase our winning percentage, we can also set-up a trailing stop loss. For more information on what a trailing stop loss is, you can read our documentation about it here.

We will set up our trailing stop loss to arm (activate) at 7% as that is double than the risk we have taken by entering a position in the first place. We can then set-up our trailing stop loss percentage to trigger at 2%.

With this system, we know that we will gain at least 5% per profitable trade, which should be more than enough to cover the fees of any exchange.

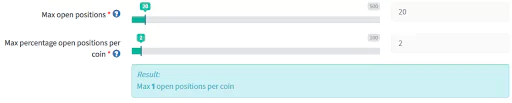

Our strategy is currently pretty loose, as the signal from the indicator William’s %R is being kept for 10 candles. We may, therefore, end up with a lot of positions and funds directed toward a single currency. To limit the risk of this occurring, we need to either limit the open positions to 1, set-up a cool-down option, or to have a low percentage buy amount to account for the multiple open positions. In our example, we will combat this risk by limiting the open positions to 1.

(You can set up your open positions per coin in your config/baseconfig/buy settings) (These settings are not financial advice, they have been built to serve as an example for this blog)

Finally, let’s now view how our strategy looks like on the char together with the settings we have chosen:

Conclusion

A sound trading system consists of a good strategy + the appropriate settings for your strategy. One without the other would not work. As previously mentioned, this strategy and its settings are not financial advice and have been created for educational purposes only.

You may use this strategy as an example to create your own.

All of the indicators, settings, and features that have been used in this blog are available at Cryptohopper. Join us today and create your own successful automated trading system!