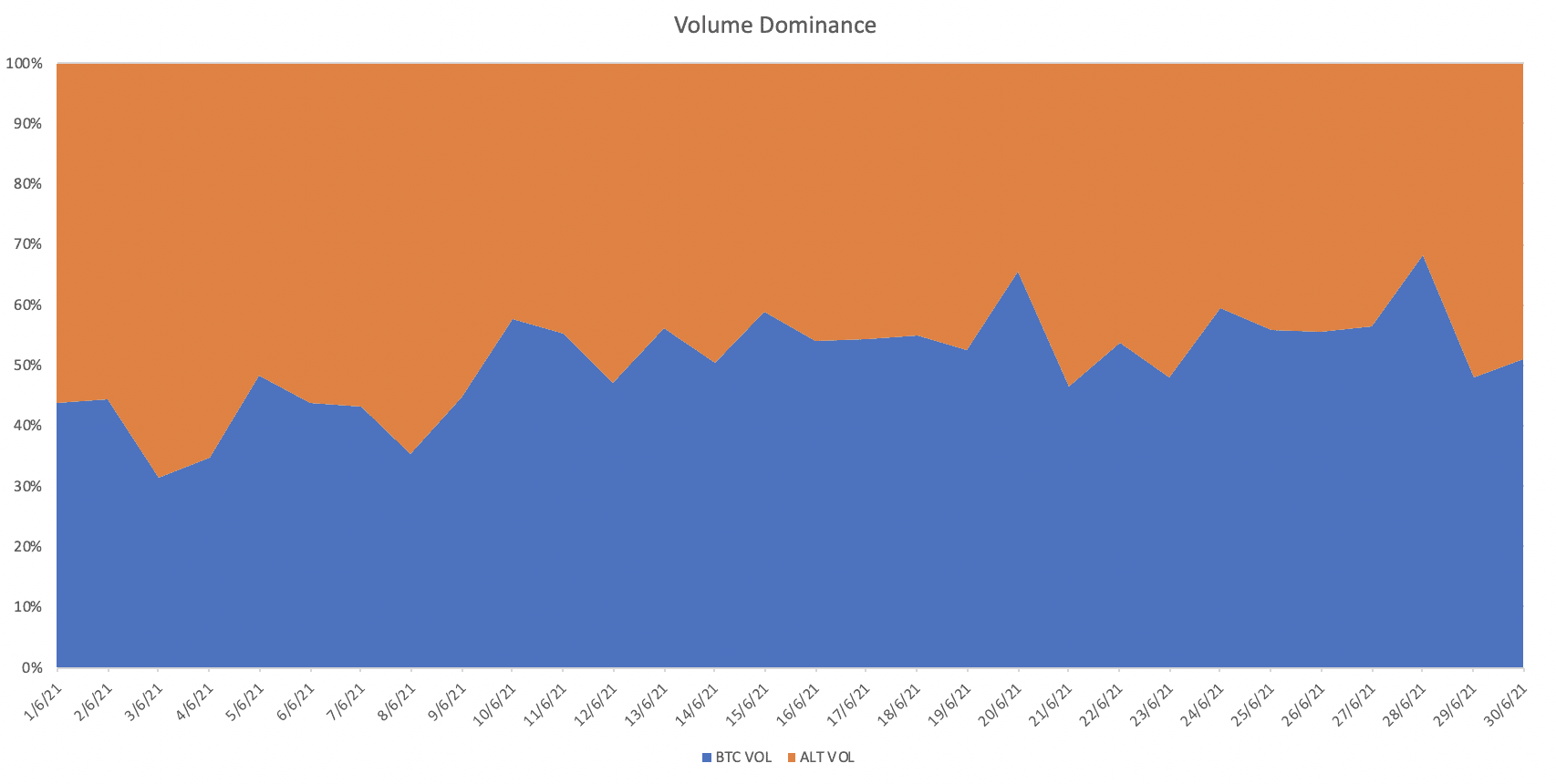

Bitcoin’s volume dominance climbed to 50% by the end of June, in line with the recent surge in the BTC dominance index.

The first half of 2021 concluded with Bitcoin (BTC) gaining just over 20% — one of its weakest first-half performances since 2018. In previous years, the bellwether cryptocurrency saw gains of 27% and 187% in the first halves of 2020 and 2019, respectively.

In June, Bitcoin had fallen nearly 6% to $34,200 on June 30th, posting its third consecutive losing month. The 10,776 cryptocurrencies tracked by the website CoinMarketCap had a combined market value of $1.4 trillion as of June 30th, down 12.5% from May.

Although June’s decline was not as devastating as the one from May, most investors are still shaken by their losses from May 19th and remained unconvinced about Bitcoin's short-term prospects.

Despite the gloom and uncertainty, Bitcoin had scored a historic win following news that El Salvador had officially adopted Bitcoin as legal tender. The Latin-American nation also announced that it would be giving away $30 worth of Bitcoin to every citizen via e-wallet.

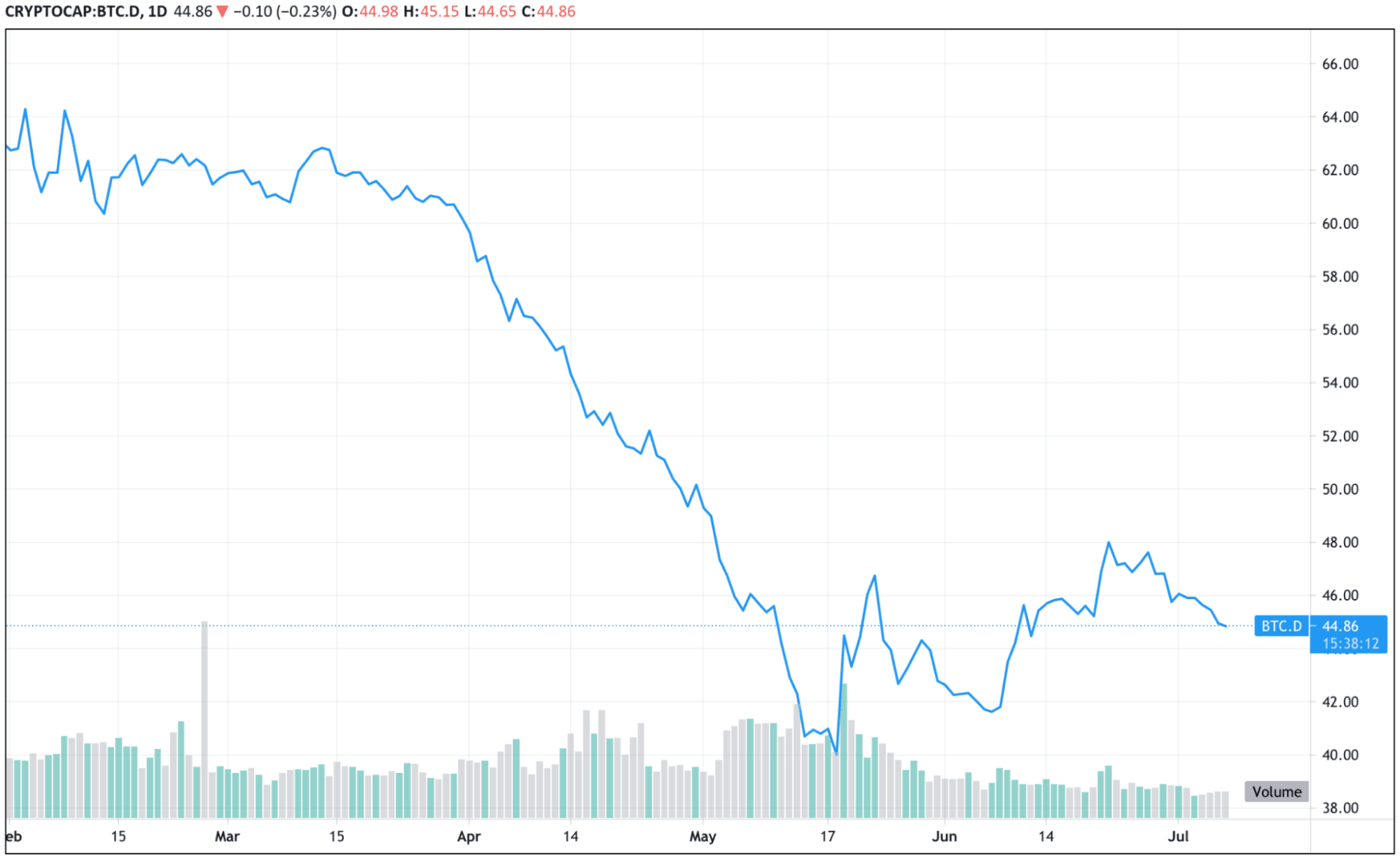

Source: Tradingview

The BTC dominance index gained 7% in June, hitting as high as 48.2% at one point despite the broad-based decline. Since the collapse of May 19th, the index, which measures Bitcoin's market value compared to the entire crypto market, has regained value, owing to altcoins' considerable underperformance amid the current downturn.

Most altcoins underperformed Bitcoin in the month of June. For instance, Ethereum, the second-largest cryptocurrency by market capitalization, registered a double-digit loss of near 16% in June, shedding over $50 billion in market value.

The month’s highlight came when Skybridge Capital founder Anthony Scaramucci revealed his company's plan to create a $25 million private Ethereum fund, a companion to the $25 million Skybridge Bitcoin fund. Additionally, the company also stated ambitions to pursue an Ethereum ETF; they previously applied for a Bitcoin ETF.

Even though ETH's recovery has been mediocre, investors remain optimistic about ETH's future as the London hard fork comes near. As previously said, there are a number of upcoming Ethereum improvements that may redirect ETH on a higher trajectory. ETH 2.0 is scheduled to go out later this year, and it will result in substantial enhancements to the network. By implementing these changes, we would see increased transaction speed and cheaper transaction costs. And as such, the network would become more accessible to users who could not previously afford to use it. This increased capacity will help to strengthen Ethereum's ecosystem and in turn, the demand for ETH tokens.

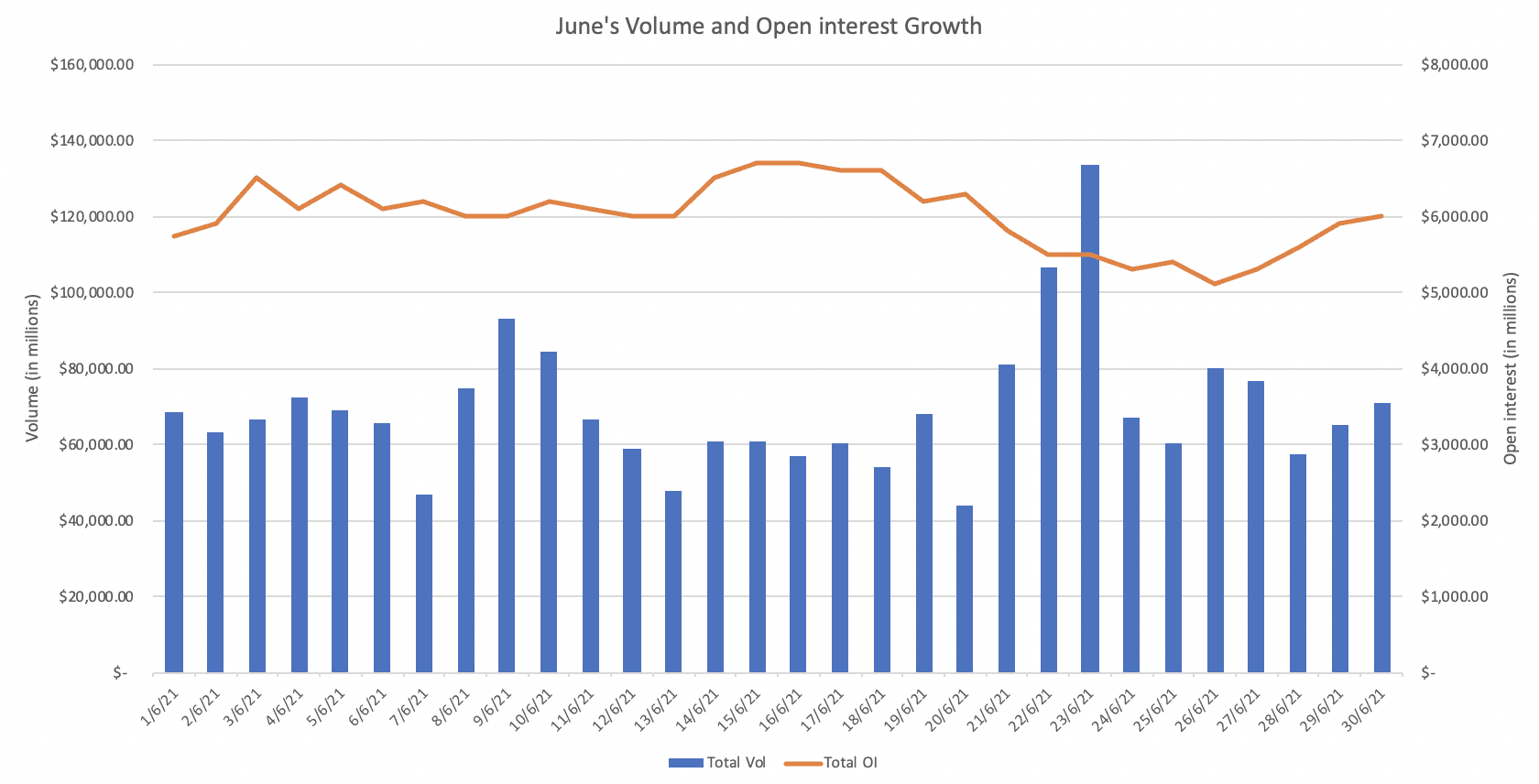

Crypto volatility and volume had contracted significantly in June, and as a result, trading volume on derivatives exchanges declined in tandem. Binance Futures monthly volume declined 33% to over $2 trillion in June. On June 22nd, trading activity on Binance Futures saw a substantial surge with 24-hour volumes surpassing $130 billion as Bitcoin and altcoins ground new lows.

Source: Binance Futures

Meanwhile, open interest in Binance remained unchanged. Open interest trended down from June 19th to 26th in tandem with the broad-based decline in crypto prices but subsequently recovered as prices stabilized.

Without surprise, Bitcoin’s volume dominance surged and climbed to 50% by the end of June. This observation is in line with the recent surge in the BTC dominance index. Since the crash of May 19, traders have turned their attention towards the bellwether cryptocurrency to capitalize on its increased volatility.

Source: Binance Futures

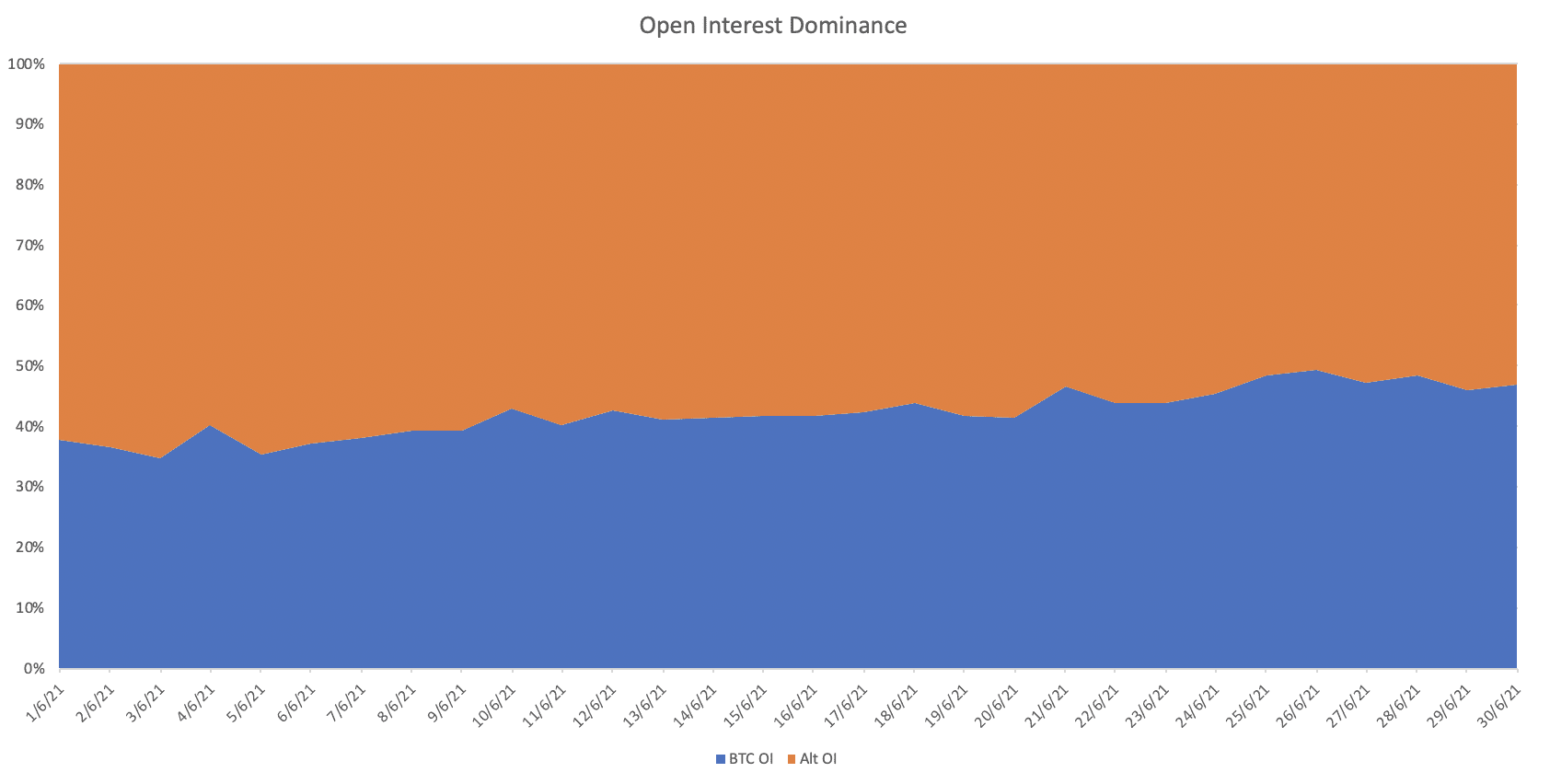

Bitcoin’s open interest dominance steadily grew from under 40% to 50% in tandem with volume trends, suggesting that traders are positioning long-term directional bets on Bitcoin.

Source: Binance Futures

Will Bitcoin break out of range soon?

Despite the depressed prices, many investors remain optimistic about the long-term prospects of cryptocurrencies as fundamentals continue to grow. For instance, Bitcoin’s exchange-held supply has been gradually decreasing since mid-May, indicating that the market sell-off has subsided. According to crypto analytics firm Santiment, the current supply on exchanges based on the percentage of the total supply saw a new six-month low, falling from 14.3% to just 13%. The lack of Bitcoin in exchanges means there cannot be any major sell-offs like the ones already seen this year.

Investors are also watching macroeconomic developments for clues about Bitcoin's future trajectory. Since the pandemic-induced crisis, the devaluation of the US Dollar has been a significant driver of Bitcoin's growth. However, the recent surge in the value of the US dollar has pushed risk assets downwards, particularly cryptocurrencies. Any signs of continuation in the Dollar's decline will set off the next wave of growth for digital assets like Bitcoin.

Furthermore, one might argue that the current downturn could provide more opportunities to acquire more crypto assets at cheaper prices. In these circumstances, Dollar-Cost-Averaging may be the best way to invest, in which you invest a small and fixed amount every month, say $1,000, in a cryptocurrency of your liking regardless of how bleak the headlines are.