You may have heard the term “cross margin” in the context of perpetual futures. In this context, the user’s margin, or assets used as collateral, are shared across their positions in order to mitigate liquidation. This is in contrast to isolated margin mode. In isolated margin mode, each position uses isolated margin, or collateral, which cannot be used across other positions.

The main difference between cross margin mode and isolated margin mode is that cross margin mode allows you to use your total margin balance to support several positions, while isolated margin mode limits how you can use that margin. Cross margin mode has the potential to maximize gains, but it also carries greater risks as a result. Isolated margin mode offers more control over risk as it allows you to set separate margin levels for different positions.

So, essentially…

Cross Margin Mode: Cross margin positions share the same assets which can help keep positions open amid market volatility. Margin level is determined using the value of your collateral assets and the value of the debt in your account. Should the value of your account reach the maintenance margin level, liquidation can happen, and your margin balance as well as any remaining open positions may be forfeited through liquidation.

But what, then, is cross margin mode for spot trading?

Cross margin for spot trading

Cross margin mode for spot trading is essentially the same thing. A trader can borrow an asset against collateralized assets to put on a leveraged margin position. Compared with the isolated margin model, a user’s margin and profit & loss under cross margin can offset different positions, improve the utilization rate of funds, and reduce the risk of liquidation.

For example, Alex uses USDT as margin, and borrows ETH and BTC to buy more USDT (Alex is shorting ETH and BTC). After borrowing the currencies, ETH falls and BTC rises. If these positions were in isolated margin mode, due to the rise of BTC, the risk of liquidation would increase. However, in cross margin mode, the rise in value of ETH (an unrealized profit) and the decline in value of BTC (an unrealized loss) offset each other, so the risk of liquidation is reduced.

Margin, for the uninitiated, refers to the funds a user puts up as collateral to support a leveraged trading position and reduce counterparty credit risk.

Advantages and risks

Margin trading offers users the ability to leverage their capital to increase their buying (or shorting) power and their profit potential. This can be especially beneficial for traders with smaller trading capital. As the amount of capital used increases, so goes the amount of profits that can be earned.

However, this potential for increased profitability also comes with increased risk. As more capital is used to borrow for a margin position, more of it is subject to fluctuating market prices and potential losses. Additionally, traders must be aware of their margin levels and how those compare to margin calls and maintenance margin requirements. Otherwise, the system could trigger forced liquidations before the trader has the time to top up their collateral, potentially leading to premature losses on the position. It is also important to remain mindful of the current state of the market and of unexpected market movements, as these can also lead to losses and reduced profits.

Auto-Borrow & Repay

Poloniex’s cross margin feature comes with an “Auto-Borrow” feature. After the user turns on the “Auto-Borrow” button on the trade page, they can initiate a loan when trading, transferring, or withdrawing coins. The user’s maximum borrowable amount will be determined according to the overall margin rate of the user’s spot account.

As for the “repay” capability, every time a user trades, transfers or recharges a currency, the asset will be used to automatically repay the loan, avoiding additional interest burdens on the user.

What tokens will be supported as margin assets?

Poloniex will support USDT, BTC, ETH and TRX as marginable and borrowable assets at first. We will consider adding to that list in the future to give traders even more options when using cross-margin mode.

How to use cross margin mode

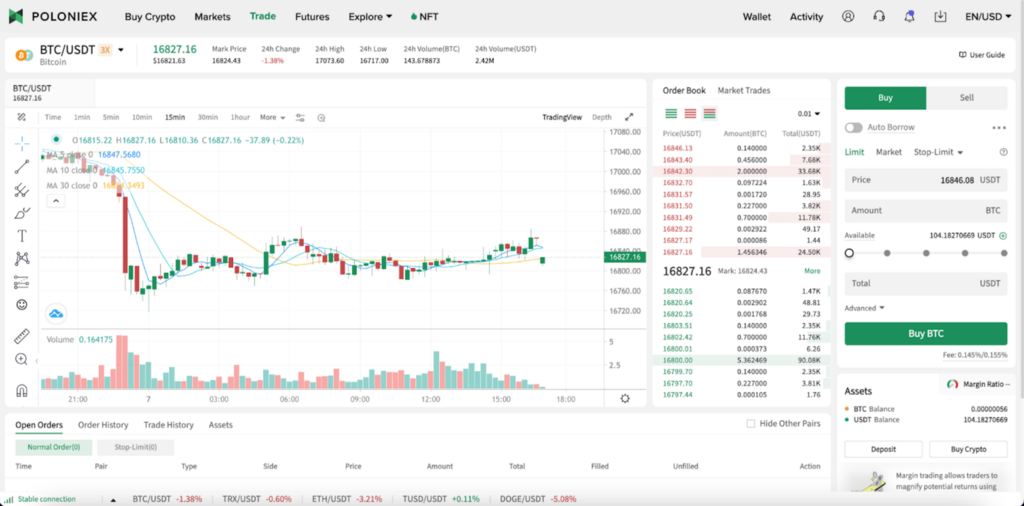

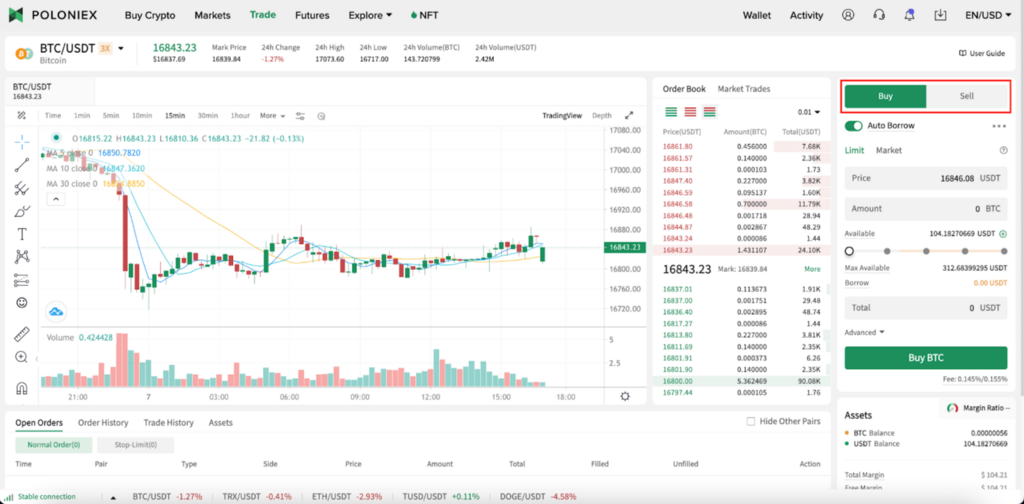

1. Open the Trading Interface

Log in to your Poloniex account, then click the [Trade] button on the navigation bar at the top of the page to enter the trading interface:

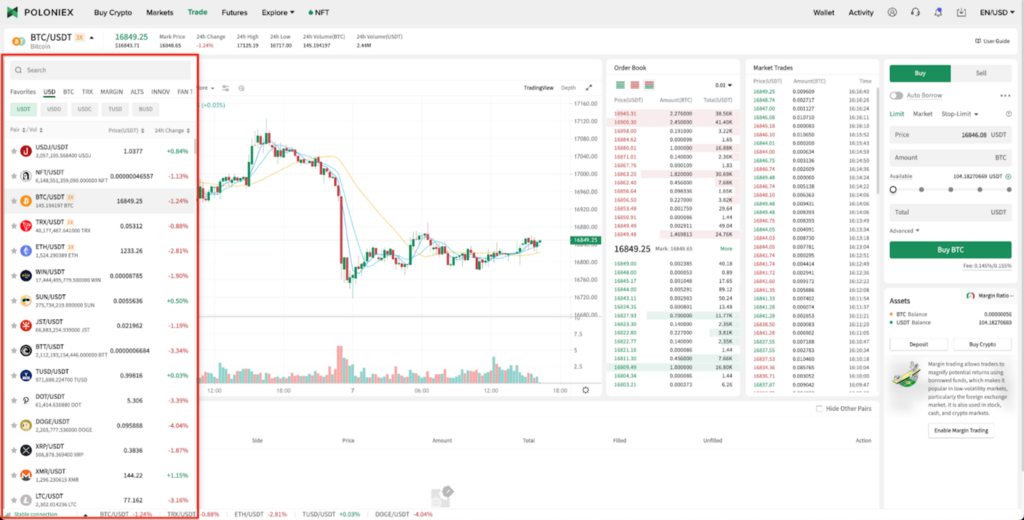

2. Choose a Trading pair

After entering the trading page, select a leveraged trading pair on the left to view the latest price and trades (take BTC/USDT as an example).

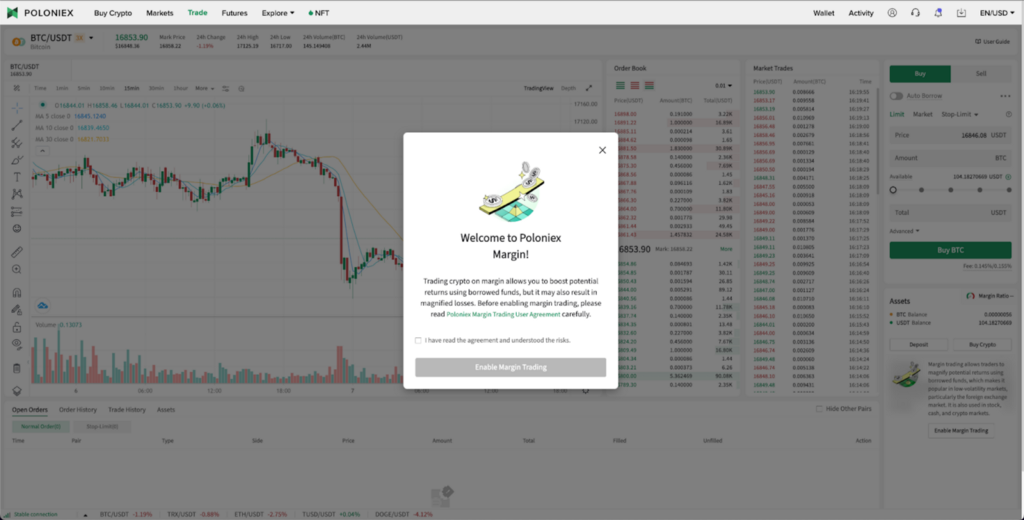

3. Enable Cross Margin mode access by clicking on the corresponding button in the pane on the right-hand side of the trading screen.

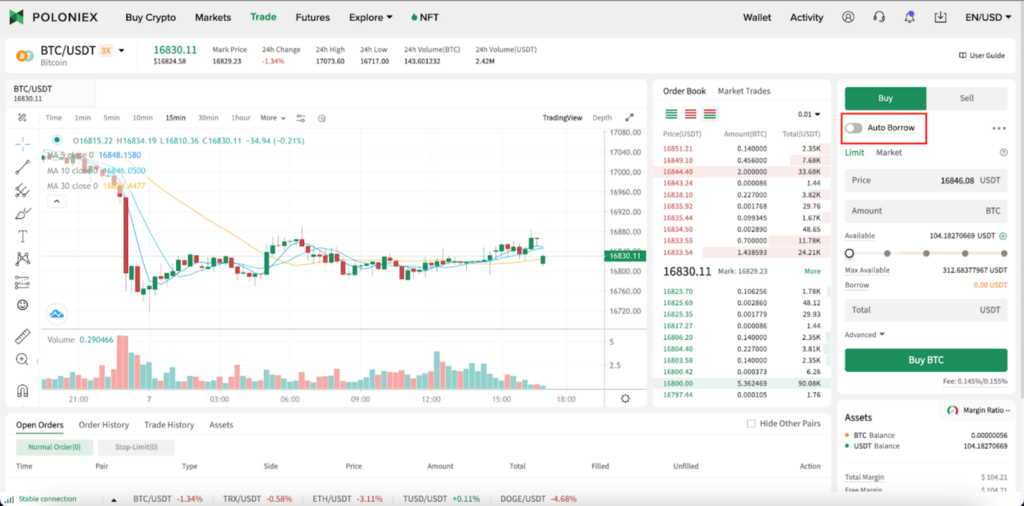

4. Turn on automatic borrowing

Click the [Auto Borrow] button to toggle the leveraged trading mode. You can use borrowing to increase your trading position.

5. Submit your order

Click [Buy] to go long or [Sell] to go short! You can set the buying/selling price and the coin amount to suit your needs.

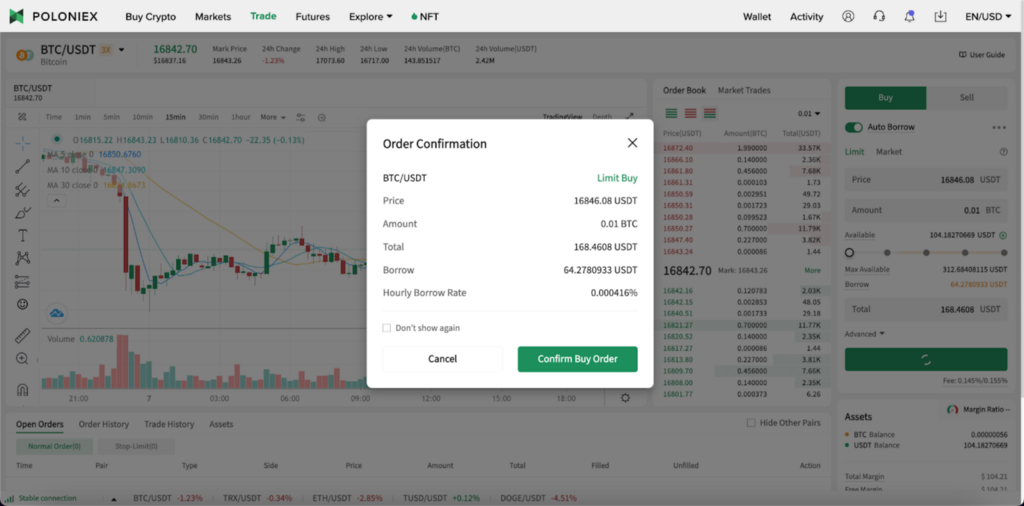

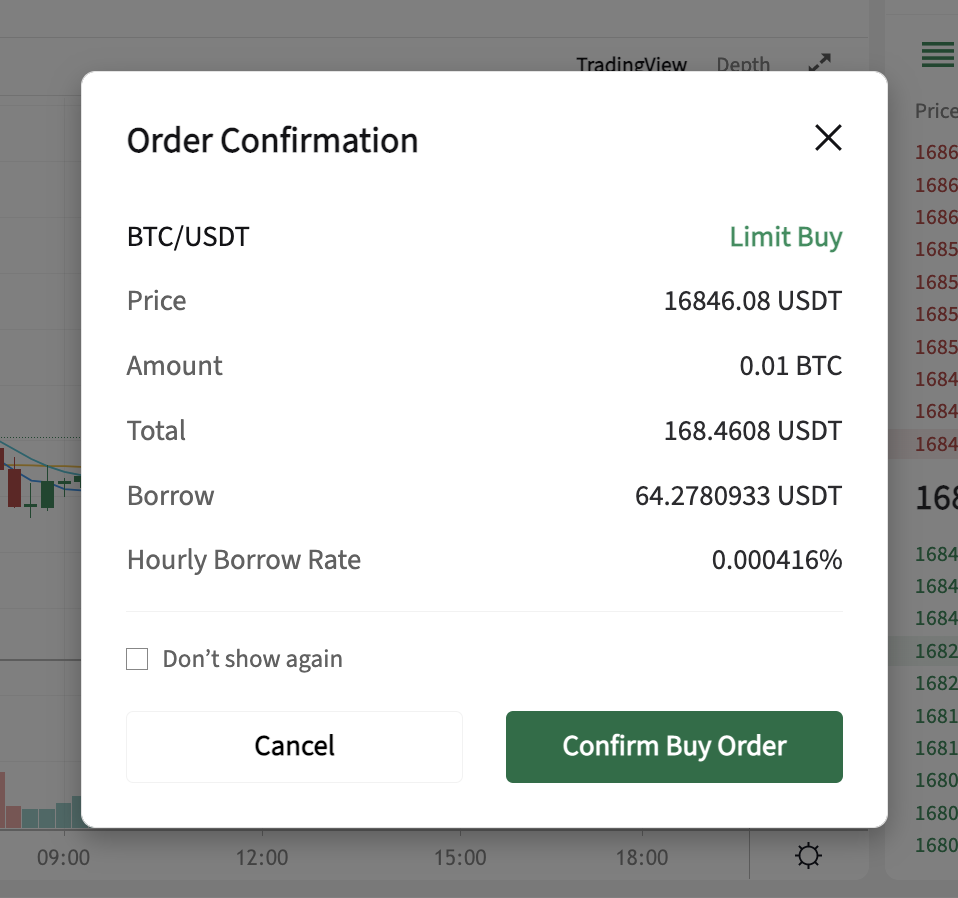

6. Confirm your order

After confirming that the order price and quantity are correct, click [Buy] or [Sell].

That’s it! Below we have some other features you can use to keep track and manage your orders👇

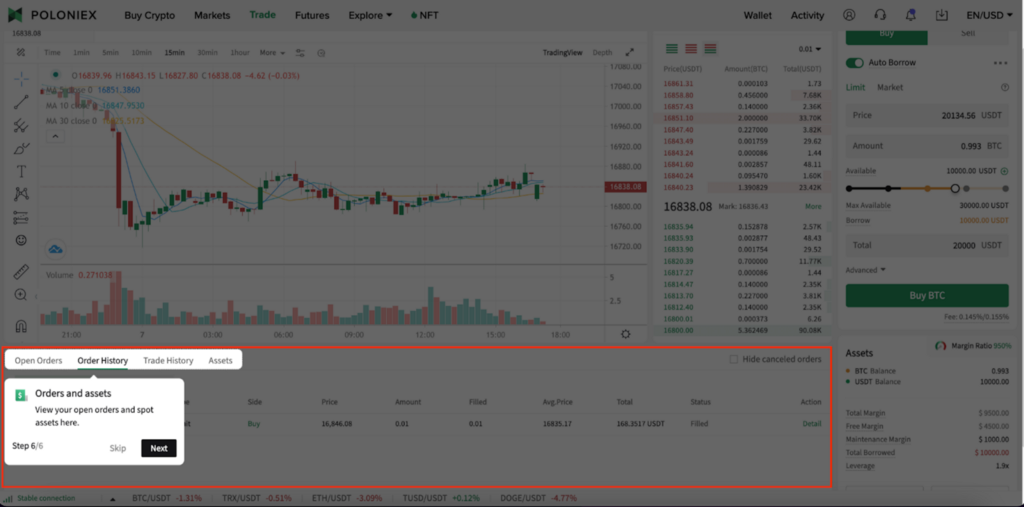

Check your orders

After the order is successfully placed, you can check the status of the pending order in the “Order History” section at the bottom of the transaction page. Here, you can also click [Cancel] next to the current order to cancel it.

View margin ratio

After using cross margin mode to borrow money, you can check the margin ratio as well as other risk related information here. Liquidation will affect margin assets.

How to avoid liquidation (recharging/repaying debts)

When the margin ratio is too low, it can be increased by upping the margin collateral or repaying the debt. The margin currency will have a “Margin” label on the asset page. Any increase in the asset value of this type of currency will increase the margin ratio. You can also query the currency that belongs to the margin asset through the “margin asset list”.

The method of repaying debt includes recharging or buying the currency of the debt. If the currency acquired in the transaction already has a debt during the transaction, the transaction result will be used to repay the debt first.

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.