TL;DR

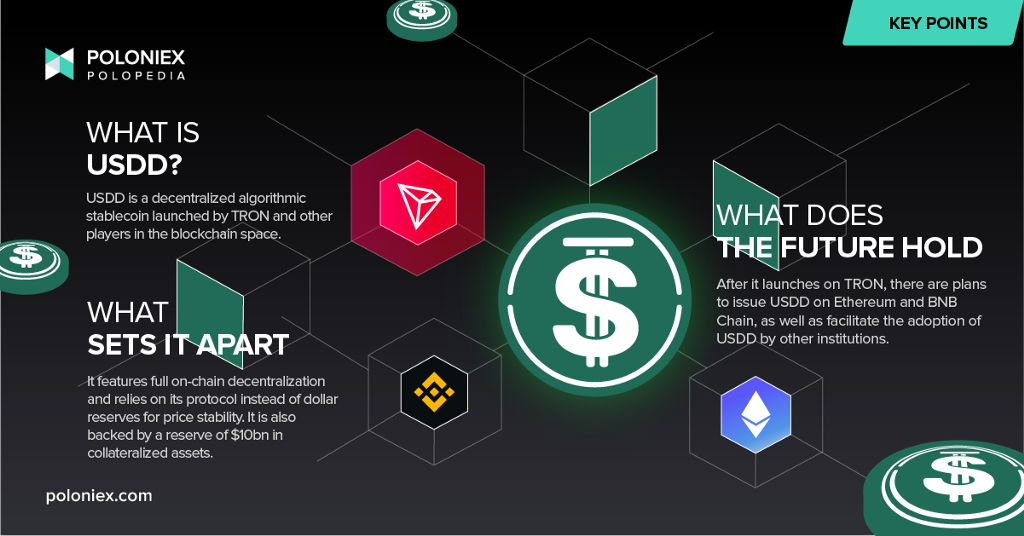

USDD, TRON’s forthcoming completely decentralized stablecoin, has generated buzz for being the most decentralized stablecoin to date, being that its 1:1 value with the US dollar is not based on reserves held by centralized institutions but rather is pegged to USD and utilizes algorithms to maintain price stability.

A new era of stablecoin

In an open letter published on April 21, 2022 by TRON founder H.E. Justin Sun, USDD is described as bringing about era 3 of stablecoins which is characterized by complete decentralization and the end of reliance on centralized institutions to ensure price stability. To understand what is meant by the term “Stablecoin era 3.0” as termed in the open letter, one should consider this era’s context, especially in relation to TRON:

Era 1.0 is the first iteration of stablecoin application, where USDT, one of the first stablecoins, was built on Bitcoin’s network using the Omni Layer. Although revolutionary at the time, this stablecoin technology suffered from very low throughput because of its deployment on Bitcoin’s network, meaning it took a long time to transfer USDT. Furthermore, handling fees were exorbitant by today’s standards, and of course the US dollar reserves that were pegged to USDT were managed by centralized institutions.

Era 2.0 is described as the “TRON-based USDT 2.0 era” in Sun’s open letter, where an independent decentralized layer on the TRON network handles transactions. With higher throughput came less time for transfer and lower handling fees, but of course reserves and general custodianship remained centralized.

Now, with era 3.0 and a decentralized algorithmic stablecoin, on-chain algorithms are used to control volatility, people will have access to a stablecoin that has achieved complete decentralization.

USDD’s Price Stability

USDD is a decentralized stablecoin, so no centralized institutions control the reserves that ensure the stablecoin’s price. Instead, USDD’s 1:1 value with the US dollar is ensured by algorithms and the use of what are called Super Representatives. In its early stages, TRON DAO Reserve will act as a custodian, backing the USDD in circulation with a reserve of $10 billion in collateralized assets. This serves TRON’s vision of a decentralized financial system, as this removes a huge centralized component of earlier stablecoin iterations.

The Use of Super Representatives

Basically a smaller, decentralized network of block validators, Super Representatives in TRON’s network are tasked with providing price oracling for USDD. They do this by voting on what they believe the current exchange rate of USDD to be, and because, by nature, they maintain a large stake of TRX, they have a vested interest to accurately quote pricing.

They absorb price volatility in the short term, but are economically incentivized in the long term via fee rewards from token swaps.

TRX and exchange mechanisms to hedge against short-term price fluctuations

TRX (or Tronix), TRON’s native token, is used as the base currency that prices USDD. TRX is essentially USDD’s safeguard against price fluctuations.

Another feature is that USDD offers users the ability to exchange USDD for TRX. When USDD’s price is lower than 1USD, users and arbitrageurs can send 1USDD to the system in order to receive 1USD worth of TRX. On the flip side, when USDD is valued higher than 1 US dollar, users and arbitrageurs can send 1USD worth of TRX to receive 1 USDD.

Rewards

In order to incentivize Super Representatives over the long-term, USDD employs two types of rewards- the Tobin Tax and the Spreading Fee.

Tobin Tax: The Tobin Tax is essentially a fixed fee rate for stablecoin swaps in USDD’s protocol. However, this won’t be in effect until more stablecoins are present the protocol.

Spreading Fee: A minimum .5% spreading fee is applied to TRX/USDD swaps.

The Future of USDD

In the open letter, Sun mentioned that USDD’s development is split into 4 stages: 1.0 Space, 2.0 ISS, 3.0 Moon, and 4.0 Mars.

USDD will launch on TRON’s network on May 5, 2022 with an initial total supply of 66,560,006.61 on TRON. USDD will also be launching on Ethereum and BNB Chain blockchains through the BitTorrent Chain (BTTC) cross-chain solution. As of stage 4.0 Mars, USDD will also have its own Mainnet.

For more information on USDD and its stages of development, you can check out the USDD whitepaper.

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.