Technical Analysis 101 | Trade the Ichimoku Cloud Like a Pro

Just with a single look at the chart, the Ichimoku Cloud helps you to pinpoint what the current trend is. But not only that, in this blog we will explore all the different ways in which you can profit from this interesting indicator. Trend reversals, supports and resistances are the main factors that the indicator can easily spot.

Ichimoku Cloud (also known as Ichimoku Kinko Hyo) was initially created by the journalist Goichi Hosoda in the 30s. However, this innovative indicator wouldn't be published until 1969, after years of research and improvements. Nowadays, many traders, ranging from professionals to amateurs, are profiting from including the Ichimoku Cloud in their trading strategies. With Cryptohopper, you can be the next one doing it.

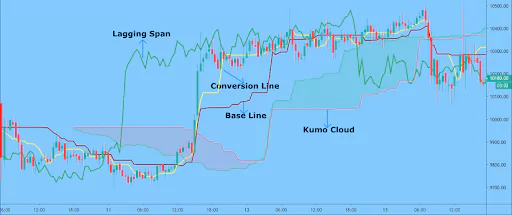

The Ichimoku cloud especially includes trend components, but it also measures the momentum of the price. The cloud has four components that are formed by 5 different moving averages. The 4 components are:

Conversion line: this is a short-term moving average. Its stepped shape helps to detect short-term supports and resistances.

Base line: this is a medium-term moving average. It serves to spot the current trend and its stepped shape helps to detect medium-term supports and resistances. Some traders use the “Base line” as a trailing stop loss

Lagging span: this is created by plotting the current closing prices 26 periods in the past. It is designed to allow traders to visualize the relationship between current and past trends. When the Lagging span is above the price, the price is considered strong and it is expected to increase. When the Lagging span is below the price, the price is considered weak and it is expected to decrease.

Kumo cloud: And, of course, the cloud. It’s the most unique aspect of the Ichimoku cloud. It is defined by two lines, the Span A (green line) and Span B (red line). The cloud acts as a major area of support and resistance based on price action. The longer the price lies above the cloud, the stronger the trend is. The wider the cloud, the stronger the expected support and resistance. You should avoid trading inside the cloud as much as possible.

As you can see, many are the components that form the Ichimoku Cloud, and many are the different ways in which you can profit from it. In the next section, we are going to dive deeper into the most used trading strategies involving this indicator.

Ichimoku trading strategies

There are many interesting ways in which the Ichimoku Cloud can be used in trading. Today we will analyze the 4 main ones. These are: the Kumo Cloud breakout; crossover of the Conversion Line and Base Line (with either the Lagging Span or the Kumo Cloud as a filter); and the Kumo Cloud crossover.

Kumo Cloud breakout

The most common and widely used strategy is the Komo cloud breakout. This strategy is implemented in Cryptohopper, so you can easily automate it just by selecting the Ichimoku Cloud in your strategy. When trading the Kumo Cloud breakout, a buy signal is given when the price breaks the Kumo Cloud upwards. Likewise, a sell signal is given when the price breaks the Kumo Cloud downwards

Crossover of: Conversion line - Base line (with “Lagging Span” as the filter)

A buy signal will be given when the “Conversion Line” crosses the “Base Line” upwards but only if the Lagging Span indicates a bullish bias (if the lagging span is above the price).

A sell signal will be given when the “Conversion Line” crosses the “Base Line” downwards but only if the Lagging Span indicates a bearish bias (if the lagging span is above the price).

Crossover of: Conversion line - Base line (with “Kumo Cloud” as the filter)

A buy signal will be given when the “Conversion Line” crosses the “Base Line” upwards but only if it is above the Kumo Cloud. A sell signal will be given when the “Conversion Line” crosses the “Base Line” downwards but only if it is below the Kumo Cloud.

Kumo Cloud cross-over

It involves buying when the cloud is green and selling when the cloud turns red. When the Span A crosses above the Span B and the price is above the cloud a buy signal is generated.

When the Span A crosses below the Span B and the price is below the cloud a sell signal is generated.

Improved and perfected for over 30 years, the Ichimoku Cloud has become a very popular technical indicator among amateurs and professional traders.

Now, you can easily profit from it. On Cryptohopper, you can use the most popular Ichimoku strategy, the Kumo Cloud breakout, by simply going to the section Strategy and selecting this indicator from the list.

You can include this indicator in your strategy to generate both buy and sell signals in your hopper when you are working, working out or just buying groceries.