SushiSwap pushing strong USDT demand in China

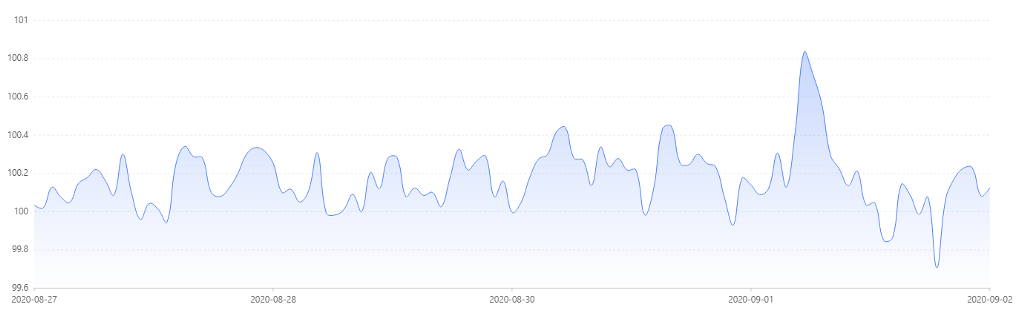

Tether (USDT) saw strong market demand in the Chinese over-the-counter market recently. The USDT OTC index by ChaiNext is calculated based on the over-the-counter price of USDT and the offshore RMB/USD exchange rate. The index reached 100.8 at one point on Sept. 1, meaning that USDT was traded at a premium, where 100 USDT equaled $100.8. At the time of writing, the index stands at $100.33.

The USDT premium traded in the Chinese market is driven by the DeFi hype. SushiSwap, a fork of automated market maker Uniswap, is the hottest DeFi project among the Chinese community, with over $1.2 billion locked in, to date.

Key takeaways

The massive interest in SushiSwap can partly be explained by the “fear of missing out,” especially due to limited understanding of the DeFi space. ARPA’s DeFi survey, published in July, indicated that only 25% of the Chinese crypto community understood and used DeFi protocols such as lending.

Market participants should be mindful of the security risks in SushiSwap’s unaudited smart contract.

Top Chinese state banks push for DCEP testing

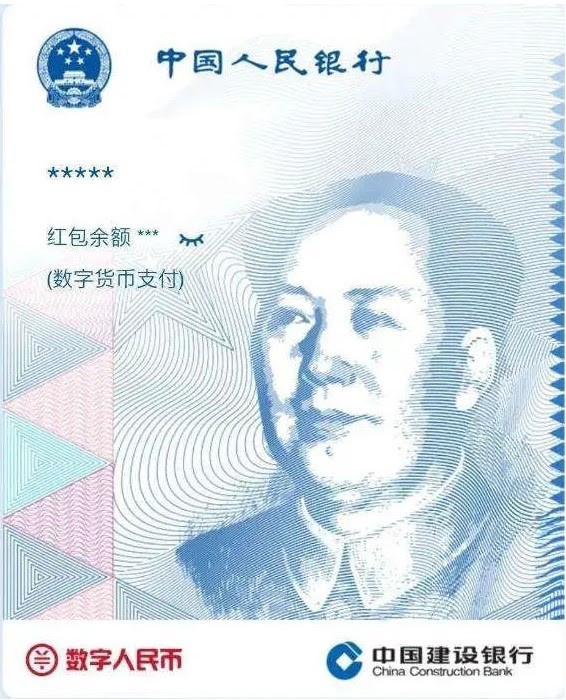

The China Construction Bank and the Industrial and Commercial Bank of China — two of the top four Chinese state banks — are pushing to adopt the country’s official digital currency system, the digital currency electronic payment, or DCEP.

On Aug. 28, the CCB launched a trial for an online digital currency wallet on its mobile application, enabling users to convert their fiat currencies into digital RMB. However, the bank disabled the digital wallet the next day, stressing that the testing does not imply the launch of DCEP.

On the other hand, ICBC recently announced the issuance of digital credit cards, allowing users to activate digital currency services by linking the service to their cards. However, service activation does not mean that users can spend digital currencies now.

Key takeaways

The CCB is not the first Chinese bank to test the Chinese digital currency wallet. Another top-four Chinese state bank, the Agricultural bank, launched internal testing of a DCEP wallet in April.

The top four Chinese state banks — including the CCB, ICBC, the Agricultural Bank and Bank of China — reportedly tested DCEP for payments and transfers among their internal employees in August.

Mining rigs maker Canaan Inc. reported net losses in Q2 2020

Canaan Inc., the first Bitcoin mining rig manufacturer listed on the Nasdaq stock exchange, released its unaudited financial results for Q2 2020.

According to the report, the company saw a net loss of 16.8 million RMB ($2.4 million) in Q2, an improvement from the 39.9 million RMB the company lost in the previous quarter. The mining rig manufacturer has improved its operational and sales performance in Q2, with gross profit improved by 17.1x and total computing power sold nearly tripled, at 2.6 million Thash/s.

Key takeaways

As the first Bitcoin mining rig manufacturer listed on the Nasdaq in November 2019, Canaan Inc.’s share price, currently at $2.01, has dropped 85% from its [initial public offering price](https://www.prnewswire.com/news-releases/canaan-inc-announces-pricing-of-initial-public-offering-300962865.html#:~:text=(Nasdaq%3A%20CAN)%20(%22,total%20offering%20size%20of%20US) of $9.

Canaan Inc. has been reporting net losses since 2019, but the latest quarter has seen some improvements. CEO Zhang Nangeng attributed this to the enhancement of Canaan’s research and development capabilities and the execution of the company’s AI initiatives.

Canaan has declined to forecast its business performance in the near future due to the uncertainties brought by COVID-19.

Visit https://www.okex.com/ for the full report.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.