After rising to dizzying heights in 2017, the price of Bitcoin ( BTC) suffered a prolonged bearish spell, trading below $4,000 between December 2018 and March 2019. However, cryptocurrency prices rebounded in the second half of 2019, and BTC was trading above $10,000 at the start of 2020 — that is, until it again fell below $4,000 in March this year.

Specifically, it was on March 12 dubbed “Black Thursday” (though the crash spanned March 12–13 in Europe and Asia) that both traditional and crypto markets suddenly plummeted due to a panic-induced sell-off sparked by the rising number of COVID-19 cases. With the magnitude of the pandemic suddenly coming into focus in the United States, U.S. stock markets underwent their largest single-day decline in about 30 years.

While traditional markets somewhat recovered the next day, Bitcoin and the crypto space continued to drop, with the price of the leading digital currency losing around 50% by March 13. However, those who might have been lucky enough to have invested in the market at the bottom of the March crash had the potential to realize significant gains in November when Bitcoin’s price touched nearly $19,400.

That being said, the reality of Bitcoin’s unpredictability is evident in the price action since Nov. 25, when the concept for this article was first fleshed out. Bitcoin was near its all-time high at the time, but it has since undergone a major correction and is trading at above $17,000 at the time of writing. This latest drop appears to be fueled by apprehensions surrounding a potential regulatory crackdown on cryptocurrencies in the U.S. While it is unclear how soon the leading digital asset will recover, it appears that a short- to mid-term top was seen on Nov. 24–25.

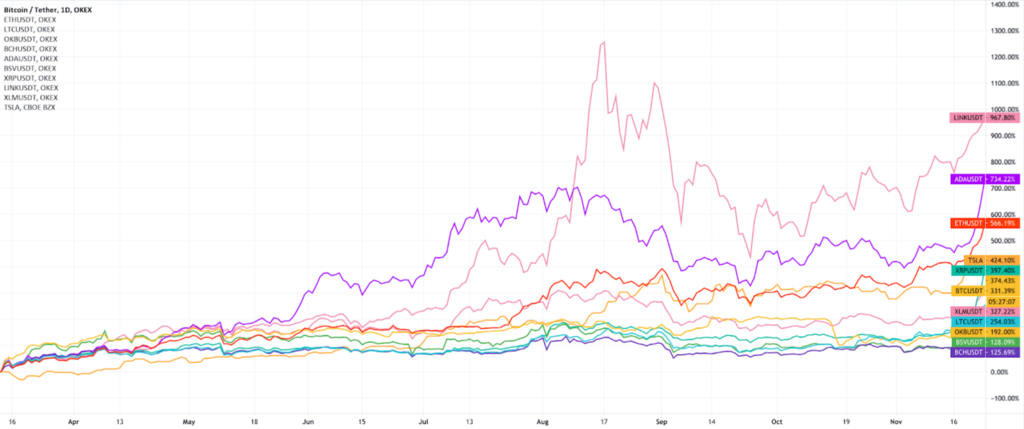

This current correction also gives us a complete cycle to analyze, so we decided to do a comparison of the potential returns that $1,000 invested in various traditional and crypto assets on March 13 would have brought, if sold on Nov. 24.

For this report, we looked at the top 10 crypto assets ranked in terms of their market cap on OKEx, as well as our platform token, OKB. Meanwhile, from the traditional side, we included gold, Tesla’s stock (TSLA) and global stock indexes like the Nasdaq 100 (listed in the U.S.), the Nikkei 225 (listed in Japan) and the FTSE 100 (listed in the United Kingdom). We discuss BTC’s performance first, then altcoins and conclude with traditional assets.

Even though buying at the bottom and selling at the top is the way to realize maximum gains, for this comparison, we will assume that market participants bought $1,000 worth of the listed assets at their lowest prices on March 13, and sold them at their lowest prices on Nov. 24 (as opposed to their highest, opening or closing prices). This retrospective method results in calculating gains that would have been relatively more realistic to achieve, as opposed to those that would have required the improbability of perfectly timing the market.

Bitcoin (BTC/USDT) saw a roughly 374% return on investment

Bitcoin made a comeback this year on the heels of institutional interest, retail adoption and large-scale buying by companies like Square, MicroStrategy and, recently, PayPal. While the leading digital currency is undergoing a correction at the time of writing, it posted its recent highest green candle on Nov. 24, with a high of roughly $19,380 and a low of $17,990, as per the OKEx BTC/USDT market.

An investment of $1,000 in Bitcoin when it traded at roughly $3,792 on March 13, would have gotten you around 0.2637 BTC, which was worth roughly $4,744 at its lowest point on Nov. 24 — adding up to a gain of 374.43%.

While these figures are still relatively unheard of in traditional markets, Bitcoin is far from being the highest performer among crypto and traditional markets, as we’ll see below.

Top altcoins saw up to a 967% return on investment

Even though Bitcoin is the market leader, and has been touted as the best-performing investment of the previous decade, it was easily outperformed by top altcoins over the March 13-Nov. 24 range. This is due to several reasons, including the altcoins’ accessibility in terms of price per coin and the resultant suitability for speculation. However, in order to exclude extremely volatile and easily manipulable coins, we are only considering the top cryptocurrencies in terms of market capitalization.

Chainlink (LINK), Ada (ADA), Ether (ETH) lead the pack

LINK was the altcoin leader, with a massive 967% gain, but was closely followed by Cardano’s Ada (ADA) and Ethereum’s Ether (ETH) — with increases of 734% and 566%, respectively. LINK’s stellar performance was partly due to the boom of decentralized finance and the hype surrounding blockchain oracles — and partly due to its strong community and growing user base.

$1,000 invested in LINK at the lowest point of the Black Thursday crash stood at a whopping $10,670 at the lowest price seen on Nov. 24 — nearly $6,000 more than the gains of an equal investment in BTC.

The same amount of USD put into ADA or ETH back in March was worth $8,340 and $6,660 on Nov. 24, respectively.

ADA, despite being a slow-moving project, is backed by a team that commands respect in the space. As investors generally seek to hold full coins — as opposed to a fraction of a coin — relatively “cheap” coins are more attractive and are purchased in higher volumes, often translating into significant gains during general crypto rallies. As such, ADA benefited greatly from being the cheapest of the top coins.

ETH also benefited from the DeFi hype but appreciated more recently due to the approaching upgrade to Ethereum 2.0. The major network upgrade will introduce a proof-of-stake consensus mechanism that requires a minimum of 32 ETH to participate and earn rewards. This naturally encourages investors looking to participate in the new ecosystem to accumulate ETH.

Visit https://www.okex.com/ for the full report.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.