Coinbase Ventures (or “Ventures”) has grown into one of the most active VC investors in crypto by deal count. In Q3, Ventures made a record 49 investments, averaging a new deal every ~1.8 days. This is up from 28 investments made in Q2, and 24 in Q1. As of Q3 2021, the Ventures portfolio size stands at over 200+ companies and projects.

On a cumulative basis, 90% of the capital invested by Ventures has been deployed in 2021 YTD, reflecting the accelerated pace of Coinbase Ventures in its fourth year of operation. 50% of the new unique “logos” in the portfolio have also come in 2021.

Motivation & philosophy

Coinbase Ventures primary mandate is to support the growing crypto ecosystem. As such, we invest broadly across the space in strong entrepreneurs driving crypto forward. We want the crypto ecosystem to bloom and are not focused exclusively on specific outcomes (as is typical with corporate venture capital).

Ultimately, we see crypto as a rising tide, and growth in the ecosystem lifts all boats — Coinbase included. Traditional strategic benefits, such as commercial partnerships and potential M&A, are great, but we view them as icing on the cake.

Investment Categories

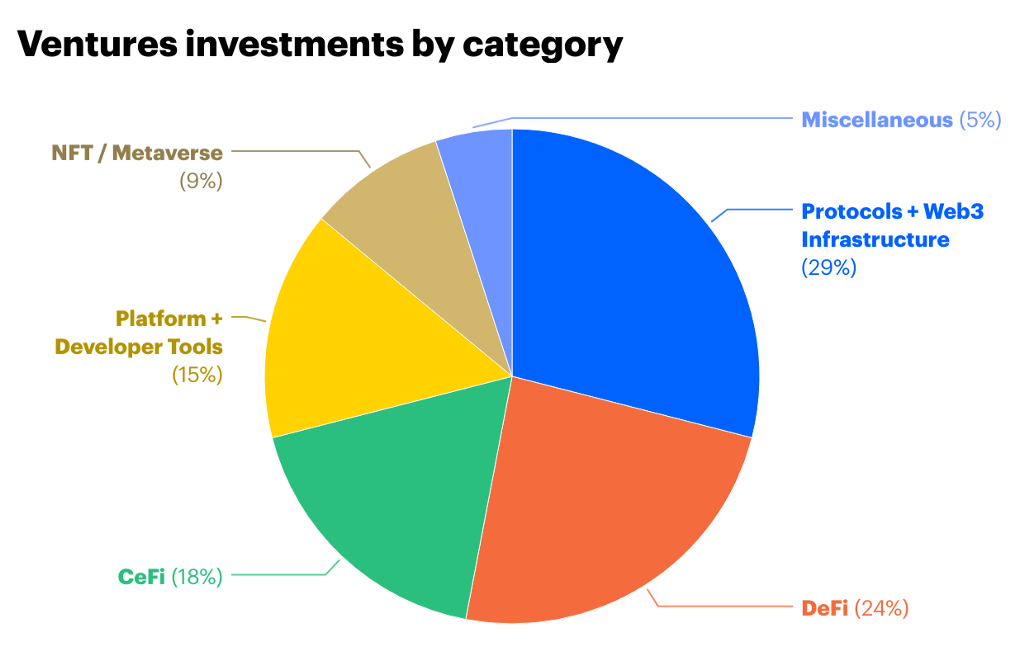

Coinbase Ventures investments range from six-figure seed deals to multi-million dollar growth rounds. There are many ways to slice our investments, but at the highest level we break down the market across the following categories: Protocols + Web3 infrastructure, DeFi, CeFi, Platform + Developer Tools, NFT / Metaverse, and Miscellaneous.

Our current distribution of total investments by company is as follows:

Key Themes & Learnings

*Coinbase Ventures portfolio company

In our most active quarter to date, we saw heavy development across centralized finance (CeFi) in the United States, Layer-1/Layer-2, cross-chain protocols, as well as Web3 tooling. Here’s some of the major themes we observed.

Regulators and centralized players waded deeper into the crypto waters

Regulatory bodies made their presence more widely known in Q3, as the SEC and Treasury Department in the US, and the Financial Action Task Force (FATF) internationally, all stepped up engagement across the crypto ecosystem. This has introduced some forms of regulatory risk for early stage protocols and teams. On the flip side, the largest cap asset scored positive tailwinds in the form of the BTC Futures ETF approval which we believe will allow latent capital to enter crypto markets, leading to significant volumes, inflows, and interest.

Web 2.0 companies like Square, Twitter, Stripe, and Tik Tok also expanded their crypto strategies in Q3. Square announced a Bitcoin based platform for financial services, Twitter revealed future BTC Lightning and NFT integrations, and Stripe announced its return to crypto with a new dedicated crypto team. Tik Tok announced a partnership with ImmutableX\* to launch a creator-led NFT collection.

Meanwhile, banks, fintechs, and broker dealers moved to further integrate crypto into their product offerings, enabled by Coinbase Prime, Coinbase Cloud and other third party platforms. All in all, the crypto industry made tremendous strides with respect to maturation and institutional adoption over the quarter.

The multichain ecosystem hit its stride

Following years of development on solutions designed to alleviate bottlenecks on Ethereum, scaling is finally here with a range of Layer-1 and Layer-2 ecosystems taking off. The majority of the current traction is on solutions leveraging EVM (Ethereum Virtual Machine) compatibility, allowing users and developers to migrate to new environments with relatively low switching costs. Users can access EVM compatible L1s like Avalanche, or sidechains/L2s like Polygon*/Arbitrum*/Optimism* with their existing wallets. Solidity smart contracts can also be generally copy + pasted to any EVM compatible L1/L2, which has led to implementations of popular DeFi applications across multiple chains.

As CeFi exchanges have been slow to integrate with these new L1s/L2s, we saw traction across newly launched cross-chain bridges. These bridges facilitated the movement of billions in funds from Ethereum to various L1s/L2s.

While EVM compatible applications written in Solidity saw the most traction on L1s and L2s in Q3, other ecosystems are bringing more expressive programmability to the table. New primitives focused on more familiar programming languages like Rust (Solana, Polkadot), Golang (Cosmos), and Move (Facebook Diem*, Flow*) may usher in a wave of new Web 2.0 developers to the industry.

Better Web3 UX is on the way

In Q3 we saw further development of Web3 tooling that will simplify the experience of Web3 interactions. XMTP\* is spearheading a messaging standard across Web3 addresses. Spruce\* is standardizing “OAuth” (open authorization), which will allow users to securely share digital credentials, private files, and sensitive media with Web 3 applications. Snapshot\* is making it simple to access governance forums and decisions across Dapps.

Meanwhile, a tremendous amount of work is being done to create added security for Web3 applications. OpenZeppelin’s decentralization effort, Forta*, is making progress on real-time security monitoring of smart contracts with the goal of providing more transparency around smart contract code execution, detection of bugs, and eventually, the prevention of hacks in real-time. Similarly, Certik\* is providing a “fast-and-easy” automated audit tool to help Dapps go-to-market more quickly.

Simultaneously, the DAO tech stack continues to evolve, with the technical and legal formation of on-chain communities beginning to take hold. Syndicate\* (among others) aims to be the “AngelList of crypto” through the creation of a decentralized investing protocol and social network.

NFT 2.0 & crypto gaming took flight

Q3 also saw a ton of development focused on NFT creator tools that will ultimately broaden the scope of NFT use cases and audiences while creating new social features.

Meanwhile, NFT based gaming continued to accelerate led by Axie Infinity, as its play-to-earn model took hold in emerging markets (Philippines, Brazil, India among others) attracting 2M DAUs and generating over $2B in revenue. Loot Project also captivated the industry by introducing an inverted model for game development. This was done by first releasing NFT based game assets to the public in order to bootstrap a community and incentivize further development.

Stay Tuned

Stayed tuned for more insights and updates from the Coinbase Ventures team in the future. Also check out previous editions of Around The Block that you may have missed:

was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.