Over the last 5 years, crypto markets saw very large returns due in part to adoption by institutional and retail investors, and the laying of the foundations of web3.

Whereas crypto markets were originally uncorrelated to the financial markets, the correlation has risen sharply since 2020. Thus, the market expects crypto assets to become more and more intertwined with the rest of the financial system .

Nowadays, the risk profile of crypto markets is similar to those of oil prices and technology stocks.

The recent decline in crypto markets can be attributed for ⅔ to worsening macro-factors, and for ⅓ to a weakening of the outlook for cryptocurrencies.

Introduction

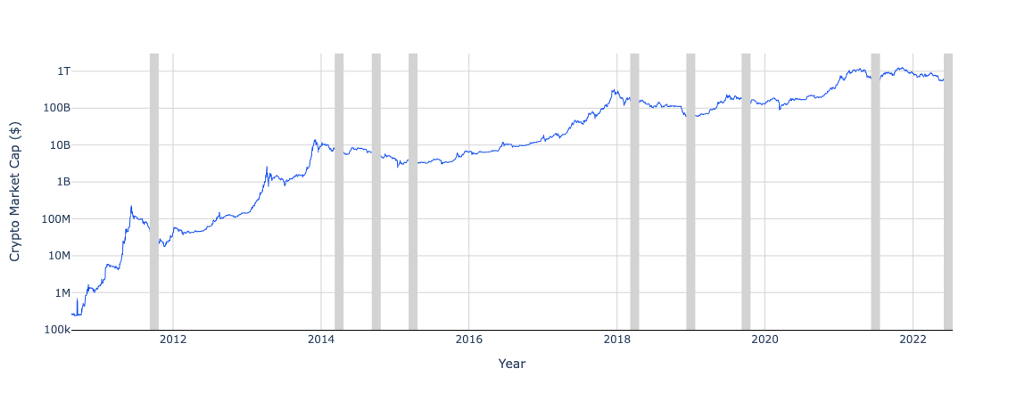

Over the last eight months, the market capitalization of all cryptocurrencies went from a peak of $2.9T to a current level of less than $1T, a decline of over two thirds. This is not unusual in crypto markets: Since 2010, total crypto market capitalization experienced a quarterly decline of 20% or more (a typical measure of bear market conditions) nine times.

Each time a sharp decline in crypto prices occurs, media and expert commentaries usually take one of two forms:

(i) the “Crypto is dead” response, where crypto is painted as a gigantic Ponzi scheme fueled by the desire not to be left out of great returns (Fear of Missing Out, or FOMO in short) followed by anxiety and despair when prices decline (Fear, Uncertainty, and Doubt, or FUD in short). The price drop is the sign that the bubble bursted, and we should run for the exits before prices go down to zero.

(ii) the “HODL” response, where crypto is seen as a groundbreaking technology. Crypto winters and summers are a feature, not a bug, of disruptive innovations, like national banks in the early 18th century, railways in the mid 19th century, and the internet and artificial intelligence in the late 20th century. We should hold and ride through the volatility, as crypto prices will resume their rise in the near future.

However, neither of these explain both the historical trends we have seen in crypto and how we are seeing the correlation with overall stock markets today. But there is a third way to interpret changes in prices, the “market efficiency” response, where prices are a reflection of the market’s assessment of the future prospects of digital assets.

Market Efficiency

Examining the crypto markets based on an understanding of market efficiency can help us interpret the data. For example:

From June 2017 to June 2022, crypto market cap rose 860%, indicating that the outlook about cryptocurrencies today is much brighter than it was back then: The adoption by institutional and retail investors, and the laying of the foundations of web3(i.e., decentralized finance applications, non-fungible tokens, decentralized identity solutions, tokenization of real assets, and decentralized autonomous organizations) were part of the reason for these exceptional returns.

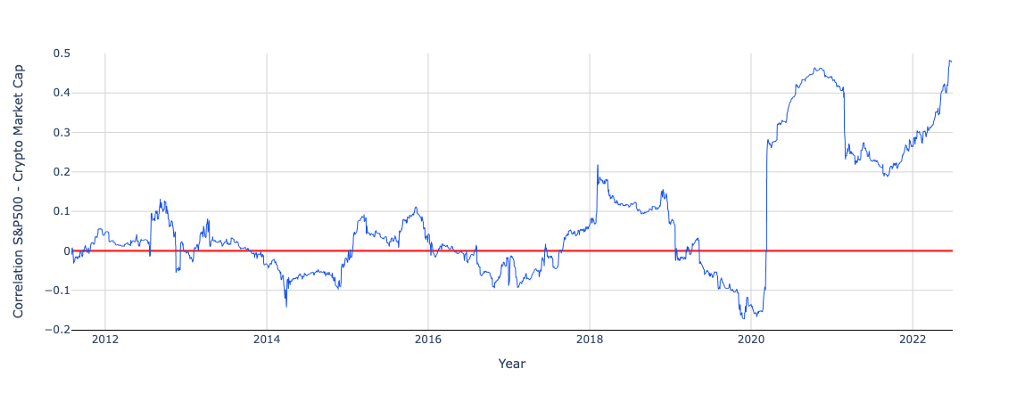

Since 2020, the correlation between the stock and crypto asset prices has risen significantly: while for the first decade of its existence, bitcoin returns were on average uncorrelated with the performance of the stock market, the relationship increased quickly since the COVID pandemic started. This suggests that the market expects crypto assets to become more and more intertwined with the rest of the financial system, and thus to be exposed to the same macro-economic forces that move the world economy.

In particular, crypto assets today share similar risk profiles to oil commodity prices and technology stocks. Beta is a typical measure of systematic risk for financial assets. A beta of zero means that the asset is uncorrelated with the market. A beta of one means that the asset moves together with the market. A beta of two means that when the stock market rises or falls by 1%, the asset increases or decreases by 2%. The animation below shows that the betas of bitcoin and ethereum have jumped from 0 in 2019, to 1 in 2020–2021, and to 2 today — they are now very similar in risk profile to a more traditional asset, technology stocks. (We wrote about this in our Coinbase Institute May 2022 Newsletter.)

As the U.S. Federal Reserve and other central banks around the world recently began to increase interest rates, long-term assets like crypto and tech stocks became heavily discounted and their values dropped rapidly. It might be useful to consider how much of the current decline is due to worsening macroeconomic conditions, as opposed to souring outlook specifically for cryptocurrencies, especially considering the crypto market cap declined over 57% year-to-date in 2022. It’s worth noting that during the same time, the S&P 500 declined 19%, and if macroeconomic conditions were the only cause of the decline, we would have expected crypto assets, with a beta of 2, to drop by about 38%. We can thus roughly estimate that two-thirds of the recent decline in crypto prices can be attributed to macro factors, and one-third to a weakening of the outlook solely for cryptocurrencies. This is similar to what happened during the 2000–2001 dot-com recession, where the S&P 500 declined 29%, and the Nasdaq composite index (composed heavily of tech stocks), with a beta of 1.25, declined 70% from peak to trough.

The Future of Crypto Markets

There is one topic that the market-efficiency view is mostly silent about: the direction of crypto prices in the future. The most important pillar of the market efficiency hypothesis is that any traded asset, from stocks to bonds, commodities, and even crypto, incorporates into its price the market’s expectation about the future value of the asset. For example, if the market expects Tesla to sell a very large number of cars in the future, the stock price today will be high to reflect that expectation. If Tesla meets that expectation in the future, its stock price will not rise, because it already incorporated that event into its price today.

Similarly, then, changes in prices occur only when there are changes in the expectation of the future outlook about the assets. Thus, according to the market-efficiency view of crypto markets, only changes in the outlook of the crypto industry relative to what is already expected will bring changes to prices.

NOTE: The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Coinbase or its employees and summarizes information and articles with respect to cryptocurrencies or related topics that the author believes may be of interest. This material is for informational purposes only, and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations or (iii) an official statement of Coinbase. No representation or warranty is made, expressed or implied, with respect to the accuracy or completeness of the information or to the future performance of any digital asset, financial instrument or other market or economic measure. The information is believed to be current as of the date indicated on the materials. Recipients should consult their advisors before making any investment decision. Coinbase may have financial interests in, or relationships with, some of the entities and/or publications discussed or otherwise referenced in the materials. Certain links that may be provided in the materials are provided for convenience and do not imply Coinbase’s endorsement, or approval of any third-party websites or their content.

was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.