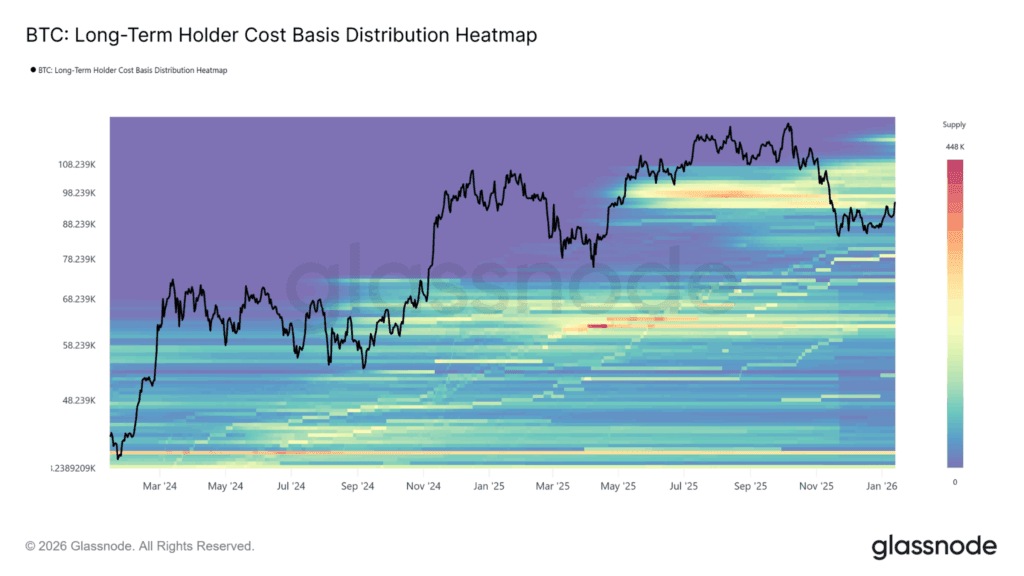

However, BTC is advancing into a dense long-term holder (LTH) supply zone between roughly $93,000 and $110,000, where previous recovery attempts stalled. While LTHs remain net sellers, the pace of distribution has slowed sharply, with realised profits down to around 12,800 BTC per week from cycle peaks above 100,000 BTC. This moderation, combined with supportive Q1 seasonality and stronger order-flow dynamics than prior rallies, improves the probability that BTC can absorb overhead supply. A sustained move through this zone would require further easing in LTH sell pressure, paving the way for a more durable recovery and a potential re-test of all-time highs.

Recent economic data points to an increasingly complex global macro and financial backdrop, marked by persistent inflation pressures, uneven consumer resilience, and tightening regulatory oversight.

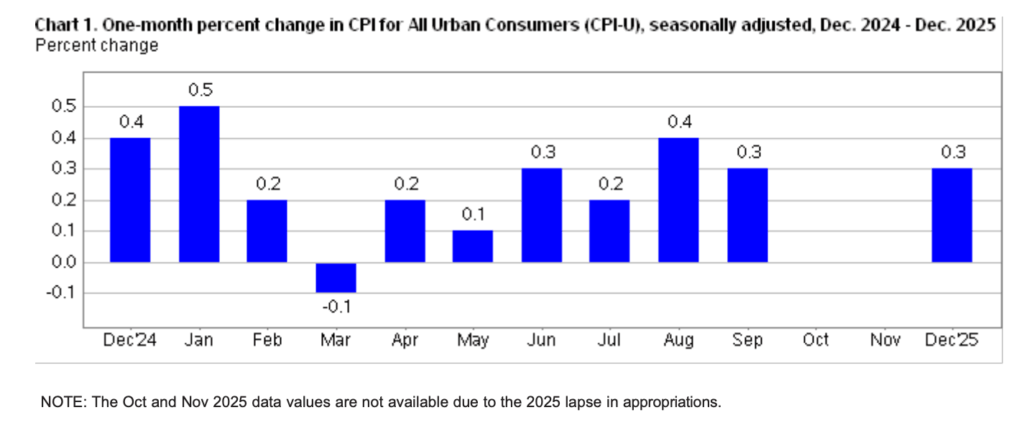

In the US, December inflation appeared stable on the surface, but rising food and housing costs continue to strain household budgets, limiting the Federal Reserve’s room to cut interest rates quickly.

At the same time, consumer spending held up in November, driven largely by higher-income households, with lower-income groups facing mounting pressure from higher essential prices, tariffs, and uneven tax benefits as refund season approaches, highlighting growing imbalances beneath headline strength.

Beyond the US economy, regulators continued to assert greater control over digital asset markets, with Dubai banning privacy-focused tokens, tightening stablecoin rules, and shifting responsibility for token approval to firms. In South Korea, access to unregistered overseas crypto exchange apps via Google Play is being blocked, to comply with domestic regulatory requirements. Alongside these regulatory shifts, China’s cross-border digital currency initiative gained momentum, with transaction volumes on the mBridge platform surpassing $55 billion and domestic use of the digital yuan expanding rapidly, signalling a gradual move toward a parallel payment infrastructure that reduces reliance on dollar-based systems. These developments underscore a global environment where economic resilience is increasingly uneven, policy flexibility is constrained, and both traditional finance and crypto markets are being reshaped by tighter regulation and evolving payment architectures rather than short-term growth dynamics.

The post appeared first on Bitfinex blog.