Despite Bitcoin’s consolidation, it continues to trade well above the realised cost basis of 95 percent of holders, highlighting that most of the supply sits in profit. This historically marks late-stage bullish phases where profit-taking by short-term holders intensifies. Long-term holders have started distributing coins for the first time since early 2024, while ETFs, retail, and newer market participants absorb that supply. This natural rotation between holder classes reflects a maturing cycle, but it also raises near-term fragility, especially if buyer momentum fades.

Bitcoin briefly pulled back to $115,820 after testing the +1 standard deviation band (σ) above the Short-Term Holder cost basis at $120,000, a zone that historically attracts distribution. For the rally to continue, the next resistance lies at the +2σ band near $136,000—a level associated with overbought conditions and peak market exuberance. Sustaining momentum to reach that level will likely require renewed institutional inflows or strong macro tailwinds to absorb profit-taking pressure. For now, the baton has passed to altcoins, but Bitcoin’s structural strength remains intact—just entering a more delicate, reactive phase.

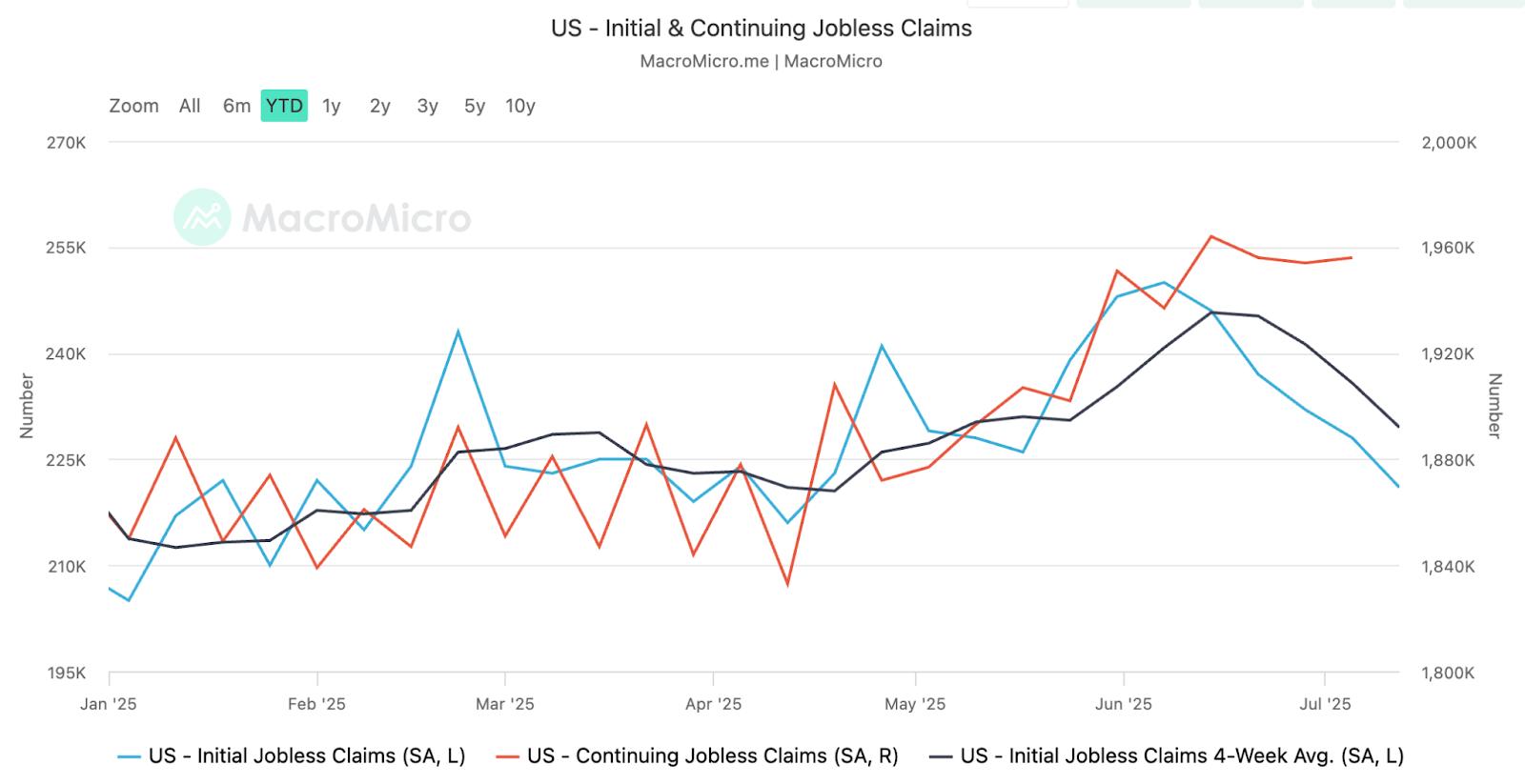

In the macro economy it is becoming clearer that tariff-driven inflation is surfacing, with June’s CPI rising 0.3 percent and core inflation up 2.9 percent annually, as higher import costs from China and other key US trading partners push up prices in consumer goods like appliances and apparel. While shelter and services inflation shows mild easing, producer price data points to rising upstream costs and potential “stagflation-lite” risks, prompting the Fed to hold off on rate cuts for now. Despite these inflationary pressures, US retail sales rebounded by 0.6 percent in June, driven by auto sales and preemptive consumer buying ahead of further tariff hikes, though real consumption gains remain marginal. Labour market data adds to the mixed picture—initial jobless claims are down, but continuing claims and slower wage growth suggest potential softening ahead.

In crypto, institutional adoption surged as Strategy (formerly MicroStrategy) became the first public company to hold over 600,000 BTC, now valued above $73 billion. Meanwhile, Hungary imposed strict penalties for unlicensed crypto trading, forcing major platforms to suspend services, and Kazakhstan is weighing crypto allocations in its sovereign reserves.

The post appeared first on Bitfinex blog.