In last week’s Futures Friday article, we noted how OKEx trading data showed market participants consistently selling at important resistance levels in order to secure profits. This week’s trend was largely the same, as the long/short ratio generally went opposite to the price movement. However, the increase in margin lending ratio this week is more indicative of market participants’ confidence in mid- to long-term prices.

OKEx trading data readings

Visit OKEx trading data page to explore more indicators.

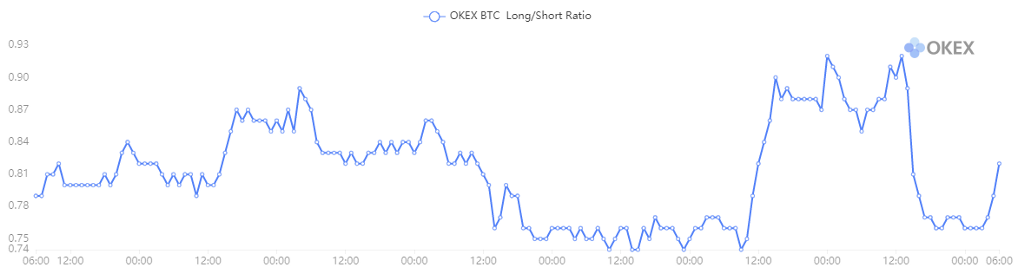

BTC long/short ratio

The volatility of the long/short ratio has reduced from last week, ranging from 0.74 to 0.92. This could be a sign of market optimism after the price broke above the $13,000 resistance level. Especially on Thursday, when the price retreated sharply, retail investors opened longs and pushed the long/short ratio to its highest level of the week. At the same time, we also observed how after approaching $14,000 on the OKEx quarterly futures price, the long/short ratio fell faster. This indicates that retail investors do not expect the price to break through $14,000 any time soon.

As the U.S. election day approaches, the market has an aversion to risks, which has accelerated traders’ profit-taking actions. We may continue to see prices move in a consolidation pattern next week, while the dramatic impact of major events cannot be ruled out.

The long/short ratio compares the total number of users opening long positions versus those opening short positions. The ratio is compiled from all futures and perpetual swaps, and the long/short side of a user is determined by their net position in BTC. In the derivatives market, whenever a long position is opened, it is balanced by a short position. The total number of long positions must be equal to the total number of short positions. When the ratio is low, it indicates that more people are holding shorts.

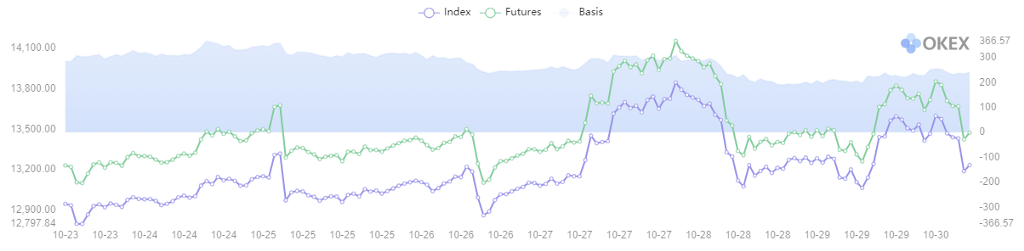

BTC basis

The basis between quarterly futures and spot has dropped from Sunday’s $350, or 2.7%, to the current $140, or 1.8%. This shows the market is not as optimistic as it was just after the price broke through $13,000, as per the OKEx BTC Index price.

The current BTC basis at $140 remains healthy and sustainable, but it also shows that market sentiment has turned more cautious.

This indicator shows the quarterly futures price, spot index price and also the basis difference. The basis of a particular time equals the quarterly futures price minus the spot index price. The price of futures reflects the traders’ expectations of the price of Bitcoin. When the basis is positive, it indicates that the market is bullish. When the basis is negative, it indicates that the market is bearish. The basis of quarterly futures can better indicate the long-term market trend. When the basis is high (either positive or negative), it means there’s more room for arbitrage.

Visit https://www.okex.com/ for the full report.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features and curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.