Fast forward to 2018, and we see Uniswap, one of the first AMM platforms, launch on the Ethereum blockchain, marking the first time that AMM’s were used in practice. Uniswap quickly gained popularity due to its user-friendly interface and low transaction fees. This, of course, paved the way for other AMM platforms like SushiSwap and PancakeSwap. In 2021, the DeFi space saw a massive growth, and AMMs were the main driver of this growth, with total locked value in DeFi platforms reaching a new all-time high. Additionally, chains like Polygon and Binance Smart Chain have created new opportunities for AMM platforms, which has led to an explosion of new platforms and liquidity pools.

TL;DR

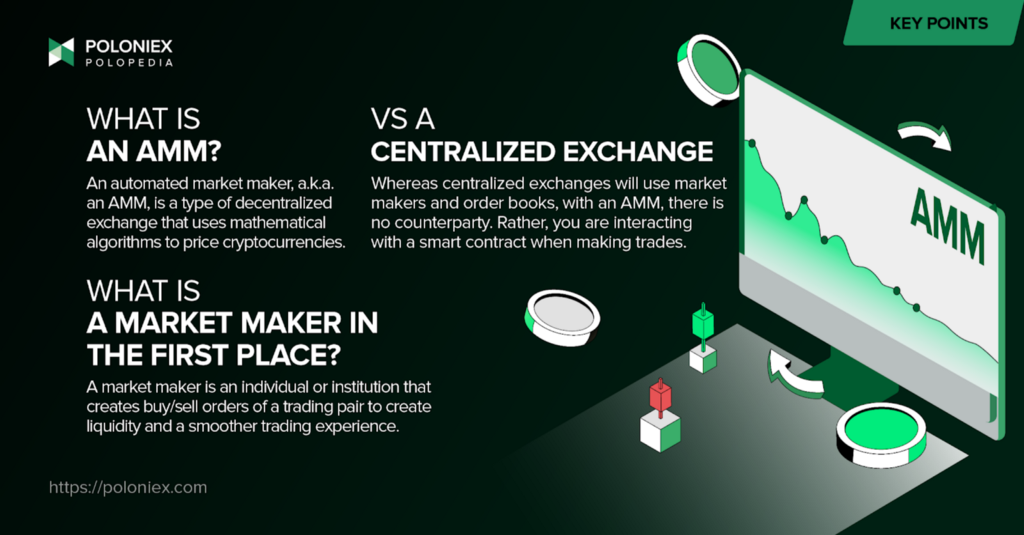

Known more by their abbreviated name, automated market makers, or AMMs, are a type of decentralized exchange that determines pricing and handles trade execution using algorithms.

Popular AMMs are Uniswap, Sushiswap, and Pancakeswap, and overall popularity has exploded over the course of 2021 and 2022.

How do AMMs work?

Before we talk about how AMMs work, let’s talk about the last two letters, the MM, or market maker, of it all. Market makers are the people or entities responsible for providing liquidity so that traders can, well, trade the assets they want on a given exchange. How this works is that market makers will put out buy and sell orders with a price spread. That is, they help fill up the order book with orders that are above and below (within a certain margin) the current market price.

Automated Market Makers (AMMs) function by using mathematical algorithms to automatically match buyers and sellers in a decentralized market. The algorithm is designed to maintain a constant supply and demand for a particular asset, by adjusting its price according to the buying and selling activity. This also means that there is no order book, and thus no order types. And as a trader, you interact with the AMM by trading within trading pairs, like ETH/USDD.

Speaking of interaction, you may be wondering about who…or what, is on the other end of your trade. Normally, DEXes are peer-to-peer. This means that a trader directly trades with a human counterparty, with no intermediary. With AMMs, however, you will be interacting with smart contracts that fulfill trade orders. No intermediary here either, but there is now no need for the existence of a seller to have put up a matching sell order to your buy.

To boil it down, an AMM protocol is able to handle the execution of trades and pricing of assets. But where exactly does an AMM get the tokens needed to provide liquidity? This is where liquidity pools come in. A liquidity pool is a bundle of different assets that enable trading of said assets on a decentralized exchange. These pools are what the AMM trading robot draws from when helping execute trades. In order to attract liquidity providers, AMMs often have an incentive structure built in that rewards these providers with a percentage of the trading fees generated on the platform.

A comparison and contrast with centralized exchanges

Even as DEXes become an ever more popular option for accessing crypto, centralized exchanges far exceed in terms daily volume and overall popularity, so it’s important to study how these two different types of exchanges compare, and what might make one right for you over the other.

Centralized exchanges, also known as CEXes, are typically owned and operated by a central authority or company. They act as intermediaries, matching buyers and sellers and facilitating trades. These exchanges often have strict Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations, which makes them more secure, but also more restrictive. They also offer a wide range of trading pairs, order types, and advanced trading tools and features, which makes them more suitable for professional traders and high-volume traders.

On the other hand, AMMs are decentralized, meaning they are not controlled by a central authority. They use smart contracts to automatically execute trades based on predefined rules and algorithms. AMMs are also defined by having lower transaction fees, and are more appealing to traders who may not want to go through the process of KYC and AML regulations. And because AMMs execute trades on-chain, they are much more transparent than their centralized counterparts. However, as mentioned before, AMMs do not have order types (currently) as they do not employ the use of order books.

In summary, the choice between an AMM and a centralized exchange will depend on the specific needs and preferences of the trader. This distinction isn’t so rigid, but it might help to think of AMMs as suitable for users who value liquidity and transparency, while centralized exchanges are more suitable for high-volume traders and those who value control and security.

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.