Exchange arbitrage: How big are price differences across exchanges?

Imagine that the most wonderful time of the year has just arrived, it’s vacation time. You stuff all the summer clothes in your luggage to hop on that 10 hours flight that will take you to a hidden tropical paradise. Once you are all settled, you start realizing how cheap the surfboards are in comparison to your hometown. Then, dollar signs appear in your eyes. You just had a brilliant idea, it’s called Arbitrage.

You come up with a business model: buying surfboards in bulk in the cheap tropical paradise and selling them in your expensive city. After subtracting transport and other costs, you know what your potential profit is. Finally, you turn the machine on and let your new surfing business make money for you.

However, transporting the surfboard from point A to point B, filling all the necessary documentation, finding potential clients and a long etcetera, are things that will take your time away. And if you already have a full-time job, this becomes Mission: Impossible.

This great arbitrage opportunity is massively sabotaged by an endless amount of costs. Arbitrage opportunities are usually threatened by big commissions, delays and other unforeseen factors. But there’s an exception: Trading.

Buying a stock or commodity from your laptop via your preferred broker will only cost you a very small commission. But there’s a downside, these assets are so liquid that the arbitrage opportunities are very scarce, hard to find or not profitable enough. But again, there is another exception: Cryptocurrencies.

Bitcoin, Ethereum and other cryptocurrencies have shown significant price differences across exchanges since their inception, and many traders have taken advantage of this phenomenon. Many of them started to spread the word and arbitrage in crypto trading became a trading style itself.

Buying cheap in exchange A and sell for a profit in exchange B. But not only that, while the people carrying out this trading technique began piling up their profits in Bitcoin, the BTC price had been increasing as well. Therefore, the real profit in fiat money went through the roof.

How large are price differences across exchanges?

Price differences between crypto exchanges depend, mostly, on two factors: volume and volatility. Why? Stable and non-volatile markets usually converge to the same point.

However, when the volume starts flooding a market, big waves form and the prices don’t increase or decrease at the same pace, which creates price differences and arbitrage opportunities. But, of course, just adding volume won’t make the price move, we need volatility to make these differences even bigger and profitable for us.

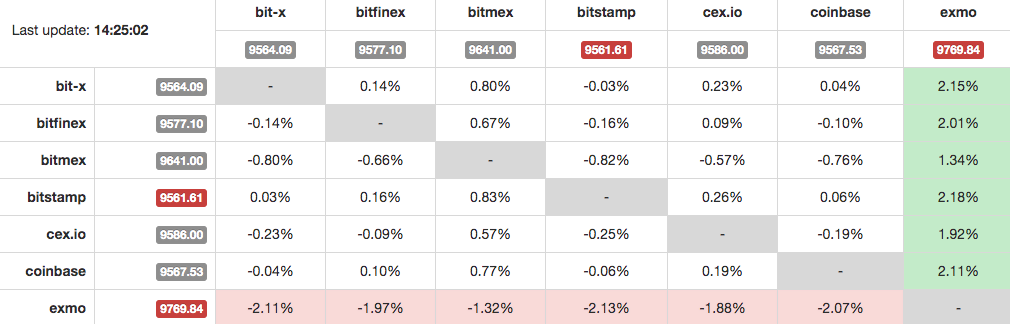

In the next table, we are going to analyze the Bitcoin price across 10 different exchanges.

Source: http://data.bitcoinity.org/

This table shows the price differences for the most liquid pair of the cryptocurrency market, BTC/USD(T). Depending on the volatility and liquidity of the market, the arbitrage opportunities are larger or lower. By taking less liquid pairs, like any altcoin/BTC pair, the arbitrage opportunities are more obvious and easier to trade.

As you can see, in some exchanges, the price differences are not big enough to even cover the trading fees. But in other ones, an arbitrage strategy would grow your portfolio. Since there is more capital and liquidity entering the market day by day, spotting the exchanges that usually offer the most arbitrage opportunities is key to have a consistently profitable arbitrage strategy.

As the crypto industry develops, markets inevitably get more liquid and there are fewer arbitrage opportunities. However, when enough volatility shows up, it shakes the crypto markets and creates price divergences across exchanges in many trading pairs. By creating alerts that notify you when the whales are entering the market will make it easier to spot these price-differences.

Paper trading different exchanges can be a very good way to spot the best ones for arbitrage. But not only that, the speed of the trade is something crucial in this trading practice.

Arbitrage opportunities are like gems, once they are spotted they don’t last long in the market. Therefore, a regular human has nothing to do against machines. A computer is going to be faster than you 99.99% of the time in spotting these rare occurrences.

From manual to automated arbitrage

After this profitable trading style became more known, more traders started keeping an eye on the price of several cryptocurrencies in different exchanges.

What did it mean for arbitrage trading? Opportunities began to last less time in the market. The fastest in spotting the opportunity and pulling the trigger got the reward. This developed to a point where only professional trading desks with automated systems were reaping these rewards.

The manual traders could barely benefit from this trading style anymore.

Nevertheless, that belongs to the past. You don’t need to be a professional trader to take advantage of this trading style. Arbitrage crypto traders have quickly progressed from manual to automated techniques and with an automated trading platform like Cryptohopper anybody can easily configure an arbitrage strategy that will scan the market 24/7.

Traders have been tirelessly seeking for new tools that would let them cover more markets and trade longer hours without needing to devote more time to actually trading, and the technology has made this possible.

In the cryptocurrency markets, this shift towards more automated strategies started to take place in 2017. The market became so bullish that the industry quickly began to innovate and the crypto traders started to automate certain aspects of their trading with tools like trailing stop-loss. This kept evolving to the point when even full arbitrage strategies could be easily automated by any person.

Is automation the answer? In such a competitive environment, we lean more towards a yes. It’s difficult to think that a computer can take into account all the factors involving a market though.

There are aspects in trading that are very hard to code, like supports, resistances or micro trends. Nevertheless, in arbitrage it’s only the price that needs to be taken into account.

Just price differences across different marketplaces and nothing else, a situation where an arbitrage bot is in its element. After having configured the strategy properly, the arbitrage bot will trade any market inefficiency in less than a jiffy.

Check out the trading contest in OKEx by clicking here!