Our journey so far:

SMA vs EMA for trend direction

MACD for momentum shifts

RSI for overbought/oversold zones

Bollinger Bands for volatility and price extremes

Stochastic Oscillator for timing reversals

VWAP for fair price detection

Volume + OBV for spotting smart money flow

ATR for volatility-based risk management

Today, we’re exploring Fibonacci retracements, the mathematical tool that reveals where markets are most likely to find support and resistance.

The Mathematical Foundation

The Fibonacci sequence is a simple pattern where each number is the sum of the two before it (1, 1, 2, 3, 5, 8, 13…). What makes it fascinating is the ratio between these numbers. As the sequence grows, the ratio stabilises around 1.618, also known as the Golden Ratio.

This ratio shows up everywhere in the natural world:

The spiral of seashells and galaxies

The way leaves grow around a stem

The proportions of the human body

The branching of trees and rivers

In trading, we convert these mathematical relationships into retracement percentages. The key Fibonacci ratios are derived from the Golden Ratio (1.618):

61.8% = 1 ÷ 1.618 (the inverse of the Golden Ratio)

38.2% = 1 – 61.8%

23.6% = 38.2% × 61.8%

78.6% = the square root of 61.8%

Why this matters for trading:

These aren’t arbitrary numbers – they’re mathematical relationships that appear throughout nature. When applied to price movements, they often mark where buying and selling pressure naturally shifts.

61.8%: The golden ratio. The most powerful retracement, where major bounces often happen. Institutional traders monitor this level closely as it represents the mathematical “decision point” for trend continuation.

38.2%: A common correction level where price temporarily pauses before resuming the primary trend.

23.6%: Indicates strong underlying momentum. Robust trends rarely retrace beyond this level before continuing.

78.6%: Represents the “last stand” for trend continuation. Breaks below this level typically signal impending trend reversal.

Setting Up Fibonacci Retracement on Bitfinex

Fibonacci retracements identify potential reversal levels during market corrections. Here’s the process:

Identify the trend:

Open trading.bitfinex.com and select your trading pair.

On the left toolbar, look for the “Fib Retracement” tool (it looks like 4 horizontal lines)

Spot a clear move on the chart – either a rally (low to high) or a drop (high to low).

Find your swing points:

Swing Low: The obvious lowest point where price bottomed out before moving up

Swing High: The obvious highest point where price peaked before moving down

Tip: Zoom out to see the bigger picture – you want the most obvious turning points, not small bumps

Apply the tool:

Uptrend: Click the swing low, drag to the swing high

Downtrend: Click the swing high, drag to the swing low

Watch the levels: The tool automatically plots retracement lines (23.6%, 38.2%, 50%, 61.8%, 78.6%). These act as potential support and resistance zones.

Plan your trades: Traders use these levels to time entries, set profit targets, and place stop losses.

The psychology behind it: Markets move in waves due to human emotions, fear and greed create predictable patterns, and Fibonacci levels often line up with where traders collectively step in or take profit.

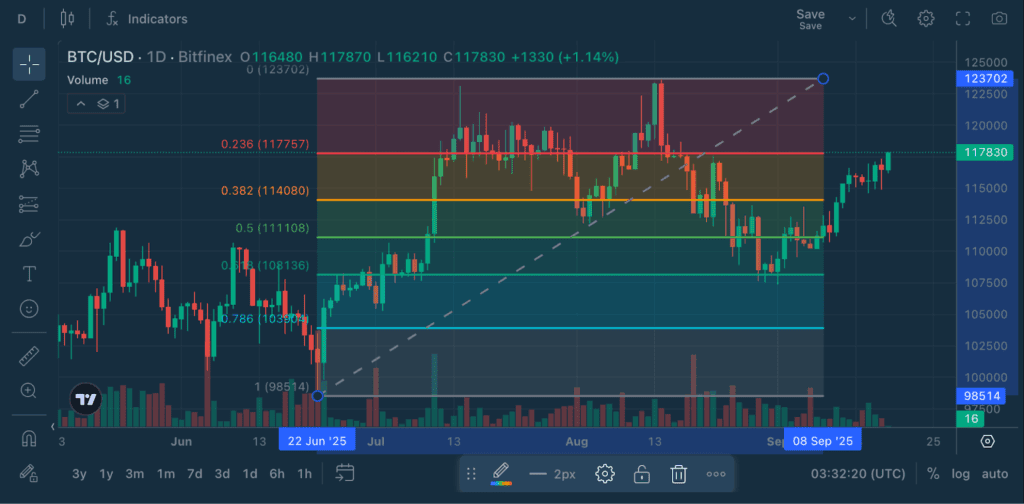

Real Example: BTC/USD Analysis

Swing low: $98,514 (22 Jun)

Swing high: $123,702 (8 Sep)

Range: ~$25,188

Calculated retracements:

23.6% – $117,757

38.2% – $114,080

50% – $111,108

61.8% – $108,136

78.6% – $103,904

Current price: $117,830

Notice how BTC retraced deeply from its September high, testing the critical 61.8% “Golden Ratio” level around $108,136. This demonstrates the power of Fibonacci retracements – the 61.8% level acted as strong support and generated a significant bounce. This is classic Fibonacci behavior where the Golden Ratio level provides a high-probability reversal zone, allowing the trend to continue after testing this mathematically significant support level.

Advanced Fibonacci Strategies

1. Multiple Timeframe Analysis

Apply Fibonacci on different timeframes for confluence:

Daily chart: Major swing points for position trading

4-hour chart: Intermediate levels for swing trading

1-hour chart: Fine-tune entries for day trading

2. Fibonacci Confluence Zones

The most powerful setups occur when multiple factors align:

Fibonacci level + horizontal support/resistance

Fibonacci level + moving average

Fibonacci level + trend line

Multiple Fibonacci levels from different swings

3. Extension Projections

Once price breaks past the previous high or low, Fibonacci isn’t just about pullbacks, it can also project where the move might go next. Traders often watch:

100% – Equal to the last swing.

127.2% – First extension target.

161.8% – The “golden target,” where many trends pause.

200%+ – Aggressive moves in strong trends.

4. Fibonacci + Other Indicators

Fibonacci + RSI : RSI oversold at key Fib level = high-probability bounce. For example, RSI below 30 at 61.8% retracement often marks significant lows. Wait for RSI to turn up from oversold at Fib support

Fibonacci + ATR Use ATR to set stops beyond Fibonacci levels. For example, If 61.8% level is $96,460 and ATR is $3,000, place stop at $93,460. ATR ensures your stop accounts for normal volatility

Fibonacci + Volume High volume at Fib levels confirms significance. For example, Volume spike + bounce at 61.8% = strong reversal signal. High volume break of 78.6% suggests trend change

Fibonacci + MACD MACD divergence at Fibonacci levels creates powerful reversal setups. Your entry trigger comes when the MACD line crosses above its signal line while price holds Fibonacci support.

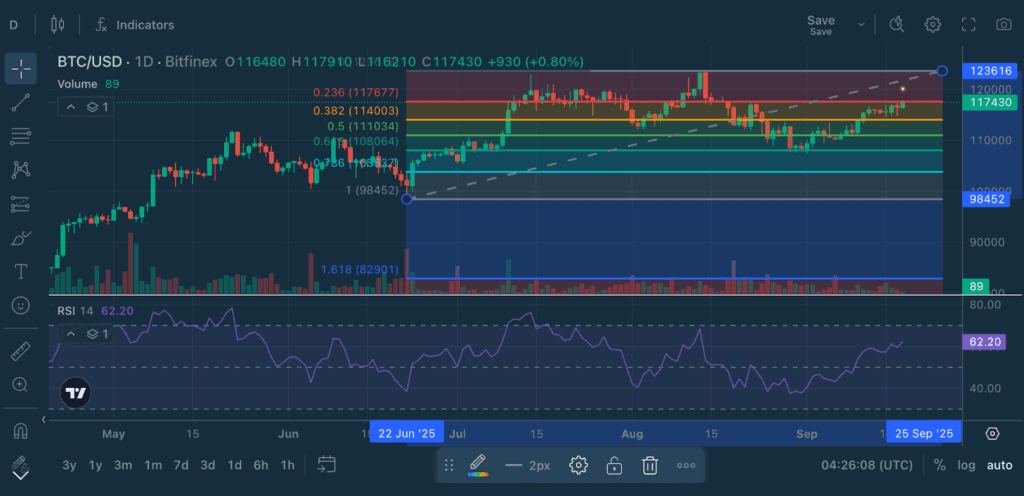

Bonus Read: Fibonacci + RSI in Action

Looking at this BTC daily chart, we can see the 61.8% “Golden Ratio” level at $108,064 acting as major support. When BTC retraced from its highs down to this critical Fibonacci level, it found strong buying interest and bounced significantly.

BTC rallied from this mathematical support level back above $117,000, demonstrating how the 61.8% retracement often marks important turning points. The current RSI reading of 62.20 shows healthy momentum has returned after the recovery.

The next key level to watch is the 23.6% retracement at $117,677. A break above with rising RSI could signal continuation toward new highs. However, if RSI starts diverging negatively while price struggles at this level, it might indicate another test of deeper Fibonacci support is coming.

Common Fibonacci Mistakes to Avoid

Swing Point Slip-Ups Don’t use tiny highs and lows. They give messy signals. Stick to clear, obvious swing points that show up on multiple timeframes.

Fighting the Trend One Fib line won’t overturn the bigger picture. Always trade in the direction of the larger trend, not against it.

Jumping In Too Fast Don’t buy the second price touches a level. Wait for confirmation: candlestick patterns, volume, or momentum indicators.

Trusting Fibs Blindly Not every level holds. Use stops and look for confluence with moving averages or other Fibonacci levels.

Ignoring Context Consider news, economic data, and market sentiment alongside your Fibonacci analysis.

Fibonacci Limitations

Subjectivity: Different analysts may select varying swing points, leading to slightly different level calculations.

Market Conditions: Fibonacci analysis performs optimally in trending markets but may provide false signals during choppy, sideways price action.

Historical Basis: These tools analyse past price movements rather than predict future price action with certainty.

False Signals: Market conditions can change rapidly, causing price to break through expected support or resistance levels.

The post appeared first on Bitfinex blog.