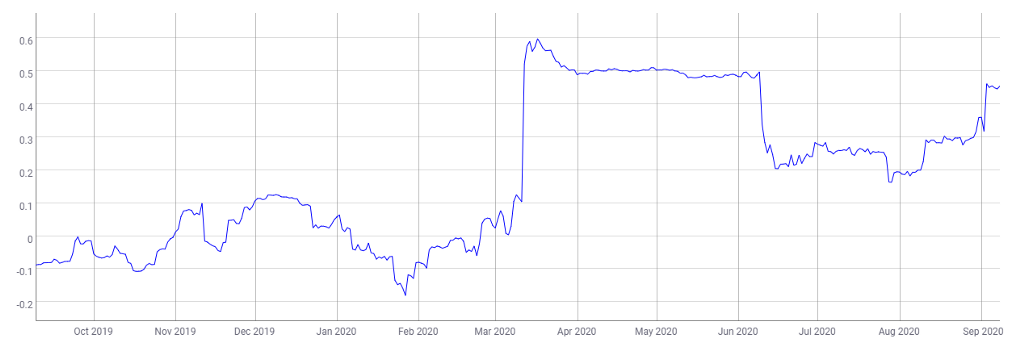

The 90-day correlation between Bitcoin (BTC) and the S&P 500 reached an all-time high during the COVID-related market crash in March, when investors frantically sold all their risk-on assets for cash. The correlation reverted in the six months that followed. However, in September, the correlation steepened again.

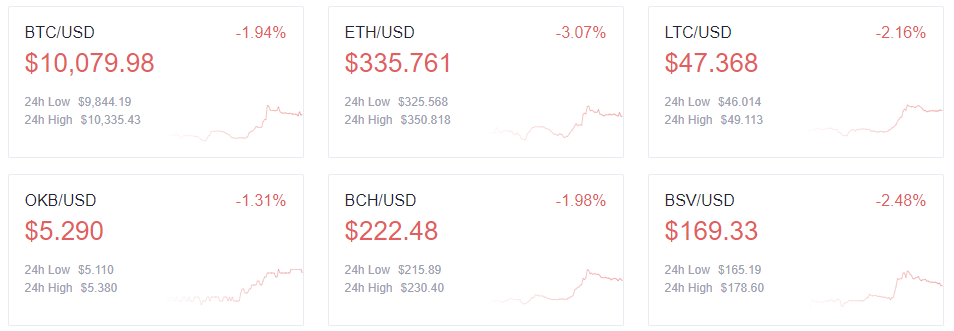

The Nasdaq Composite Index plunged 4.1% overnight. Tesla, in particular, plunged 21%. Last night’s heavy drop at the opening of the equities market also caused the price of BTC to decline to as low as $9,850, as per OKEx’s BTC Index price. BTC lost 1.94% over the last 24 hours and is currently trading just below $10,100. However, as the equity market continues to pull back, BTC remains above its low from Sept. 5.

The total crypto market capitalization lost another 2% and fell below $330 billion, as BTC dominance added 0.1% and increased to 56.75%, as per data from CoinGecko.

Major altcoins all saw declines ranging between 2% and 4%, with the exception of TRON ( TRX). There have been over 7 billion TRX locked in TRON’s liquidity mining project, SUN, as of today, which is constraining sell pressure. TRX climbed 7.7% overnight and is trading back to around $0.035.

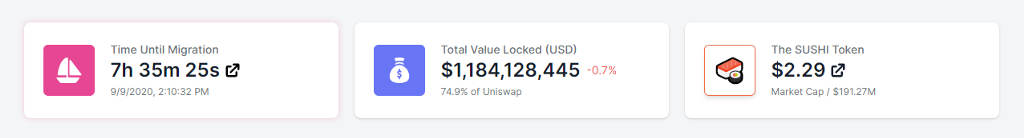

The SushiSwap ( SUSHI) migration is coming up in approximately eight hours. The current total value locked in SUSHI is roughly $1.2 billion. This could be a defining moment in decentralized finance after an anonymous developer copied a VC-funded project, Uniswap, with only the addition of a SUSHI token, and drained 80% of Uniswap’s liquidity in 10 days.

Over the past 24 hours, SUSHI’s price has fallen 19% — making it the biggest loser among all of the cryptocurrencies listed on OKEx.

Top altcoin gainers and losers

LBA/USDT +18.56%

CVP/USDT +16.43%

SWFTC/USDT +15.52%

YFV/USDT -16.01%

JFI/USDT -17.61%

SUSHI/USDT -19.05%

Cred ( LBA) is today’s top gainer, with an 18.56% return. PowerPool Concentrated Voting Power ( CVP) rebounded quickly and added 16.43% overnight, though it has lost roughly 60% over the last seven days.

The DeFi sector didn’t perform well overnight. Other than SUSHI, the other altcoins on the top losers list are also DeFi tokens — with JackPool.finance ( JFI) and YFValue ( YFV) losing 17.61% and 16.01%, respectively.

BTC technical analysis

BTC still shows no clear signs of stopping its decline and entering into recovery. The foremost cryptocurrency has repeatedly dipped to $9,800 but has been unable to break below this support. The $10,370 resistance level remains in focus, which is a short-term threshold for a possible bullish reversal. If BTC closes below the $9,800 support, the next support areas are around $9,300 to $9,500.

Visit https://www.okex.com/ for the full report.

Not an OKEx trader? Learn how to start trading!

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.