Intro

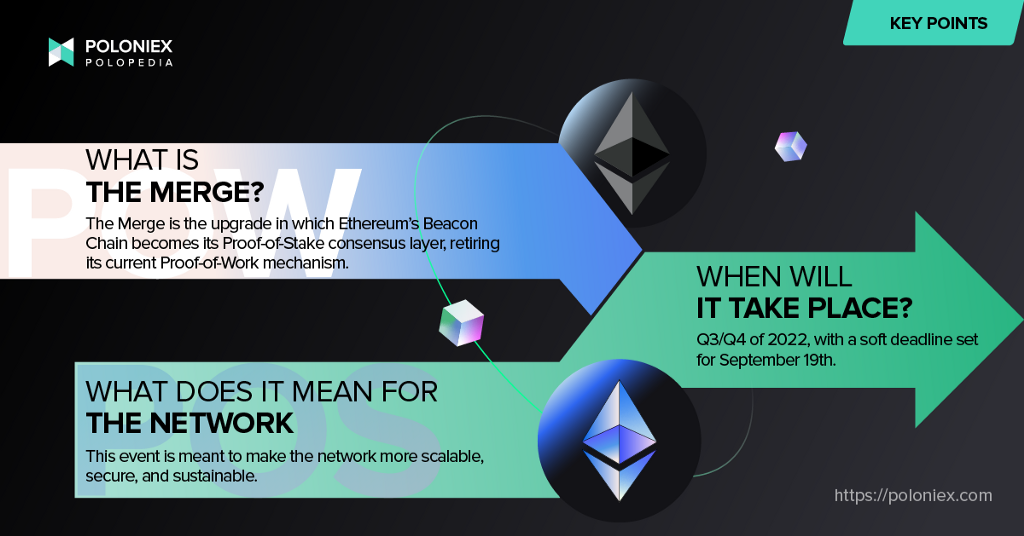

The Merge. One of the biggest events in crypto, and certainly the biggest (positive) piece of crypto news this year. This and its crucial component, the Beacon Chain are often mistakenly called Ethereum 2 (or Eth2.0), although this will usher in a new era for the network. This era will be one of better scalability and sustainability that doesn’t compromise security.

First things first, WHEN is the Merge??

Before the Merge can take effect on Ethereum’s mainnet, it needs to go through dry-run’s on some of Ethereum’s testnets. Namely, Ropsten and Goerli. The Goerli merge successfully took place recently, setting the stage for the mainnet merge.

As we mentioned in What is Ethereum?, developers are targeting Q3/Q4 of 2022 for the event to take place. And according to the ethereum.org website, there is a soft deadline set for September 19, 2022. This is highly contingent on various factors, but a ballpark date to look forward to nonetheless.

What does the Merge mean for the Ethereum network?

First and foremost, the Merge means that the Ethereum network, which is currently Proof-of-Work (PoW), will become a PoS network. This will happen through the swapping of its current consensus layer with the Beacon Chain, its PoS consensus layer.

It may surprise you to know that this Beacon Chain shipped all the way back in 2020, and has been reaching consensus on its own state since. It has passed through several tests which, agreeing on active validators. And as the current PoW system is responsible for block production, so will the new PoS system be responsible for every block produced after the Merge.

Now, one question you may have, considering that a consensus mechanism has to agree on a blockchain’s entire history, is how that history is handled with the Beacon Chain joining the network. You can rest assured that while the Beacon Chain does change how transactions are validated, it doesn’t change that history, meaning funds are safe and users/holders of ETH don’t need to do anything in preparation for its onset.

Validators in Ethereum’s network

Validators will become the driving force for network security and block production. And how exactly do they secure the network? For validators running block-producing nodes, they must stake at least 32ETH in order to participate. It’s important to note that not all validators need 32ETH to participate, because not all validators produce blocks.

Scalability

Currently, the Ethereum blockchain can only process 12–15 transactions per second(tps). The low processing rate means network bottlenecks and congestion as well as high gas fees, which is what users pay to conduct transactions. With the upgrade, the network’s tps will be much higher, and will set it up for further scalability upgrades such as sharding.

* Sharding is a way to distribute a blockchain’s database into smaller parts, possibly improving latency

Sustainability

As the market has matured and more intense mining rigs are needed to secure various PoW blockchains, the question of sustainability has become a hotter and hotter topic. In fact, some projects, like Cardano, have staked (pun intended😉) their identity on this very question.

When PoW consensus ends on Ethereum, so does the need for miners and thus the enormous energy needs of the blockchain. Ethereum’s website claims that the shift to PoS means a ~99.95% reduction in energy consumption. Thus, a more sustainable network that doesn’t burn energy becomes possible.

The community gets ready

As mentioned before, holders and users of ETH do not need to do anything in preparation, but because this is a fundamental shift in how the network is secured, those with more of an active role in the network will need to make certain preparations.

As far as users go, they should exercise extra caution towards scams claiming to represent Ethereum and ask for ETH in order to access the upgraded system.

The future after the Merge

After the Ethereum network becomes Proof-of-Stake, it will become much more scalable. This allows for, according to the network’s page on the matter, something called sharding. Sharding refers to the splitting of a database across multiple datasets, and means that nodes aren’t responsible for keeping a record of every single change in state. What this does is make the network more decentralized- a tantamount pillar of Ethereum’s ethos- and accessible.

As a result of the Merge, there may potentially be tokens that arise because of a fork. A fork could occur when current users of the network opt to stick with a version that still employs the use of its Proof-of-Work consensus mechanism. On August 7, 2022, Poloniex became the first crypto exchange to list and open trading for two potential hard fork tokens: ETHW (ETH1) and ETHS(ETH2).

Currently, Poloniex has listed the hard fork tokens, ETHW and ETHS, which are available to trade with the following pairs:

ETHS (ETH2)- ETH pair , USDT pair , USDD pair

ETHW (ETH1)- ETH pair , USDT pair , USDD pair

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.