The history of liquidity pools can be traced back to the early days of decentralized finance (DeFi).

In 2018, Uniswap- a DEX- was launched on the Ethereum blockchain. A hallmark of decentralized exchanges like Uniswap is that they do not require middlemen to enable trading. One of the first projects to do so, Uniswap uses a constant product market maker (CPMM) algorithm to determine the price of assets. A CPMM falls under the umbrella of automated market makers, which are smart contracts that facilitate trading and solve for liquidity on a DEX. The employment of this algorithm allowed for the creation of a liquidity pool, where users could deposit assets and provide liquidity to the exchange.

First mover advantages aside, Uniswap quickly became popular among DeFi enthusiasts and traders due to its decentralized and trustless nature as well as its ability to facilitate the trading of assets that were not available on centralized exchanges.

Since then, many other liquidity pools have been created, such as Pancake Swap and Sushiswap. These liquidity pools have also added more advanced features like flash loans, yield farming and more in order to make up the pace against their centralized counterparts, which often excel, comparatively, in terms of user experience and amount of features.

As the DeFi ecosystem continues to evolve and mature, liquidity pools are becoming an increasingly important part of the DeFi landscape, providing liquidity and earning opportunities for users.

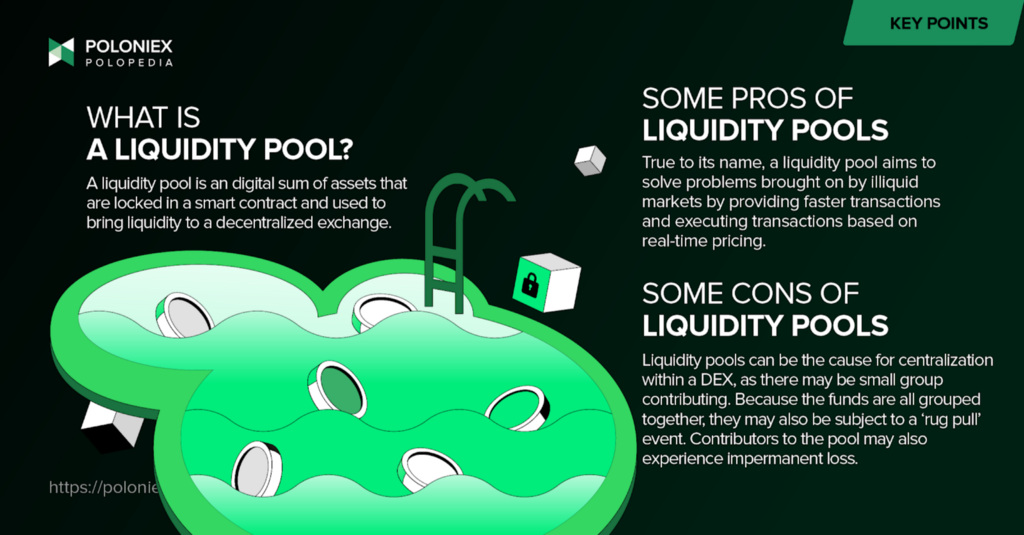

What is a liquidity pool?

For the purposes of this article, a liquidity pool is a collection of cryptocurrencies that facilitate trading on a decentralized exchange (DEX). These assets are provided by users, known as liquidity providers, who deposit them into the pool in exchange for a share of the trading fees generated by the DEX. The assets in the pool can be traded by other users on the DEX, allowing for increased trading volume and liquidity.

Liquidity pools are a crucial part of many DeFi applications, including automated market makers, yield farming, GameFi, and synthetic assets. As with other DeFi components, a liquidity pool is open to be supported by anybody, and doesn’t constitute an actual 3rd party, making them a very attractive solution to the problem of “the middleman” in centralized solutions.

The role of a liquidity provider

A liquidity provider (LP) is a user who deposits assets into a liquidity pool on a decentralized exchange (DEX). More specifically, they provide an equal amount of two tokens, forming a pair, into the pool. This creates a market. You may be familiar with the term market maker, and although “market makers” in DEXes often come in the form of a smart contract, you can see the analog nonetheless.

The role of a liquidity provider is to provide assets to the pool and ensure that there are enough assets for traders to buy and sell. In return for providing liquidity, LPs earn a portion of the trading fees generated by the exchange, and may also earn interest on their deposited assets. It’s here that we should return to one of the central theses of DeFi, which is true ownership of one’s assets. This brings us to exactly how liquidity providers are rewarded for their contributions: LP tokens.

LP tokens

An LP token (liquidity provider token) is a token that represents a user’s share in a liquidity pool on a decentralized exchange (DEX). When a user deposits assets into a liquidity pool, they receive LP tokens in return. It is important to note that the holder is in control of said token and that it stands in place of the liquidity that they provided. These tokens can be traded on the DEX and have value based on the assets and trading fees in the pool.

The value of an LP token is tied to the value of the assets in the pool and the trading fees generated by the pool. Functionally, they would allow a provider to claim their original stake and the rewards that are owed to them.

Why do DEX’s need liquidity pools?

To understand the importance of liquidity pools, let’s talk about how they fit into the operations of decentralized exchanges. To put it simply, DEXes need liquidity pools to facilitate trading on their platforms. Without liquidity, traders may not be able to find buyers or sellers for the assets they want to trade, which can make it difficult for them to execute their trades.

A liquidity pool allows users to deposit assets into the pool in exchange for a share of the trading fees generated by the exchange. These assets can then be traded by other users on the DEX, increasing the trading volume and liquidity of the exchange.

The liquidity provided by the pools also enables DEXes to function without a traditional order book. In a centralized exchange, the order book is maintained by the exchange itself, and traders can place limit orders to buy or sell an asset at a certain price. In contrast, DEXes use a smart contract to determine the price of the assets based on supply and demand.

The cons of liquidity pools

Of course with any solution there come risks, one of the most well-known being the risk of impermanent loss. Impermanent loss refers to the event in which the price of one’s assets deposited in a liquidity falls compared to when they put them in. The operative word here, though, is impermanent, because just as deposited tokens can lose value, they can also regain that value.

Something that many who are considering venturing into DeFi is that while it is indeed exciting, the landscape is still very nascent, meaning that it is a lot less user and beginner-friendly.

A very important thing to note in comparison with their centralized counterparts is a lack of insurance when it comes to liquidity pools and DEXes in general. Centralized exchanges often have insurance to cover losses in case of hacking or other security breaches, and offer a higher grade of security functionality. In events such as rug pulls, where a token creator would pull all of a token out of a pool at once, users would have little recourse as the token’s price crashes.

The last thing to consider may come as counterintuitive to readers. That is the risk of centralization. Something to understand is that even with DeFi, there is extant threat of centralization. For a liquidity pool, if there are only a small number of contributors, centralization increases.