ETH’s flippening still long way to go

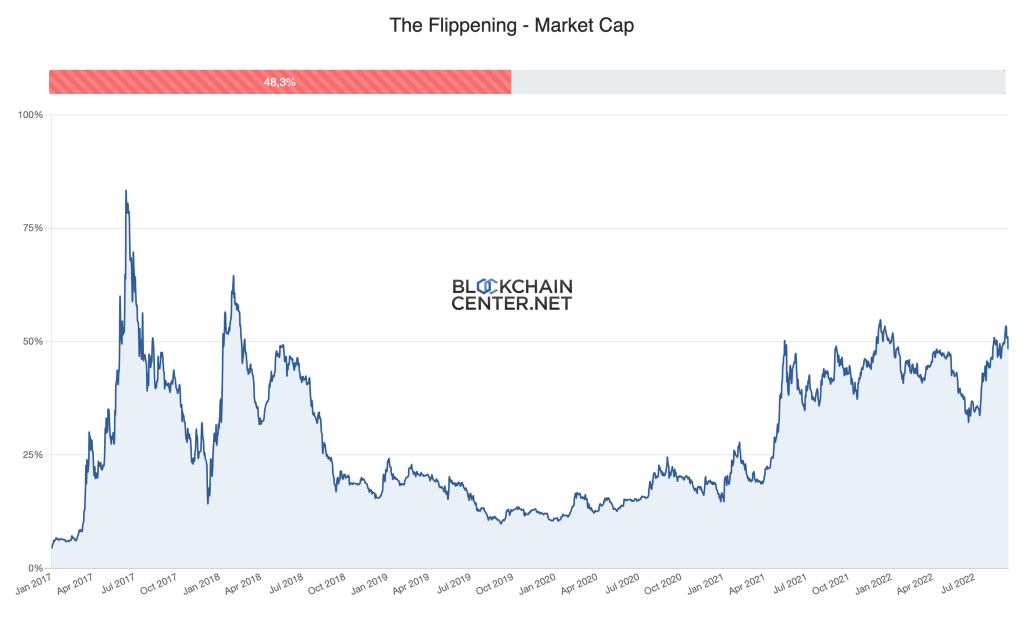

According to Blockchaincentre.net, the term “flippening” refers to the hypothetical moment of ETH overtaking BTC as the biggest cryptocurrency and the main metric to determine “the flippening” is the market capitalization (or market cap) with other factors including active addresses, transaction count, transactions volume, trading volume, total transaction fees, node count and popularity on Google.

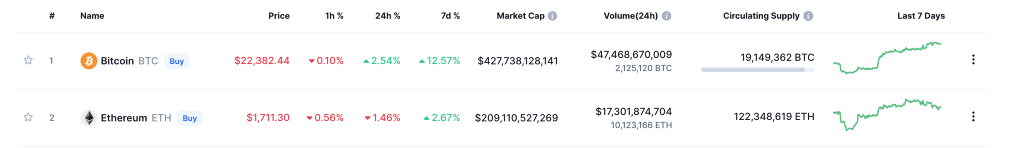

However, the data on the aforesaid website indicated that the accumulated metrics stand at 48.3% only, which is still more than halfway to go before hitting 100% to show that ETH and BTC have the same market capitalization. Currently, the market capitalization of ETH is $203B as shown on CoinMarketCap. Meanwhile, according to the same coin ranking site, the market capitalization of BTC is at $378B by press time.

Although ETH/BTC pair has seen the rise by more than 55% since the Merge’s release announcement on Jul 14, 2022, some experts said that ETH flippening BTC is still a long way to go. Josef Tetek, Brand Ambassador at SatoshiLabs and Trezor, said earlier in an interview with Crypto News that he didn’t think ETH would flip BTC anytime soon since ETH would need to reach a price of BTC 0.156 per unit for the flippening, but it stands at around 0.083 BTC at the time of writing, which means that ETH needs to double in price while BTC should stay at the same level to narrow the gap between them.

BTC was the first cryptocurrency created back in 2009 while ETH was officially launched in 2015. Since the inception of BTC, there were many Altcoins created to try to compete with BTC, hence there was an initial coin offering (ICO) boom in 2017 and the belief of ETH flippening BTC has been also around that time. However, none of them can really compare with BTC in terms of its market capitalization and risk tolerance.

What should we focus on after the Merge?

Nevertheless, instead of predicting which crypto will defeat another one, maybe we should remember that BTC and ETH are with different functionalities and their emergence is with different reasons.

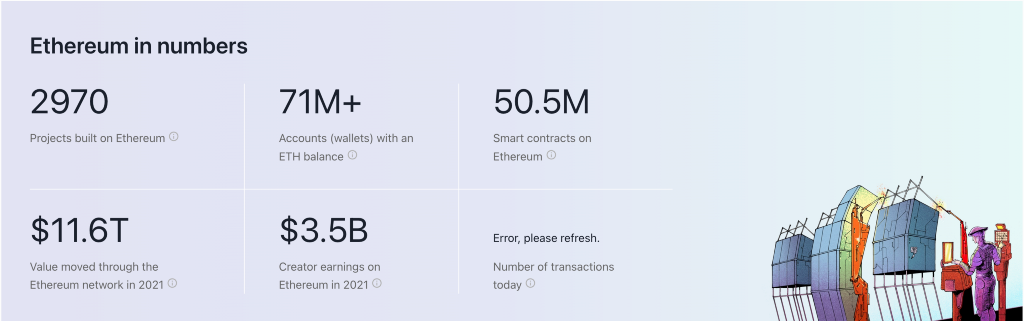

As for BTC, its value is similar to that of gold and with a store of value. Meanwhile, Ethereum, dubbed as the “World Computer ‘’, has smart contract capability to support Decentralized Application (dApp) including the two main sub-sectors: Decentralized finance (DeFi) and Non-fungible token (NFT). As of now, there are over 4,000 DAOs and nearly 3,000 dApp residing on the public chain, so the Merge will see the chain to be more secure, scalable and sustainable in the future.

Officially launched in 2015, ETH’s trading history is relatively steady, but its price skyrocketed to all-time high (ATH) at $4,800 thanks to the NFT boom and the smart contracts application. Although ETH’s price has dropped to below $900 between May and June, it went back to a steady increase and stayed above $1,000 in early July. As the Merge draws near, ETH has extended its rally to linger between $1,447 and 1,700 in the past few weeks.

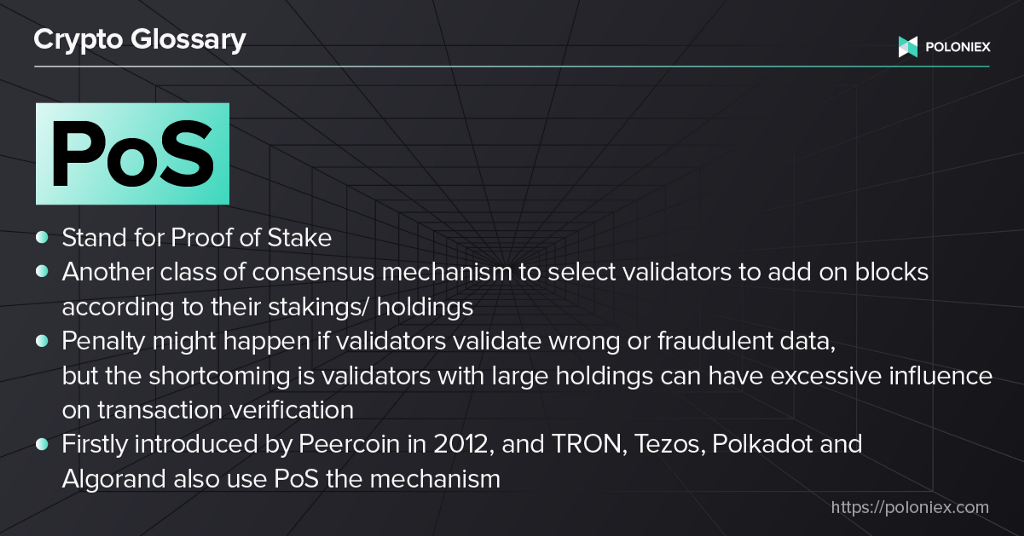

The Merge is expected to be on September 15 and the Ethereum mainnet will fully integrate with Beacon Chain, the Proof-of-Stake (PoS) consensus layer, with high likelihood that the energy consumption will be greatly reduced by ~99.9%.

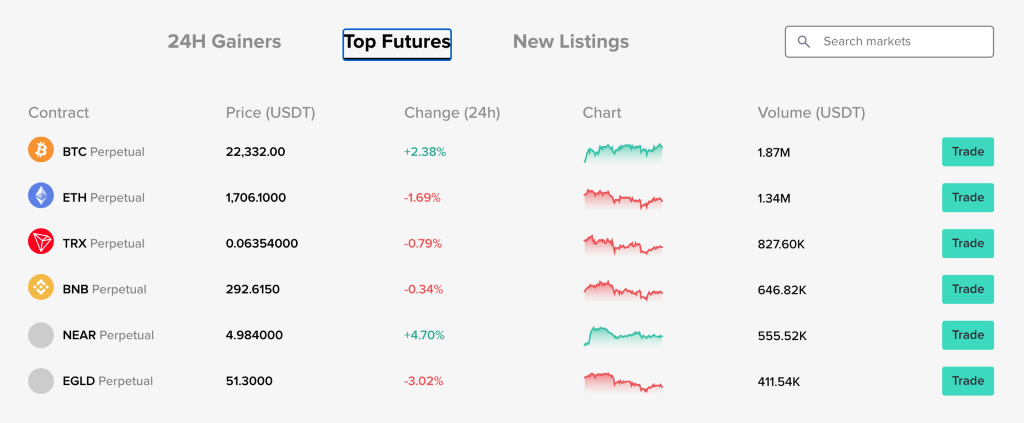

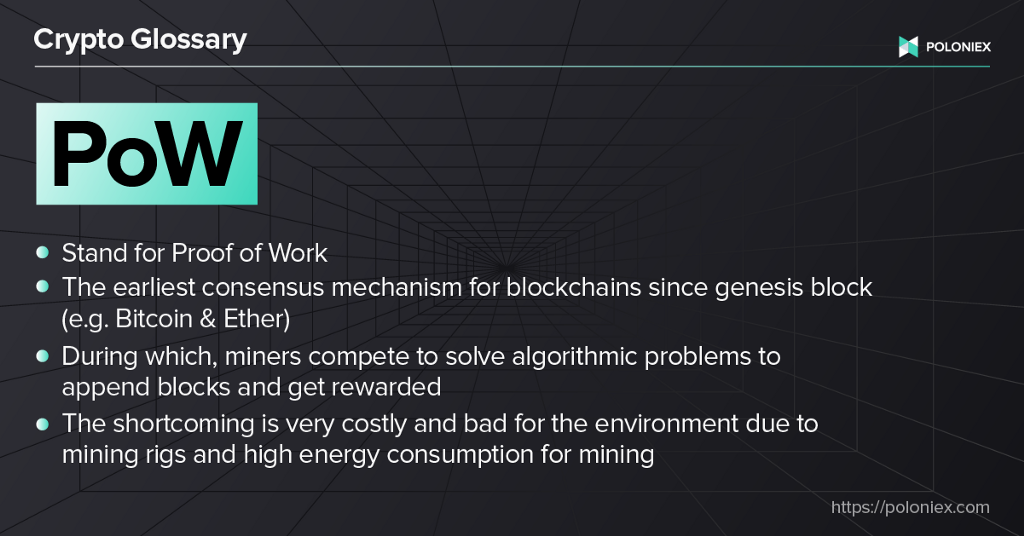

Since the Merge will signal the end of Proof-of-Work (PoW), it’s not only interesting to see where will the miners go next, but also to see how the historical event affects ETH’s price in comparison to the so-called “ETH Killers” including Cardano, EOS, Solana, BNB, Polkadot and beyond, which are relatively with lower gas fees and higher scalability.

Because of the Merge, it’s expected that there may be some potential tokens that arise in the future.

To witness the historical moment with the Ethereum community, Poloniex became the first crypto exchange to list and open trading for two potential hard fork tokens: ETHW (ETH1) and ETHS(ETH2), On August 7, 2022. For more information, please visit Poloniex Support Centre.

Read more:

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.