Crypto Trading 101: 4 Trading Tips to Efficiently Use Fibonacci Levels

The Fibonacci retracement levels are one of the most widely supported support and resistance levels used to pinpoint potential reversal points. In this trading guide, we’re going to share some of the most powerful techniques for building a trading strategy using the Fibonacci retracement tool.

What are Fibonacci Levels?

Fibonacci levels are mathematical calculations that are often used by traders to predict market movements. Fibonacci levels can be used on any time frame, but they are most commonly used on daily or weekly charts.

There are several different Fibonacci levels, but the most important ones are the 0.618, 0.786, and 1.000 levels. These levels can help traders predict where the market is likely to move next and make better trading decisions.

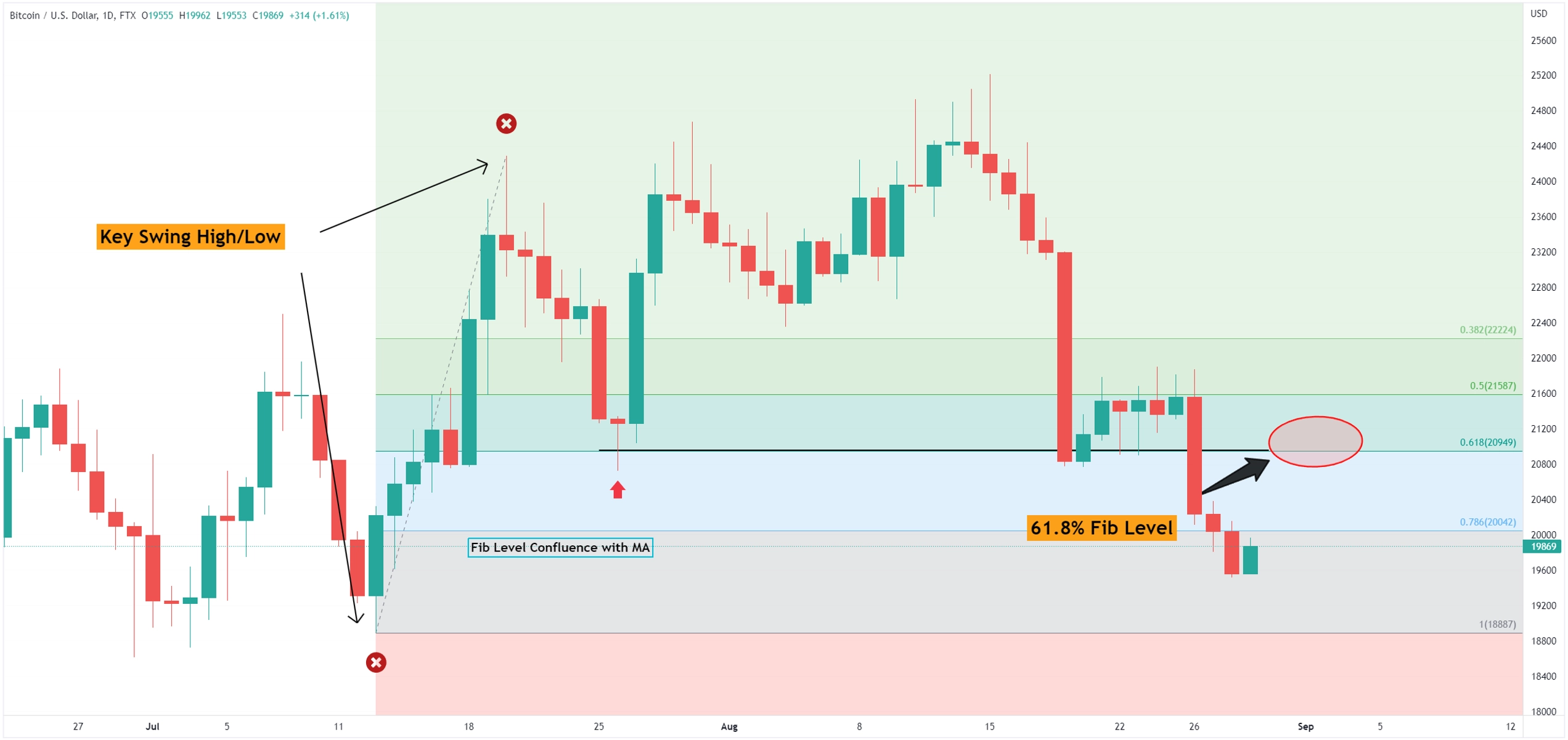

#1 Choosing the correct Swing High/Low

First, drawing the Fibonacci retracement level relies on swing high and low points. In this regard, the most important aspect is to choose the correct price swings; otherwise, the Fibonacci levels won’t have a meaningful impact on the price.

To correctly pick the proper swing levels, traders should focus on the price momentum and the trend.

As a general rule, use those swing high/low points from where price had a strong directional movement.

#2 Focus on Higher Timeframe

Focusing on the long-term trend can be more meaningful, and the Fibonacci levels would carry more weight. By comparison, the intraday charts will provide you with multiple price swings, which have a lot of noise and are not that relevant.

#3 Golden ratio of 61.8% is the Most Important Fib Level

Most price retracements are expected to fail at the 61.8% Fibonacci level.

The 61.8% fib level is known as the golden ratio because every number in the Fibonacci sequence is 1.618 times the prior number; therefore, this level carries a lot of weight.

#4 Fib Confluence with Simple Moving Averages

Combining more than one trading technique can increase the chances of a reliable trade setup. For example, a Simple Moving Average (SMA) works well together because both technical indicators work best in a trending market.

The simple moving average is a great tool to determine dynamic support and resistance level that, when aligned with a Fibonacci level, it can provide profitable trade setups.

Bottom Line: While no trading tool has a 100% accuracy rate, the Fibonacci levels are useful in finding hidden dynamic Support and Resistance levels that other don’t see with the naked eye.