Designed with a user-centric mindset, Binance Futures allows traders to plan their strategies ahead of time to improve trading consistency, manage risks properly and avoid emotional and compulsive trading.

Traders have been increasingly drawn to crypto derivatives as they offer alternative ways of investing in digital assets. Indeed, crypto derivatives, including futures contracts, are quickly gaining popularity as traders look at different ways to reap the opportunities of the ever-growing financial market.

Given the essential role that crypto derivatives play in the cryptocurrency industry, Binance Futures offers a unique opportunity to investors to enter the fast-growing derivatives market, which has witnessed trillions of dollars in trading volume every month. So to make the most out of this market, let's take a deeper look into what futures trading could do for you.

Why Experienced Traders Prefer to Trade Futures Contracts

The spot market allows traders to purchase cryptocurrencies at any time, but with certain limitations. Investors are not only limited to buying cryptos with the capital they have, but they often have to hold the assets for a while before taking profits.

On the other hand, futures contracts allow traders to diversify their portfolios and increase their exposure to a variety of cryptocurrencies without having to hold the underlying asset. The use of leverage allows for better capital efficiency as traders do not have to lock up entire amounts of capital to purchase a large amount of crypto. Moreover, short-selling gives traders a chance to profit when the value of a cryptocurrency drops.

While spot trading caters to those who are more risk-averse, futures trading attracts traders who are interested in further capitalizing on the volatility of the cryptocurrency market.

How Binance Futures Has Built an Enterprise-Grade Platform

Binance Futures has built an enterprise-grade platform with access to hundreds of crypto-to-crypto trading pairs, providing the ultimate trading experience for traders. Users can make the most out of their crypto assets in their portfolios and manage risks with Binance Futures’ complete ecosystem.

Traders can go long or short to benefit from market movements in either direction while implementing different strategies offered on Binance Futures, including TWAP, Grid Trading, and more.

The Preferred Crypto Derivatives Exchange

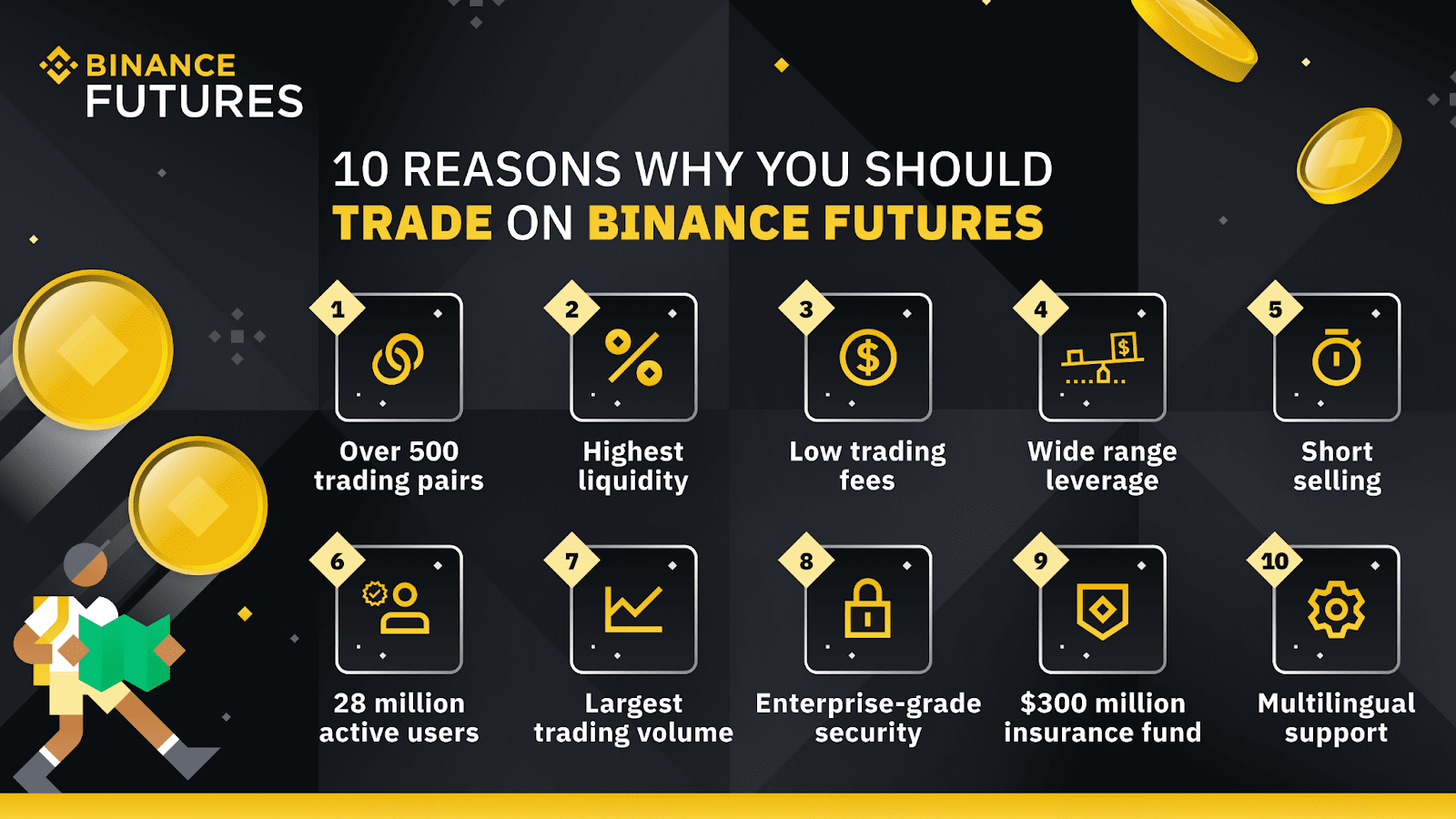

Binance Futures offers a wide range of digital assets, including the hottest cryptos in the market, to provide users with the best trading experience. The platform ensures that users are protected all year round as multiple security features have been put in place, like a $300 million Insurance Fund against hacks or technical failures that could lead to losses.

Binance Futures’ users can also take advantage of the platform’s diverse range of leverage to grow their portfolios no matter the balance they have in their accounts. The platform was designed with a user-centric mindset and even introduced a low-cost taker fee program to further benefit traders.

Trading volumes on Binance Futures have reached trillions of dollars, with more than 28 million users actively participating in crypto futures trading. These are some of the features that users like the most about the leading crypto derivatives exchanges:

Advanced Trading Technology

Binance Futures provides users access to a wide range of features, including advanced order types algorithmic trading, offering a seamless trading experience for both beginners and experienced traders.

When a trader places a Limit Order, Take Profit and Stop Loss orders (TP/SL) can also be set simultaneously. This would enable users to set two orders, a primary order and a secondary order at the same time, with the former being the Limit or Market order, while the latter being Take Profit and Stop Loss orders.

Such an enterprise-grade technology enables traders to plan their strategies ahead of time to improve trading consistency and also manage risks properly. Having a trading strategy would allow investors to lower stress throughout the day, protect their capital, and avoid emotional and compulsive trading.

Time-Weighted Average Price, or TWAP

Binance Futures’ users also get access to an algorithmic trade execution strategy, Time-Weighted Average Price, that can minimize a large order’s impact on the market by splitting the trade into smaller quantities and executing them at regular intervals over time.

TWAP strategy trading can provide a better execution price when the order size is larger than the available liquidity on the order book on the exchange. It also helps when there is an anticipation of high price volatility period with a lack of clarity of directional bias in the market.

In addition, absolutely no coding is needed to utilize TWAP on Binance Futures and is complimentary for all users.

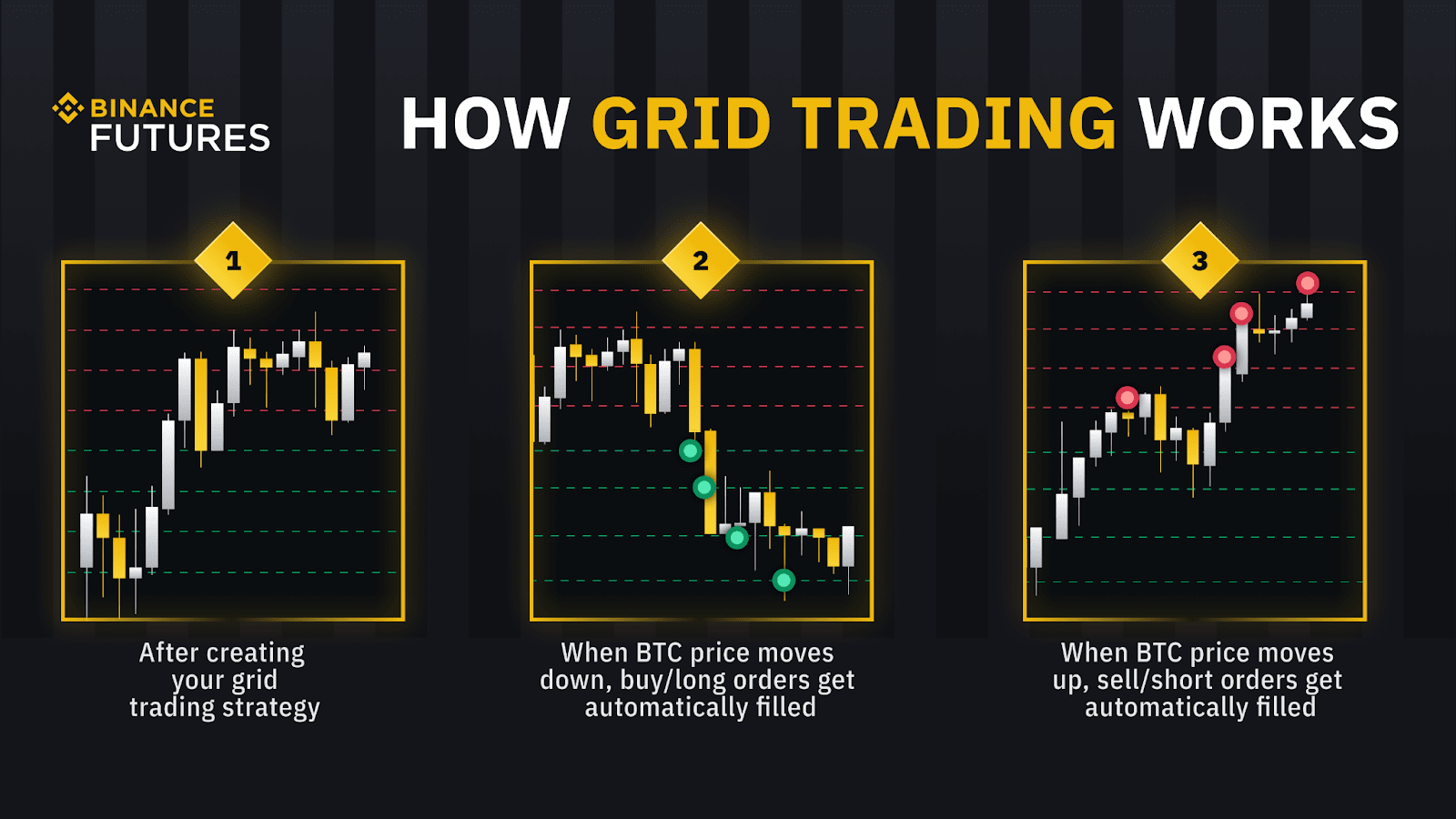

Grid Trading

Binance Futures also offers Grid Trading, a trading bot that automates the buying and selling of futures contracts by placing orders at preset intervals within a configured price range. By taking advantage of ranging conditions, grid trading enables traders to benefit the most when the market trends sideways as well as during times of high market volatility.

One of the main benefits of using this trading bot is that traders can even profit from small price changes. The more grids set, the higher the frequency of trades will be executed, despite the lower profit margin for each trade.

Binance Futures acknowledges that novice traders may have difficulties setting parameters to build their own grid trading strategy. For this reason, the platform provides recommended parameters to help improve user experience and reduce the learning curve. These include lower price limit, upper price limit, and grid count.

With the auto parameters function, anyone can create a grid trading strategy with just one click, regardless of their trading experience.

Lots of Trading Pairs, High Liquidity and Volume

Binance Futures has set itself apart from other crypto exchanges by offering users a massive diversity of tokens to trade, with over 530 crypto-to-crypto trading pairs to choose from. With a wide selection of altcoins available, Binance Futures has become one of the most liquid crypto derivatives exchanges available in the market. Therefore, traders can always expect their orders to be filled promptly without having to worry about slippage.

The enormous selection of crypto trading pairs has helped to generate massive trading volumes on Binance Futures, recording $7.7 trillion in crypto trading volume in 2021 and amassing $76 billion in trading volume in a 24-hour peak.

Responsible Trading Environment

In mid-2021, Binance Futures launched a “ Cooling-Off Period” option to enable users to disable futures trading to prevent emotional and compulsive trading. Traders can turn on this feature for one day to a week depending on their needs, as one of our top security priorities is to encourage responsible trading.

In addition, new Binance Futures users have Price Protection set by default to protect their trading strategies from extreme market movements, including abnormal trading activity. Price Protection will protect traders from stop-loss or take-profit orders being triggered during times of high volatility, such as when the Last price and the Mark price of a futures contract exceeds a preset threshold.

Experienced Traders to Chat With

Having a community to discuss market trends, project fundamentals or technical analysis is essential for traders to continually improve their trading skills. This is the reason why Binance Futures launched a Chat Room for futures and derivatives traders, allowing everyone to share news, strategies and insights on the market when trading in real-time.

Binance Futures’ users can easily access the chat room online, on desktop and mobile app. It is completely free for all traders. Never miss an important announcement and stay up to date with the latest news developments in the crypto space in the Binance Futures Chat Room!

Two Financial Instruments for Different Markets

Binance Futures has introduced two financial instruments designed with user flexibility in mind, USDⓈ-Margined Futures, and COIN-Margined Futures contracts.

COIN-Margined contracts are denominated and settled in the underlying cryptocurrencies. Therefore, traders do not need to hold stablecoins as collateral. This allows long-term investors or miners to hold the base cryptocurrency, while any profits can be contributed to the long-term holdings.

On the contrary, USDⓈ-Margined contracts are linear futures products that are quoted and settled in USDT or in BUSD, allowing traders to easily calculate returns in fiat. Using a stablecoin as the settlement currency provides more flexibility, as investors can use the same settlement currency across various futures contracts.

USDⓈ-Margined contracts can also help to reduce the risk of substantial price swings amid times of high volatility, so traders do not need to worry about hedging their underlying collateral exposure.

Join Binance Futures Today!

With the different types of derivatives products and an enormous variety of crypto trading pairs available, you can probably see why Binance Futures is the leading and preferred crypto derivatives trading platform among futures traders.

Whether you are a beginner or an experienced crypto trader, setting up an account is super easy and can take just a few minutes.

Beginners can also utilize Binance Futures’ mock trading function to practice and sharpen their trading skills before moving on to futures trading. All at their own pace and without risks. Users can also leverage Binance Academy to continue to learn all about cryptocurrencies and blockchain.

Join more than 28 million traders and start your futures trading journey today with Binance Futures!

Read the following helpful articles for more information about Binance Futures:

(Academy) How to Trade Crypto Responsibly

And many more Binance Futures FAQ topics…

Disclaimer: Crypto assets are volatile products with a high risk of losing money quickly. Prices can fluctuate significantly on any given day. Due to these price fluctuations, your holdings may significantly increase or decrease in value at any given moment, which can result in a loss of all the capital you have invested in a transaction.

Therefore, you should not trade or invest money you cannot afford to lose. It is crucial that you fully understand the risks involved before deciding to trade with us in light of your financial resources, level of experience, and risk appetite. If required, you should seek advice from an independent financial advisor. The actual returns and losses experienced by you will vary depending on many factors, including, but not limited to, market behavior, market movement, and your trade size. Past performance is not a guide to future performance. The value of your investments may go up or down. Learn more here .